Uddrag fra Authers:

The day is almost here when Jerome Powell gets his own platform to explain why the fed funds rate is where it is. Despite the drama of the last month, as the White House and administration officials have attacked him for being “too late” to cut rates, it isn’t such a difficult task.

Overnight rates in the US are the highest among developed countries because a) the US economy is in better shape than the rest of the world, and b) it’s where new tariffs will be paid, and not anywhere else. At the margin, the emerging new global trade order will be inflationary for Americans and deflationary for everyone else. Of course US rates are higher.

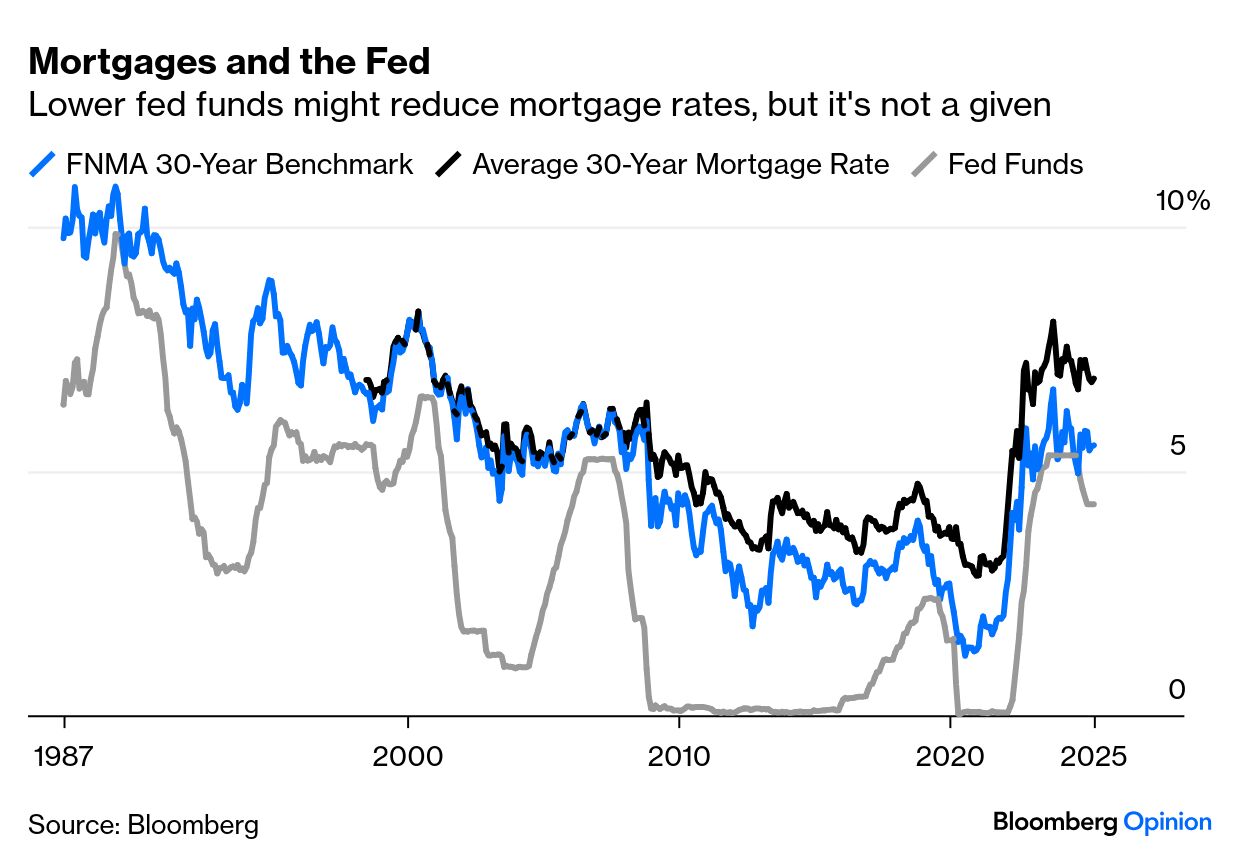

But are they too high? Scott Turner, the housing and urban development secretary, says that they’re “crippling American builders and taxpayers” by keeping mortgage rates overly elevated. There’s something in this, but part of the problem is that the market is gummed up by the Fed’s previous mistake of leaving rates low throughout 2021, allowing many borrowers to fix at rates that give them no incentive to move. And the Federal Reserve doesn’t control longer-dated bonds, or mortgage-backed securities, or the rates actually offered to consumers. There’s more to the problem than the Fed:

Beyond housing, the story is tariffs — higher than expected — and their impact on the economy, which has been much less than feared. The lack of extra inflation takes away the case for a hike. But the economy is humming with interest rates where they are, as well as with higher tariffs. There is a case to cut rates. There always is. But it’s hard to argue a desperate need to do so.

