Uddrag fra Authers, FT:

Sunday brought news of a trade “deal” with the European Union, sealed at the president’s golf course in Scotland, which he described, in Hoganesque language, as “the greatest deal of all time.” In it, the EU accepts tariffs of “only” 15% on its exports to the US, and levies zero tariffs in return. This had been largely expected, as Japan’s similar deal several days earlier left the Europeans little choice. The EU also agreed to buy $750 billion in energy from the US, to invest $600 billion in unspecified ways that it wouldn’t previously have done, and to buy American arms. The deal isn’t a trade treaty — such t, hings cannot be thrashed out in a 45-minute meeting at the golf course. It’s barely even about trade. And the EU gets nothing from it. To use a phrase from Tigress Financial Partners’ Jean Ergas, it’s more the extraction of reparations from Europe for perceived past wrongs.

And yet, it’s market-friendly, because the US had threatened to levy a tariff of 30% on EU imports from Friday. In possibly the biggest victory for Trump, stock markets have brushed off the excitement to set all-time highs.

The deals with Japan and the EU (and others in recent days) follow massive concessions to the administration by the media group Paramount and Columbia University. The classic Hulk tactics have worked, and opponents have been picked off one by one. Despite game theory to the contrary, bullying has paid off. Game theorists show that bullies can be beaten if the victims stand together, and take some pain — the bully will hurt more than they do. The rest of the world seemed ready for this a few months ago. US trading partners from China to Canada and through to the EU immediately threatened retaliation. But now they’re caving one after another.

