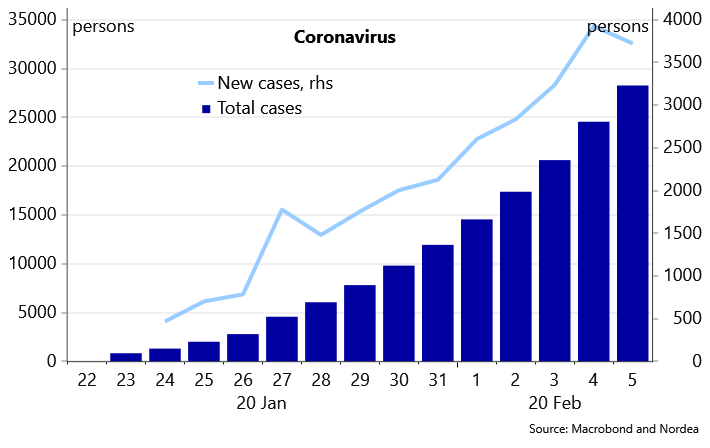

Nordea vurderer, at corona-virusen betyder en halvering af væksten i Kina i 1. kvartal til 3 pct., men hvis vendingen i corona-affæren snart indtræder, som der er indikationer på, reduceres væksten med et point til 5 pct. i andet kvartal.

Uddrag fra Nordea:

China’s short-term growth prospects have been weakened significantly by the coronavirus. Future growth depends very much on how the virus spreads and how quickly the economy turns to a recovery phase.

Read the full publication in a PDF version here

The coronavirus will have a substantial negative effect on the Chinese economy. In the light of the current information, we estimate the production loss in the first quarter of 2020 to amount to 3-4% of the quarterly GDP, which would take the annual growth rate to around 3% compared to 6% in our baseline. If recovery starts in the second quarter of 2020 as we now expect, the growth rate for the whole of 2020 could be 1 pp lower than in our baseline, ie around 5%.

At the moment, it is of course impossible to give any estimate of the size of the impact with any degree of certainty. We do not have reliable information about how devastating the virus is and especially whether the measures determined by the Chinese authorities have been effective in containing the outbreak such that the number of new cases will peak at relatively low levels over the coming weeks.

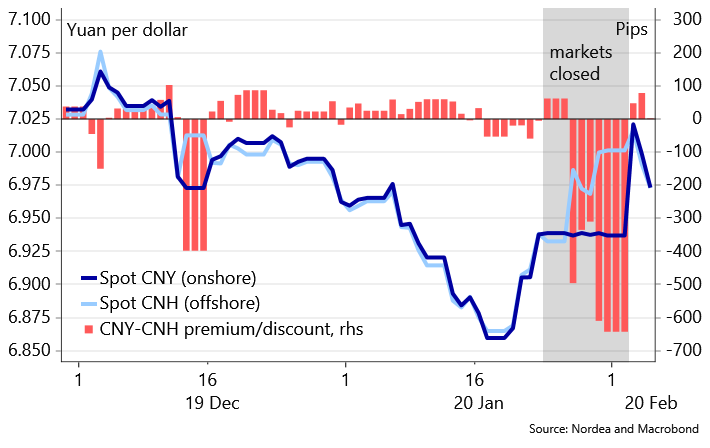

CNY: Virus fears

The outbreak of the coronavirus has unnerved investors and sent financial markets in a rout. The PBoC is taking measures to restore confidence. Until the spread and impact of the virus become clearer, the CNY will remain volatile.

for more on how the coronavirus oubtreak will affect the Nordics, read here