Despite this, the attack on Powell has broadened to include an investigation of the cost of renovating the Fed’s building (complete with a confrontation between the president and the chairman, both in hard hats) and a lawsuit from a Trump-supporting investor demanding that Federal Open Market Committee meetings be held in public. The language of Azoria Capital’s James Fishback leaves no holds barred:

The FOMC, under Chair Jerome Powell, is maintaining high interest rates to undermine President Donald J. Trump and his economic agenda, to the detriment of American citizens and the American economy. If the FOMC’s July 29–30, 2025, meeting is allowed to proceed in secret, it will unlawfully deprive the American public of timely access to deliberations that may reveal improper political motives behind the FOMC’s decisions.

It’s hard to take this seriously. With committee minutes, dot plots every quarter, and press conferences after every meeting, transparency is incomparably greater than it was before the Global Financial Crisis. The idea of markets trading in real time through a live broadcast of central bankers arguing about rates is nightmarish. And as the Fed’s mistake of allowing inflation to take off critically undermined the Democrats’ attempt to hold the White House last year, they might have more reason to complain about Powell than does Trump.

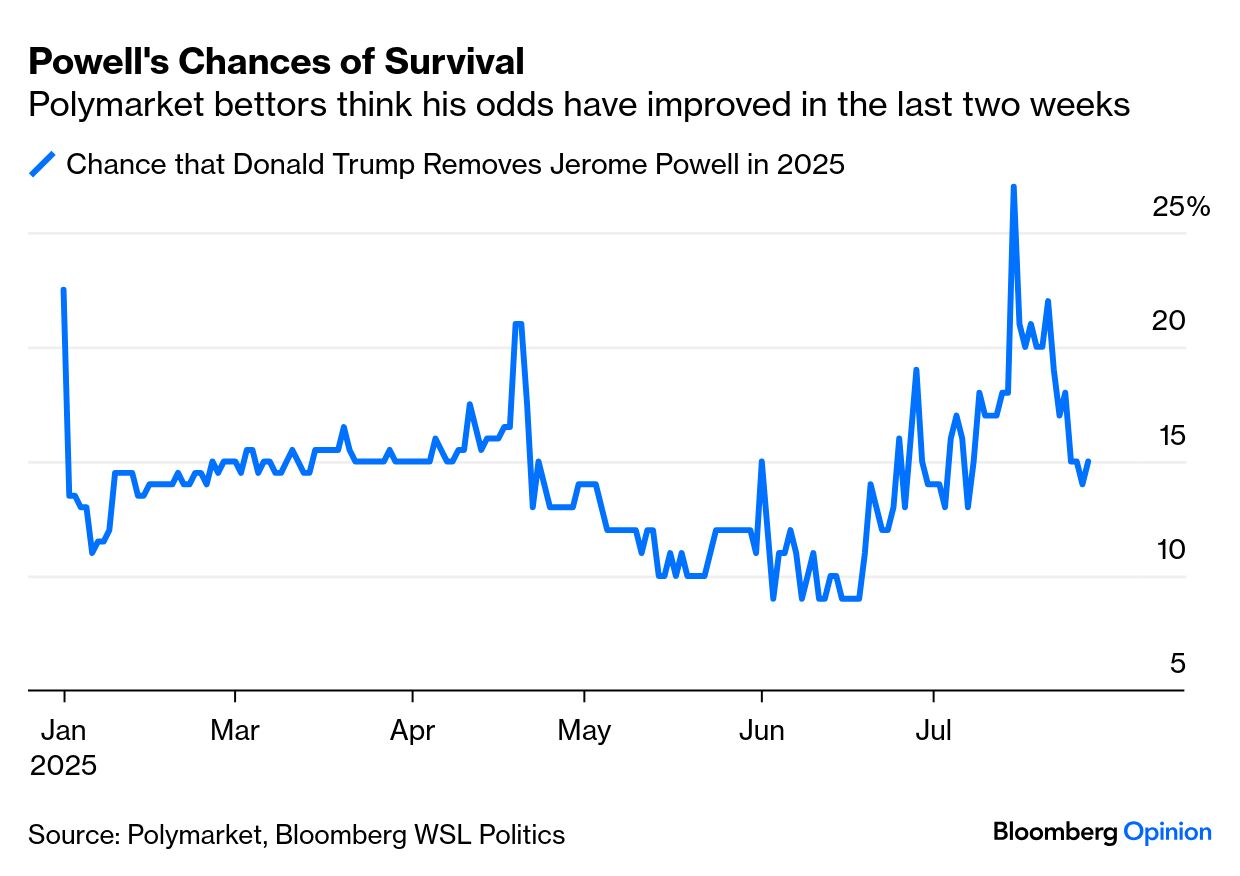

With the anti-Powell campaign blatantly clutching at straws, it’s losing some traction in the eyes of the prediction markets. From a peak of 25%, Polymarket now puts the odds of his departure this year below 15%:

Without all the excitement, this would be a quiet meeting. Last month’s employment data nixed any chance of a cut this month, and the FOMC will almost certainly leave wide open the option of a cut in September. There is no new dot plot until then.