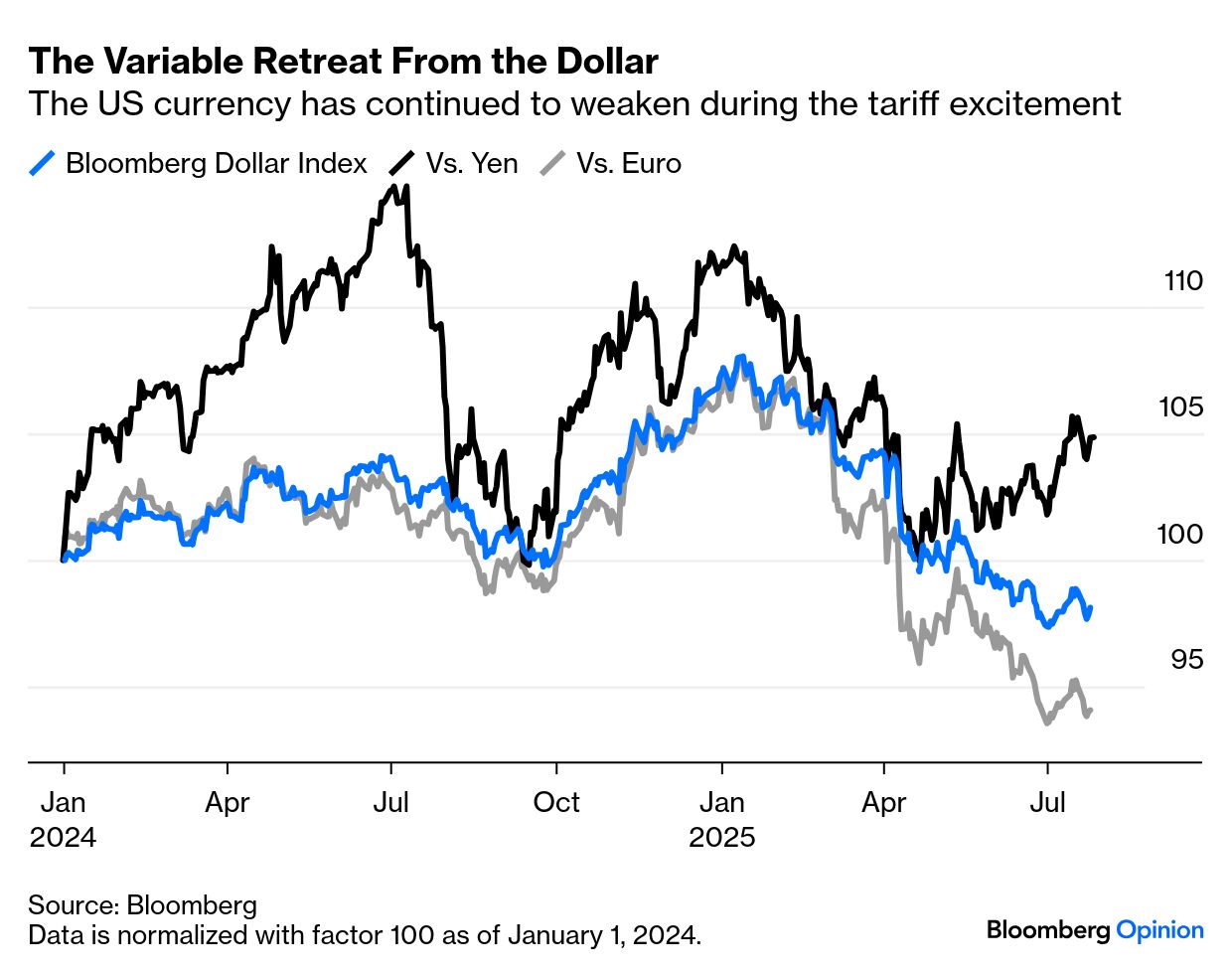

How has this happened? Facts have helped. To date, tariffs have produced a lot of revenue for Washington without clear negative effects on inflation or US profits. The dollar, contrary to expectation, has weakened, making US goods more competitive and failing to counteract tariffs. That strengthened Trump’s hand and made him more credible. Beyond that, the bully has convinced people he means business with renewed and escalating threats, and his targets haven’t coordinated their defense.

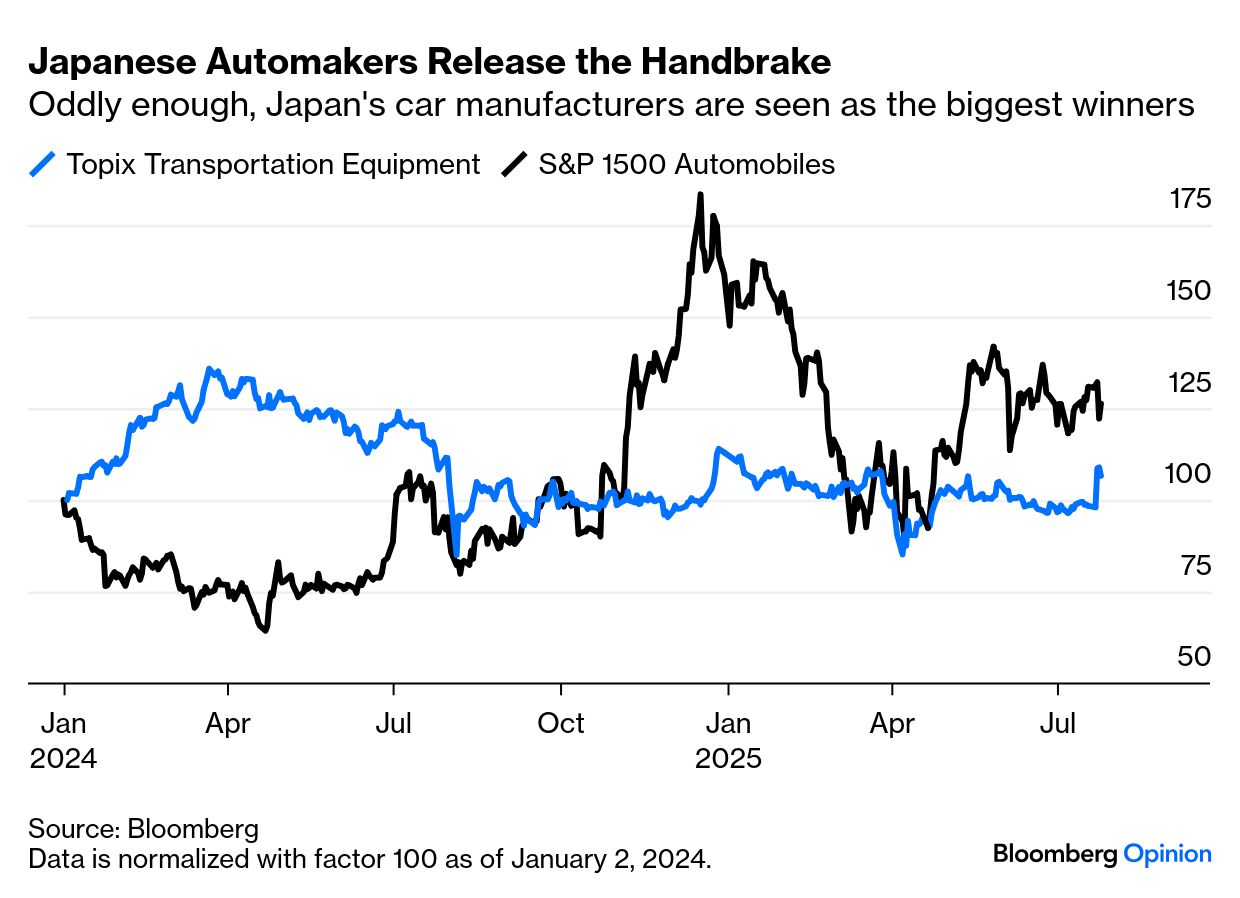

To grasp what might happen next, look at the deal with Japan, another open market that depends on exports more than the US does. Local stocks, also held back by uncertainty around its inconclusive election a week ago, suddenly leapt:

