Fra Zerohedge:

Bad news is great news for big-tech.

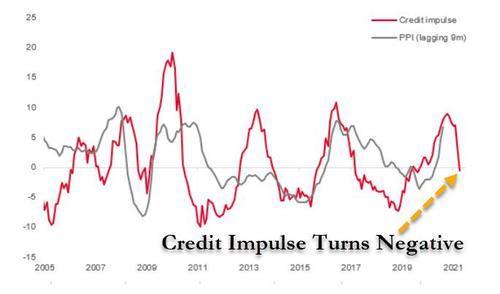

As we detailed over the weekend, with China’s credit impulse reversal, it appears the market’s rotating back to the deflation narrative, and with it the growth over value bet is back.

If market is finally getting the China credit impulse reversal, it means deflation narrative is back and tech is about to go ape

— zerohedge (@zerohedge) May 24, 2021

The latest Chinese credit data means that SocGen’s forecast for sharply lower credit impulse in the coming years will be validated. And as this all too critical metric fades, virtually every asset across the globe will be affected (especially if it is joined by the double whammy of the Fed also tapering in late 2021/early 2022).

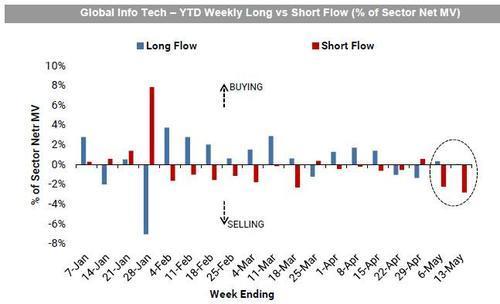

This surge is accelerated by the fact that hedgies just massively piled-in short…

Enabling yet another short-squeeze higher in the tech sector, sending Nasdaqa running stops above its 50DMA (after closing below its 100DMA on Friday)…

In the other major indices, The Dow is at a critical level…

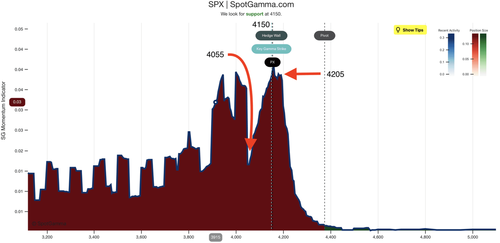

And finally for the S&P 500, as SpotGamma notes, we see the upside volatility as capped by 4200, with more room for volatility to the downside.

This view is best shown by their EquityHub model, wherein you can see distinct changes in gamma at 4205 and 4055. This implies that dealer hedging changes sharply at these levels, which corresponds with where support and resistance has been seen over the past several weeks.

And in the meantime, bond yields are tumbling with 10Y back below 1.60%…

So, to sum it all up – blame China!

China’s credit impulse is now officially in contraction, and while there is delayed impact across the globe, with the lag on various assets ranging between 1 and 22 months, the fact that China is now an active headwind to inflation suggests that in the very near future the market’s fears about soaring inflation will soon transform into worried about disinflation or outright deflation, similar to what happened in the post-2011 episode.