JPMorgan advarer investorerne mod at blive for optimistiske, fordi der har været en stærk vækst i 3. kvartal. Vi står ikke i et V-opsving. Der er lang vej endnu, før krisens tab bliver indhentet. Væksten næste år bliver moderat, og markederne kan blive meget volatile, indtil der kommer en covid-19 vaccine. Investorerne skal have en strategi, der passer til store udsving, og de skal samtidig holde krudtet tørt til et opsving efter en vaccine.

Thought of the week

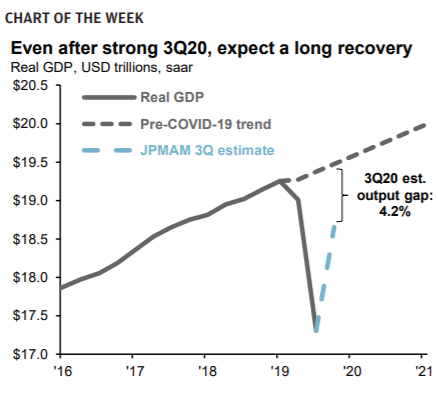

As we enter the fourth quarter, investors may find themselves optimistic about the prospects for economic growth after what will likely be an impressive rebound in GDP in the third.

Indeed, following an historic 31.4% q/q contraction in 2Q, data suggests the third quarter will likely see an equally impressive 35% q/q gain.

While visually this may appear to be a “V”-shaped recovery, investors should recognize that the continuing effects of the pandemic and indecision on fiscal stimulus from Washington will likely cause growth to moderate into 2021.

As evidenced last week, the unemployment rate still remains elevated, personal incomes fell 2.7% in August as a result of the lapse in Federal

unemployment insurance benefits and manufacturing activity has moderated after rebounding strongly.

Altogether, growth should moderate to roughly 2-3% through 1H21.

As shown in this week’s chart, if our 3Q20 estimate is realized, it would still

leave the level of 3Q real GDP about 4.2% below the pre-COVID-19 trend and about 3.1% below the level of GDP in 4Q19.

To put in context, the financial crisis resulted in a 4.0% decline in GDP, highlighting the magnitude of the last recession. It still looks like 2021 will be a year of recovery for the economy, albeit a modest one until the

distribution of a vaccine.

This suggests the need to hedge against equity volatility in the short run while maintaining equity exposure to take advantage of an economic need to hedge against equity volatility in the short run while maintaining equity exposure to take advantage of an economic surge once COVID-19 has been tamed.