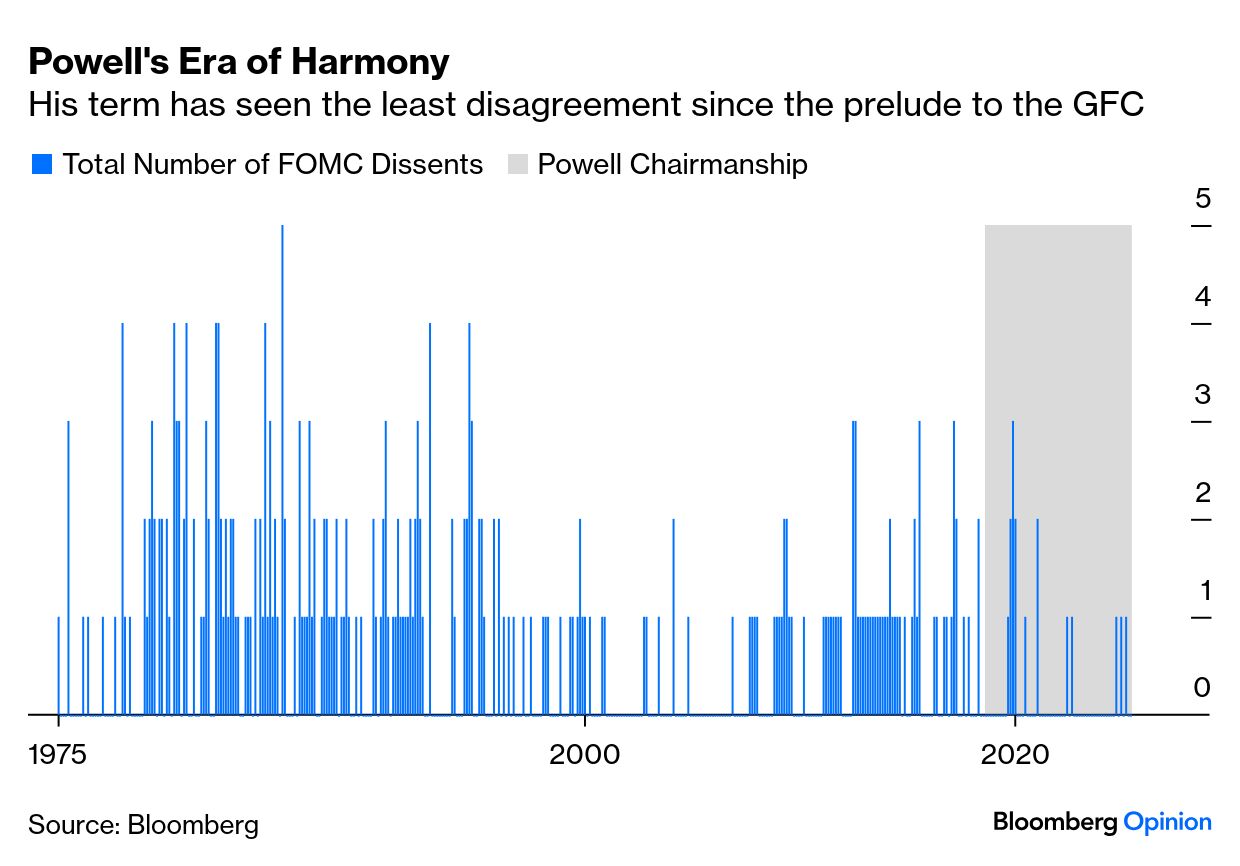

The biggest question is whether anyone formally dissents in favor of making a cut. Christopher Waller, a Trump appointee and potential candidate for the chairmanship, has laid out the case for cutting now. Dissents have grown rare, but were common in the 1970s and ’80s. The only previous period as calm as this one came ahead of the GFC — when, with hindsight, the committee should have been having spirited arguments. Other central banks often split, with the Bank of England’s monetary policy committee dividing three ways on occasion. A Waller dissent might even help Powell, as the lack of discord suggests unhealthy groupthink:

