En Nordea-analyse af det kinesiske forbrug viser, at forbrugerne er blevet meget tilbageholdne af frygt for, at deres indstjening bliver mindre fremover. De sparer mere op og investerer mindre end i de seneste ti år. Det kan svække genrejsningen af økonomien. Er det mon en indikation, der også vil gælde for den globale økonomi? På grund af det lave forbruger sænker Nordea sin prognose for Kinas vækst til 1 pct. i år og 8 pct. næste år.

China View: The missing consumers

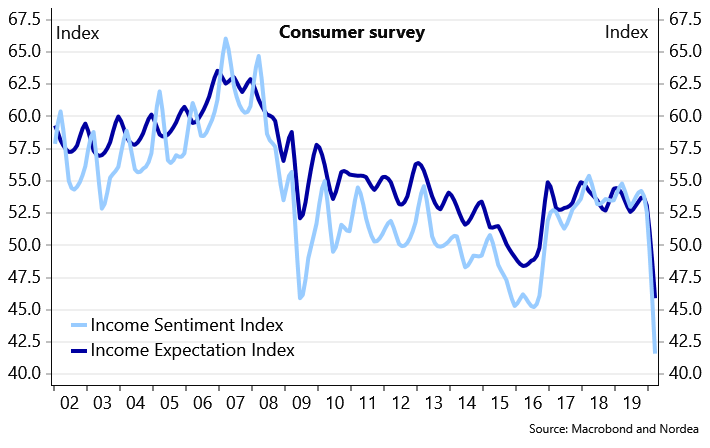

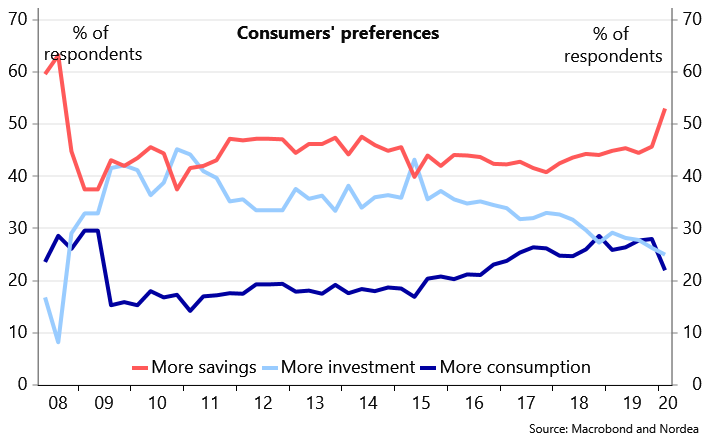

The flipside of a consumption- and service-driven economy is that when consumers are feeling blue and hold back spending, as it is happening now in China with historically low income expectations, it is delaying the overall economic recovery.

Read the full publication in a PDF version here

As a result of multi-year efforts to transform the Chinese economy, it is now highly driven by private consumption and services. The flipside of the new normal is that a shock to consumer confidence will affect economic growth to a much larger extent. Moreover, policymakers now have less control over the economy compared to when it was dominated by public investment and planned production.

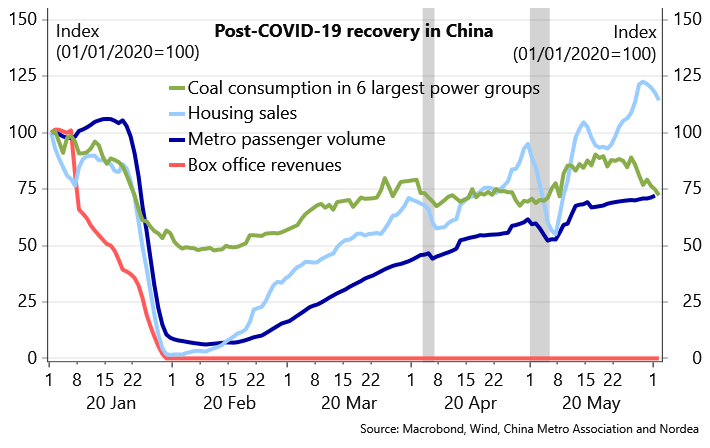

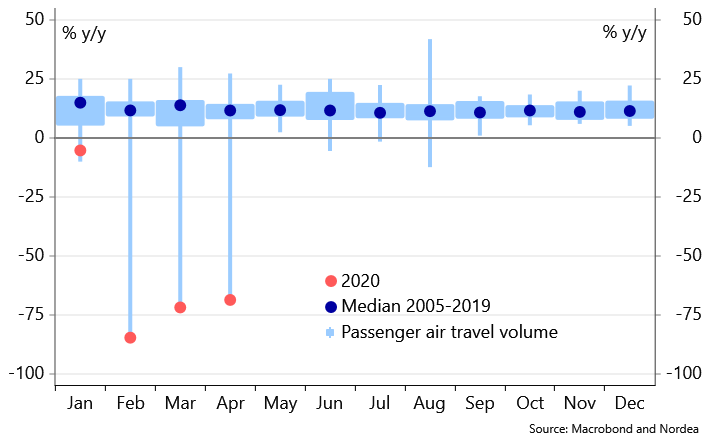

Fears of a second wave of COVID-19 infections and concerns about prolonged income losses due to high unemployment and a poor social safety net are causing consumers to tighten their belts. The slower-thanexpected recovery in consumption and services will likely be the main factor delaying the general growth rebound in China.

Macro: The missing consumers

The Chinese growth recovery is being hampered by consumers’ reluctance to spend. Fear of the coronavirus and elevated income insecurity are keeping people at home with their wallets closed. The lack of a social security safety net makes it hard to restore confidence.

CNY: The Trump slump

Renewed US-China tensions adding to the virus scare and growth challenges are downside risks faced by the CNY versus the USD. On the other hand, the PBoC will likely keep calming the market and providing a cap on USD/CNY.

Nordea’s forecasts

As a result of the slower-than-expected recovery in private consumption and service sector activity, we revise down our GDP forecasts for this and next year to 1% and 8%, respectively. The financial forecasts are unchanged.