Corona-virussen skader ikke kun den kinesiske vækst, men når regeringen formodes at sætte skub i investeringerne for at kompensere for nedgangen, vokser den i forvejen høje gældsbyrde.

Uddrag fra Nordea:

China View: Coronavirus raises credit risk

The coronavirus outbreak is hurting Chinese growth this year and jeopardising an important growth target. A large-scale investment package might shore up demand in the short term but will exacerbate the already large credit risk in China.

Read the full publication in a PDF version here

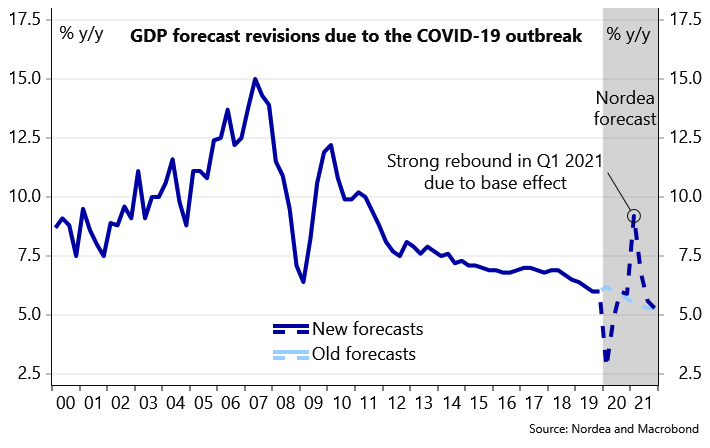

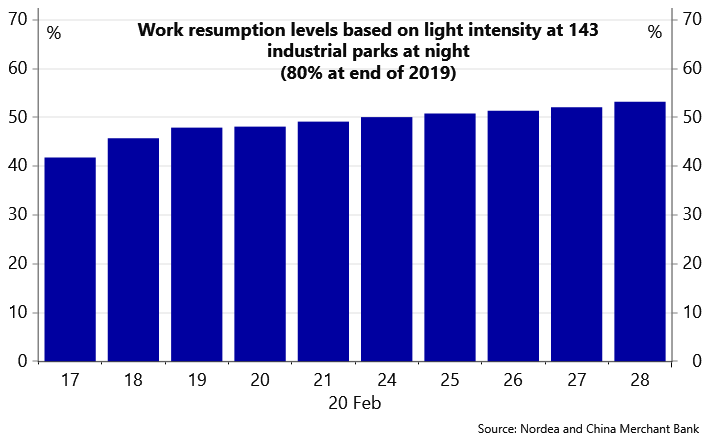

2020 is an important year for China. It is the year when China has pledged to eliminate poverty and double the economy’s size from a decade ago. With the trade war with the US on pause, the year looked promising to begin with. But the coronavirus outbreak is casting a shadow on the growth outlook. We expect activity resumption and government stimuli to stage a strong rebound later this year, but some policy actions are likely to exacerbate the systemic risks in the medium term.

Macro: A substantial impact on growth

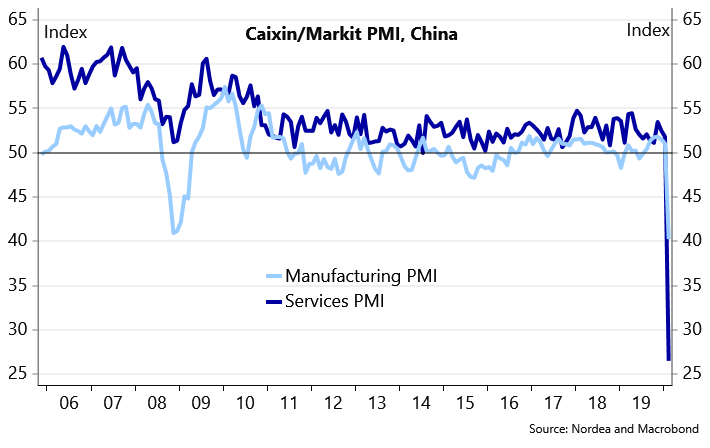

Now that the number of new infections with COVID-19 virus is on the decline in China, government officials can direct their focus on mitigating the adverse impacts on the economy. The first conventional data, the PMI surveys, suggests an unprecedented fall in economic activity in Q1. We estimate that the economy will grow by barely 3% y/y in Q1, versus our previous forecast of 6%. Due to an expected rebound in Q2 and Q3, we expect full-year GDP growth at 5%, an all-time low for China. The risk is on the downside, in our view, as the rapid spread of the virus among China’s trading partners could have a spill-back effect on Chinese growth.

Fiscal stimulus raises credit risk in China

To maintain economic and social stability, Beijing has once again turned to infrastructure investment to support growth. Half of China’s provinces have plans to spend a total of CNY 6.6tn (about 6% of GDP) this year on transportation, energy, high-tech sectors and healthcare. Other provinces will likely follow suit. Relying on bank loans and local government bonds as funding will no doubt raise the overall credit risk, as many infrastructure loans have experienced trouble with repayment in the past.

CNY: Waiting for the PBoC

The CNY has appreciated nearly 2% in less than two weeks in anticipation of a rate cut from the Fed. Now it has happened and the ball is back in the PBoC’s court. We expect the PBoC to cut the benchmark lending rates to support growth while curbing further upside to the CNY.

For our webinar on the coronvirus’ impact on the global outlook and financial markets, read here. For more on how the coronavirus oubtreak will affect the Nordics, read here