Kina har på sin folkekongres for første gang undladt at fastlægge et mål for den økonomiske vækst. Sidste år var målet på 6,1 pct. Det udtrykker, hvor usikker Kina er på effekten af coronaen, og det indikerer, at Kina ikke vil gennemføre massive finanspakker, og at Kina dermed bliver ikke så stor en trækkraft for resten af verden, som mange har ventet. Væksten faldt i første kvartal med 6,8 pct. Flere analytikere venter en lille positiv vækst for hele året på 1 til 3 pct., mens verden som helhed ventes at få negativ vækst.

Uddrag fra Fidelity/Dow Jones:

Beijing Scraps GDP Target, a Bad Sign for World Reliant on China Growth — Update

China broke with more than a quarter-century of tradition by eschewing an economic growth target for 2020, a stark acknowledgment of the challenges facing the world’s second-largest economy as it grapples with uncertainties around the coronavirus pandemic.

The unusual move–it is the first time a formal target has been omitted since the practice began in 1994–suggests Beijing’s leaders aren’t eager to unleash a large-scale stimulus after China’s sharpest contraction in four decades. It foreshadows more economic pain for a world that has become increasingly reliant on China as an engine of growth.

China reported a 6.1% gain in gross domestic product last year–its slowest pace in nearly three decades, though within the targeted range of between 6.0% and 6.5%.

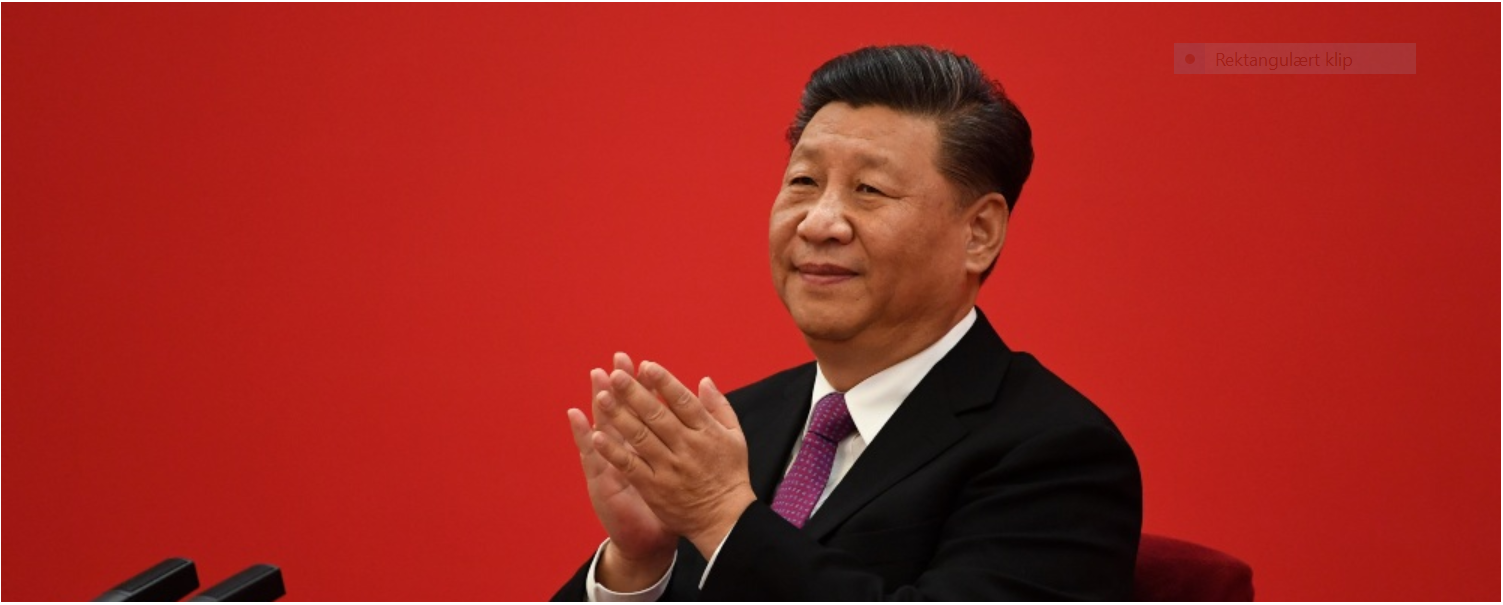

The implicit acknowledgment of sharply slower growth for 2020 marks a climbdown for leader Xi Jinping during a year when he was set to proclaim the end of absolute poverty in the country and double the economy’s size from a decade earlier–political goals meant to burnish his standing ahead of next year’s centennial of the Chinese Communist Party’s founding.

Economists had said China needed to grow its economy by at least 5.5% to fulfill the mission of doubling the economy’s overall size–a target that now appears to be out of reach in the absence of a broader reframing of the goals.

The lack of a formal growth target was a surprise to many economists, though some had predicted Beijing would have no choice given the extraordinary challenges this year. In the first quarter of 2020, China’s economy suffered its first contraction in more than four decades, shrinking by 6.8% from a year earlier.

Even so, Beijing did make clear that it would step up government spending and stimulate the economy, following the hit from the coronavirus. China’s Finance Ministry said Friday it would target a fiscal budget deficit this year of more than 3.6% of the country’s projected GDP, significantly higher than last year’s 2.8% target and above its traditional upper limit of 3%.

China’s decision to not set a growth target was revealed in a speech by Premier Li Keqiang on Friday, at the beginning of an annual meeting of China’s rubber stamp legislature, the National People’s Congress. The meeting had been delayed for nearly three months as the country reeled from the coronavirus that first appeared in the central Chinese city of Wuhan.

Mr. Li said the decision to scrap an explicit numerical forecast was made “because our country will face some factors that are difficult to predict,” pointing to the coronavirus and uncertainties around trade. But Mr. Li said the lack of a target “will enable all of us to concentrate on ensuring stability…and security.”

In the absence of larger-scale stimulus, economists now say China’s policy makers will focus on getting the economy to muddle through while trying to create employment and stable living conditions for the tens of millions of Chinese workers who economists estimate have lost work in recent months.

Mr. Li said the government planned to create 9 million new jobs in 2020, lower than last year’s target of 11 million new jobs. Official data showed China met its target last year by creating 13.52 million new jobs.

The government also said it aims to cap the urban surveyed jobless rate at 6.0% in 2020, higher than last year’s 5.5% target. China’s urban jobless rate stood at 6.0% in April, off the record high of 6.2% in February though much higher than the 5.2% rate at the end of 2019.

Economists say the official urban jobless rate excludes many rural migrant workers who had flooded into the country’s biggest cities seeking employment but who have since returned to their home villages and thus aren’t counted in the official tally.

China’s policy makers continued to roll out modest stimulus measures on Friday. For instance, they said they would extend electricity rebates and tax breaks for small businesses through the end of the year, while urging the nation’s biggest state banks to increase lending to small firms by 40% from a year earlier, versus a 30% target last year.

China’s government also said it would transfer the proceeds of local government special-purpose bonds and treasury bonds, neither of which are counted in the official fiscal deficit, to local governments to boost employment, consumption and investment that were severely hit by the coronavirus pandemic.

Among the stimulus efforts, the premier said the government will increase national rail capital funds by 100 billion yuan ($14.05 billion) this year.

Mr. Li said Beijing aims to keep consumer-price inflation at around 3.5% in 2020, higher than last year’s goal of around 3%.

China’s consumer-price index inched closer to its official target last year by rising 2.9% from a year earlier, according to official data. In the first four months of this year, China’s main consumer-price index has increased by 4.5% compared with a year earlier, lifted by pork prices.