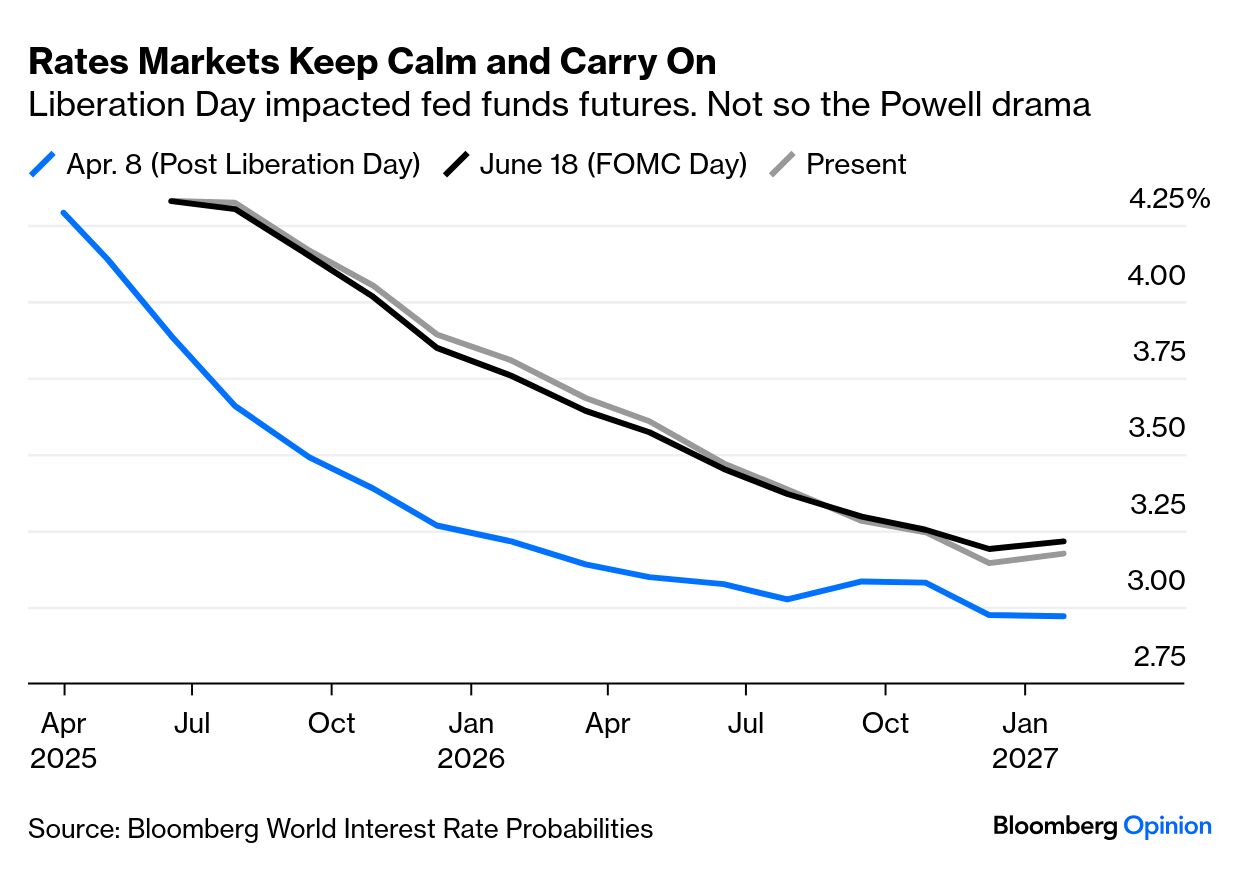

What do markets make of all this? Looking at the expected course of the fed funds rate as derived from futures by the Bloomberg World Interest Rate Probabilities function, it has stayed almost exactly where it was on the date of the last meeting. As far as the market is concerned, the Powell drama that followed changed nothing:

