Uddrag fra Goldman, det kinesiske handelsministerium og Zerohedge

Goldman is out with a note from two of its top political economicsts, Andrew Tilton (HK based) and Alec Phillips, in which the two deconstruct the latest spat between the the US (mostly Trump) and China, and note that the key question for markets is whether the 100% tariffs proposed by Trump (in retaliation to the latest crackdown on rare earth exports) are ultimately implemented (if ever), with severe effects on global supply chains and especially high-tech production, or remain just efforts to gain negotiating leverage ahead of bilateral talks on the sidelines of the APEC meeting in South Korea later this month.

While Goldman leans toward the latter interpretation and expects that the ultimate resolution will be an extension of the current tariff pause past November 10 along with some new but limited concessions from both sides, “the recent policy moves suggest a wider range of outcomes than was the case ahead of prior US-China talks over the last few months.”

That said, the most likely scenario seems to be that both sides pull back on the most aggressive policies and that talks lead to a further—and possibly indefinite—extension of the tariff escalation pause reached in May. However, the recent policy announcements could also signal that China intends to push for greater concessions from the US.

In either case, it is worth emphasizing that relative tariffs matter – a “good” market outcome to the bilateral US-China negotiation might be quite bad from the perspective of Japanese or Korean exporters, for example, who would now have a smaller (or no) tariff advantage versus their Chinese competitors in the US market.

Before we drill deeper, first some background:

1. On Friday, President Trump imposed 100% additional tariff on China and export controls on “any and all critical software” effective Nov 1st, in reaction to China’s stricter export control on rare earth:

2. On Oct 9th, China announced tighter rare earth export control measures: 1/ in principal bans rare earth export for military usage purpose; 2/ for rare earth export for manufacturing advanced chips (14mn and below logic integrated circuit and 256-layer and above storage chip) or related facilities and military-use AI, it will require case-by-case approval; 3/ other rare earth exporters need license approval by Ministry of Commerce to export rare earth from China.

3. In addition, there are a few other measures from China in the past few days: 1/ Announced special port fee on US vessels docking at Chinese ports from Oct 14th – a reciprocal move against US’s charge on Chinese vessels. 2/ Announced to restrict exports of many kinds of equipment needed to manufacture batteries for electric cars. 3/ Launched antitrust probe into Qualcomm over its Autotalks deal. 4/ Added 14 US drone technology companies onto unreliable entity list. 5/ Separately, FT reported China tightened import restrictions on U.S. chips including Nvidia AI chips.

4. Today (Oct 12th), Chinese Ministry of Commerce (MOFCOM) released a statement to explain China’s action on rare earth and urged US to use dialogue to solve disputes. With below key points:

- Rare earth export control is not banning rare earth export. China assessed the measure’s impact on supply chain is limited. China will approve compliant non-miliary rare earth exports, and will also use exemption permits etc to promote rare earth trade.

- Explained the background of the escalation is US issued a rule to expand trade restrictions for organizations on the “entity list” to any majority owned subsidiaries on Sep 29th, which impacts thousands of Chinese companies. Vessel charge on US is also reciprocal, as US’s port charge on Chinese vessels is scheduled to be effective on Oct 14th despite negotiation attempts from China side.

- On new tariffs, China hopes US to “correct” the measure and hold up to the agreements from Xi-Trump call and use dialogue to solve disputes. Meanwhile the MOFCOM mentioned China will also adopt counter measures if US go ahead with its escalation measures.

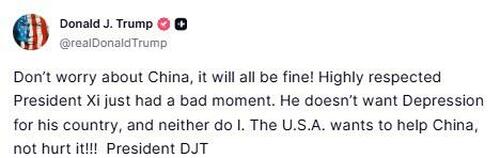

5. Also Today, President Trump made a post on social media that seemed to indicate a desire to find a solution to the current disagreement…

… which has helped send US stock futures, crypto, gold, oil and copper all sharply higher.

Below we excerpt from the Goldman note available to pro subs.

USA: President Trump Threatens Additional 100% Tariff on China in Response to Rare Earth Export Controls

BOTTOM LINE: China announced last week that it would expand its export control regime for rare earth minerals significantly, with a global scope and ramifications for a broad range of downstream industries. In response, US President Trump threatened an additional 100% tariff on Chinese goods beginning November 1, as well as controls on exports of critical software. The key question for markets is whether these are ultimately implemented, with severe effects on global supply chains and especially high-tech production, or remain just efforts to gain negotiating leverage ahead of bilateral talks on the sidelines of the APEC meeting in South Korea late this month. While we lean toward the latter interpretation and expect the ultimate resolution will be an extension of the current tariff pause past November 10 along with some new but limited concessions from both sides, the recent policy moves suggest a wider range of outcomes than was the case ahead of prior US-China talks over the last few months, with the possibility of greater concessions (and possibly lower tariffs) but also a risk of substantial new export restrictions and higher tariffs, at least temporarily.

MAIN POINTS:

- Last week, China broadened the scope of its rare earth export controls to require licenses for any product containing more than 0.1% in value of Chinese rare earths, or manufactured using equipment containing Chinese rare earths or related magnets. The regulation would include a presumption of denial for military-related end-uses and close scrutiny on uses related to high-end semiconductor production. The new rules expand the number of specific rare earth minerals covered and also limit the export of rare earth mining and manufacturing equipment from China. This was one of several new export controls announced, which also covered superhard materials and lithium batteries as well as materials and equipment for manufacturing them. Controls on some minerals and alloys are effective immediately, with the other measures going into force by December 1. China also recently added several US firms to its “unreliable entity list.”

