Uddrag fra Zerohedge:

One month ago we observed that after tumbling for much of 2020 and even turning negative early Q2, China’s credit impulse had finally troughed with significant consequences for global reflation. But with China’s economy rapidly slowing and Beijing considering what is the best way to stimulate the economy without leading to another overheating, the latest Chinese credit data released overnight which missed every consensus expectation, confirmed that Beijing’s latest attempt to reflate the local (and global) economy will not be a walk in the park.

Here are the key numbers reported by the PBOC this morning:

- New CNY loans: RMB 1080bn in July (RMB loans to the real economy: RMB 839.1bn) missing consensus of RMB 1200bn. Outstanding CNY loan growth was 12.3% yoy in July, unchanged from June’s 12.3% yoy.

- Total social financing: RMB 1060bn in July, badly missing consensus of RMB 1700bn. This was the lowest TSF print since February 2020 when the Chinese economy was effectively shut down.

- TSF stock growth (after adding all government bonds) was 11.0% yoy in July, lower than 11.3% in June. The implied month-on-month growth of TSF stock moderated to 9.3% (seasonally adjusted annual rate) from 9.9% in June.

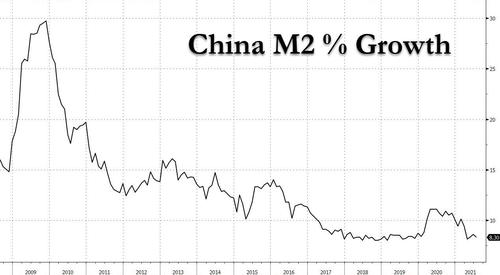

- M2: 8.3% yoy in July (-0.9% SA ann mom) also missing the Bloomberg consensus of 8.7% yoy. June: 8.6% yoy (10.2% SA ann mom estimated by GS)

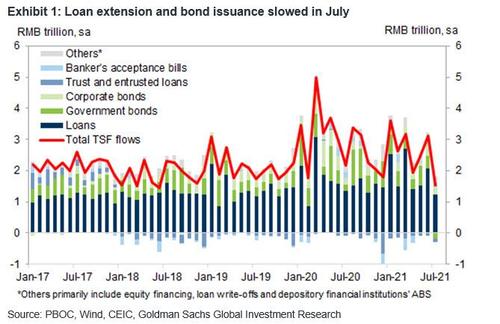

After strong prints in June, new RMB loans, total social financing (TSF) and M2 all surprised to the downside in July, as both corporate and household loans slowed, while government bond net issuance was also smaller in July vs June due to the large amount of maturing bonds in the month. Meanwhile, shadow banking credit continues to contract. Tight regulations likely continued to slow credit extensions to property, consumers and LGFV sectors, and credit demand in the rest of the economy has likely been weak, as interest rates declined along with the slowdown in credit growth in July.

Some more detailed observations:

July TSF flow and new CNY loans both came in below expectations, after both indicators surprised to the upside in June. Sequential growth of TSF stock moderated to 9.3% mom annualized sa in July from 11.1% in June, and overall RMB loans growth also decelerated to 8.8% month-over-month annualized, from 11.5% in June. M2 growth was also lower than market expectations and slowed from June.

Among major TSF components, RMB loans slowed meaningfully. Here, as Goldman reminds us, the RMB loans under TSF differs from the headline new RMB loans separately reported by the PBOC as the latter includes loans between financial institutions while the former only includes loans to the real economy. New RMB loans to the real economy were even lower than the headline new RMB loans. More specifically, the slowdown in RMB loan growth in July appeared broad-based: both corporate and household loan growth decelerated in July. Household short-term loans showed the biggest deceleration. After adjusting for seasonality, household short-term loan growth slowed to 6.3% month-over-month annualized, from 15.3% in June. Corporate and government bond net issuance was lower on the back of the large amount of maturing bonds in the month. Meanwhile China’s shadow banking system – trust and entrust loans – continued to contract, although bank acceptance bills showed a small rebound in July after seasonal adjustment.

According to Goldman, the slowdown in TSF and RMB loans likely reflected the weak credit demand amid tightened regulations on property, LGFV, and consumer credit (through regulations on online lending platforms), as interest rates in general drifted lower in the month after the broad RRR cut in the middle of the month. Disruptions such as the virus outbreak and related control measures, floods and typhoons likely also contributed.

The broad TSF growth was slow even if one looks at the average growth rate in June-July combined: average TSF growth was around 9.6% annualized in June and July, vs an average month-over-month annualized growth rate of 11.3% in the first five months of the year, and was also tracking below our 11.5% full year forecast of TSF growth.

While this may initially appear problematic, Beijing is all too aware of the credit conditions in its economy whose GDP forecast has been downgraded by every major bank in the past week amid the continued slowdown in Chinese trade, while the continued overheating in CPI and PPI means that unless China reboots its economy – and fast – it faces a stagflationary hard landing.

Needless to say, that is not an acceptable outcome to Beijing, and as a result Goldman concludes that the weak credit data and the recent resurgence of virus (along with the strict virus control measures) increased the likelihood of incremental policy easing. In fact, Goldman’s China economists continue to expect one more RRR cut later this year, and expect government bond net issuance to increase in the next few months which would support overall TSF growth.

Said otherwise, the latest data was ugly and it will hammer China’s credit impulse pushing it to the lowest level in over two years. However, it is that very downshift in Chinese credit flows that ensures that Beijing will have no choice but to aggressively easy in the coming months and push China’s hibernating credit growth back into overdrive.