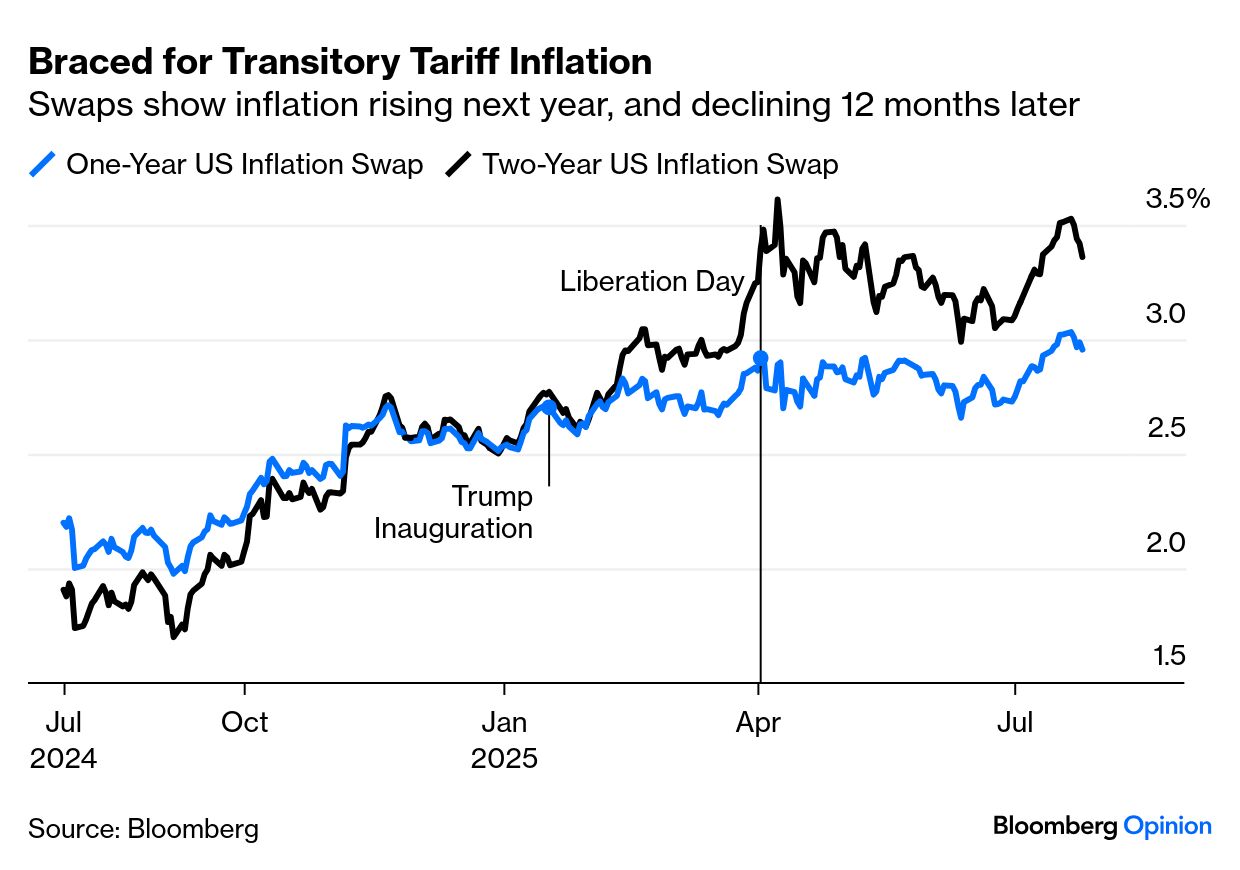

Markets also have sympathy for a Powell view that got him much derision in March — that tariffs will cause transitory inflation. The inflation swaps markets had almost identical predictions for price rises one and two years hence as of Inauguration Day. Then they parted company. Since tariffs were initially imposed on Liberation Day, April 2, the market has assumed that inflation will rise over the next year, then fall back. That’s consistent with a one-time tariff effect on the price level — “transitory tariff inflation.”

On this basis, the market’s projected path for fed funds also makes sense. It’s hard to cut aggressively when inflation is heading to 3.5%, but reductions next year should be possible. In short, the market isn’t taking the Powell drama seriously, and doesn’t think rates are absurdly high.

Even voices normally critical of the Fed counsel against this. Danielle DiMartino Booth, a long-term Fed official, authored a book in 2017 subtitled An Insider’s Take on Why the Federal Reserve Is Bad for America. She writes of the anti-Powell campaign as follows:

Whatever it is the administration THINKS it’s accomplishing by bashing Powell to deflect from Epstein, it’s not working, nor is the flirtation with ousting Powell a viable route as it isn’t legal… Firing Powell is not the way to go about accomplishing reforming an institution that has succumbed to mission creep since Greenspan came into office.

She pointed to the dangers. Even with dissents this week, most will line up with Powell. They could vote to keep him in position while any firing went through the courts. Meanwhile, recruiting a successor will be hard as “no economist worth his or her salt wants to be the next Arthur Burns, perceived as a political patsy.” It would destroy the Fed’s credibility.

The campaign against Powell is a bad idea that needs to stop. Then we can all get back to criticizing him as he again attempts to explain how he’s trying to get the economy out of the inflationary mess the Fed allowed to happen.