- President Trump responded to China’s announced export controls by announcing he plans to impose an additional 100% tariff on China on November 1, imposing additional export controls on “critical software” (and potentially aircraft components), and indicating that “there seems to be no reason” to meet President Xi at APEC (Oct. 31-Nov. 1). However, he clarified during comments at the White House later that day that he still planned to meet. While President Trump has often threatened tariffs when foreign policy challenges arise, it is still somewhat surprising that his initial response to the proposed rare earth controls was a return to embargo-level tariffs, after walking back similarly sized tariffs in May after China responded with rare earth controls earlier in the year. (While we are not making any forecast changes at this time, our discussion of the large US tariffs imposed in early April provides some sensitivity analysis as to the potential impact on economic activity in China.)

- On the surface, China’s move last week looks unusual – as most of its actions in the bilateral trade conflict have been retaliatory in nature. However, on September 29, the US announced a major expansion of its export control regime with its “affiliate rule” that restricts exports to firms with financial ties to companies on the entity list, substantially widening its scope with potentially important implications for Chinese firms’ sourcing of US technologies. The rules do not take full effect until November 28, a few days before China’s new export controls kick in. It could also be argued that China’s new regime mirrors in the rare earth space what the US has imposed for high end chips and semiconductor production equipment–a “foreign direct product rule” that controls not only direct exports of a targeted product, but other countries’ exports that embed that product.

- Since their initial rollout in October 2022, US export controls have been focused primarily on Chinese production of a small set of very high-end technology products (mainly cutting-edge logic and memory semiconductors, as well as related production equipment). Given their current parameters, they impose little constraint—by design—on most of China’s current manufacturing production. By contrast, a curtailment of rare earth exports outside China could potentially affect a much broader swath of current US and global manufacturing–although the announcement last week only appears to target defense equipment and high-end semiconductor and equipment production.

- As we noted in a recent comment, based on the apparent success of rare earth export controls in providing China with a retaliatory tool to high US tariffs earlier this year, China may now feel emboldened to “push the envelope” in its bilateral negotiations with the US. Recent reports indicate that Chinese officials are seeking, in particular, elimination of the 20% tariff the US imposed earlier this year. With Trump and Xi potentially meeting at APEC in late October, and Sec. Bessent and Vice Premier He Lifeng also potentially meeting in Frankfurt in coming weeks, the escalation from both sides could be interpreted as setting the table with additional negotiating points ahead of the end of the current tariff pause on November 10.

- The recent policy moves suggest a wider range of potential outcomes than appeared to be the case ahead of the last few key US-China meetings. The most likely scenario seems to be that both sides pull back on the most aggressive policies and that talks lead to a further—and possibly indefinite—extension of the tariff escalation pause reached in May. However, the recent policy announcements could also signal that China intends to push for greater concessions from the US. This could potentially yield a market-positive outcome in which some US tariffs are lowered, and possibly some export controls relaxed, in return for loosening of rare earth restrictions and other concessions from China (Sec. Bessent said on October 2 that he expected a “pretty big breakthrough” in the next round of trade talks). However, higher expectations along with greater threatened policy responses clearly raise the risk of a more market-negative outcome in which the US and China reimpose triple-digit tariffs imposed earlier this year and/or follow through on more serious export restrictions, at least temporarily. In either case, it is worth emphasizing that relative tariffs matter–a “good” market outcome to the bilateral US-China negotiation might be quite bad from the perspective of Japanese or Korean exporters, for example, who would now have a smaller (or no) tariff advantage versus their Chinese competitors in the US market.

- In coming days, important signals could include a statement from the White House, which might clarify how the administration views these policies; an update from either side on the likelihood of a Xi-Trump meeting; and any announcement from China on whether it intends to match the proposed US tariff increase. On Sunday, President Trump made a post on social media that seemed to indicate a desire to find a solution to the current disagreement.

Market Implications (per Goldman trader Lu Sun).

- Market has been complacent and optimistic about US-China trade talks into the end-October APEC meeting. A case in point is there lacked market response to China’s rare earth control measure on Oct 9th until Trump reacted with new tariff threat. Most believe that given Trump sets tariff effective date as Nov 1st, which is in a few weeks later and after APEC summit date (Oct 31-Nov 1), it indicates room for negotiation from US side. A Xi-Trump meeting at APEC is still not ruled out according to Trump.

- The statement from MOFCOM today indicates China intents to engage in talks with the US, but it remains to be seen whether US will retract the broader entity list measure announced Sep 29th and port charge on Chinese vessels effective Oct 14th.

- In the near term, we need to watch out for potential risks such as whether China will announce reciprocal tariff action against US’s 100% new tariff threat, which we have observed in the past.

- China’s end-use driven rare earth export control to restrict military and high-end chip/AI manufacturing usage could have broader market implication in the medium term. Other than the US, Japan, South Korea, EU, etc are also top importers of Chinese rare earth. High-end semiconductor producers and related facility makers are also exposed to uncertainty of rare earth supply, which could lead to tech equities adjustment from record high levels. Goldman continues to like short-dated USDTWD topside targeting a move above 31 to express such risk scenario.

- For the local market, China is unlikely to devalue RMB on this tension escalation, in Goldman’s view, given the domestic macro stability considerations. Instead, the PBoC is likely to keep the low-vol CNY fixing regime in the near term as China signaled willingness to engage in trade talks via MOFCOM statement today. Given the broader risk-off potential, CNY may stay relatively resilient vs risk-sensitive currencies.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her