Uddrag fra Zerohedge:

After a slew of disappointing macro data in September (including the Q3 GDP slump), China’s economy (upon which we get the usual monthly avalanche of data tonight) was expected to continue to show signs of slowing growth as the PBOC has definitely erred on the side of caution recently (refraining from cutting banks’ reserve requirement ratio since a reduction in July, and has keeping policy interest rates steady since early last year).

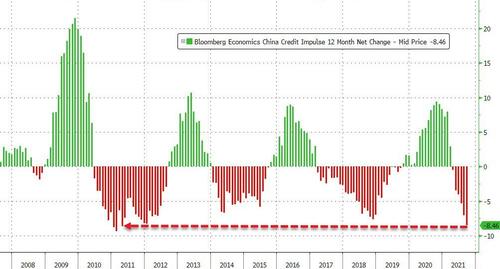

China’s credit impulse is anything but supportive, contracting at its most aggressive pace since April 2011…

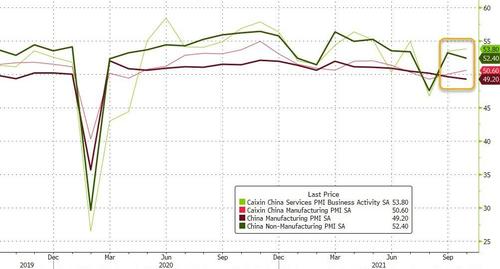

Ahead of tonight’s prints, the signals from business surveys are mixed (in other words, useless), with the private Caixin PMI showing both services and manufacturing rising, while Beijing’s official PMI showed declines in both segments of the economy…

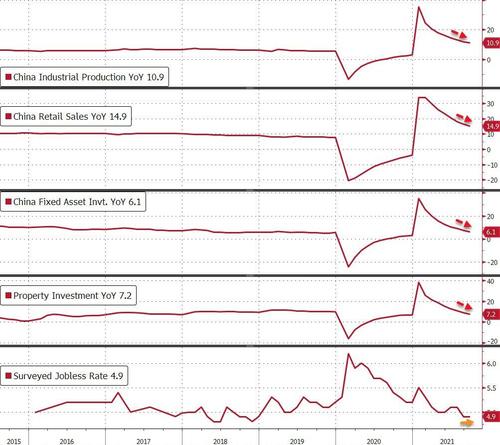

So what did the ‘hard’ data look like?

- China Industrial Production YTD YoY +10.9% BEAT +10.8% Exp DOWN from +11.8% in September

- China Retail Sales YTD YoY +14.9% BEAT +14.7% Exp DOWN from +16.4% in September

- China Fixed Asset Investment YTD YoY +6.1% MISS +6.5% Exp DOWN from +7.3% in September

- China Property Investment YTD YoY +7.2% MISS +7.8% Exp DOWN from +8.8% in September

- China Surveyed Jobless Rate 4.9% MEET 4.9% Exp SAME as 4.9% in September

So, as expected, all indicators are weaker from September to October but Industrial Production and Retail Sales managed very modest, and well-engineered, beats. On the investment side, it was a different story with big misses…

Additionally, China New Home Prices fell 0.25% MoM, the second monthly contraction in a row and accelerating lower, with prices rising MoM in just 13 of the 70 cities (well down from the 27 cities that saw prices rise MoM in September).

Given the mixed picture, it is definitely premature to call any lows here in China’s economy.

So where do we go from here?

As Bloomberg’s Chief China Markets Correspondent, Sofia Horta e Costa, notes, the central bank has little room for error.

- If liquidity tightens too much, there could be a repeat of the credit squeeze a year ago at a time when the economy is already under pressure.

- Too generous, and the PBOC may undo efforts to deleverage.

Last year, the central bank left so much extra cash in the financial system that only a few months later, Chinese officials were clamping down on excessive leverage and warning of the risk of asset bubbles.