The biggest gainers were Japan’s automakers — a strange outcome as the 15% tariffs are meant to defend the US car industry from the likes of Toyota Motor Corp. and Honda Motor Co. Japan can now send cars to the US bearing only 15% tariffs, while Ford Motor Co. or General Motors Co. must pay tariffs on all imported components, including 50% on steel; so it’s not clear this dents Japanese cars’ competitiveness. In the chart that follows, note that Tesla Inc. dominates the S&P auto sector and drives its volatility:

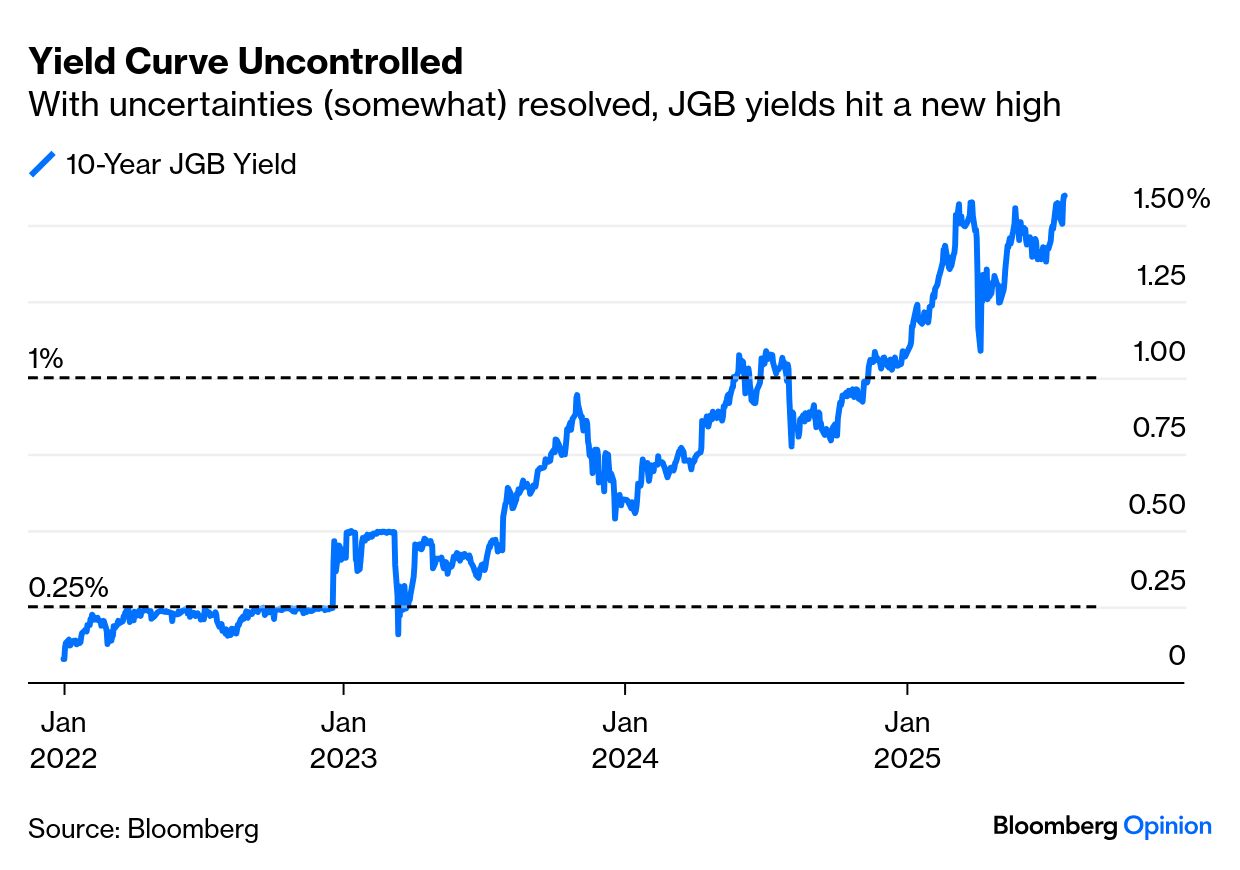

It also had an effect on the Japanese bond market. With local investors feeling less need to hold bonds for security, and with uncertainty over domestic politics and trade policy now largely removed as impediments to a rate hike by the Bank of Japan, the 10-year JGB yield, recently held at levels of 0.25% and then 1%, touched 1.6%:

With a big source of uncertainty lifted, European investors will also likely move from bonds to stocks.

Where does this leave American exceptionalism, or sustained outperformance over the rest of the world? The dollar is plainly weaker after the six months of tariff ructions:

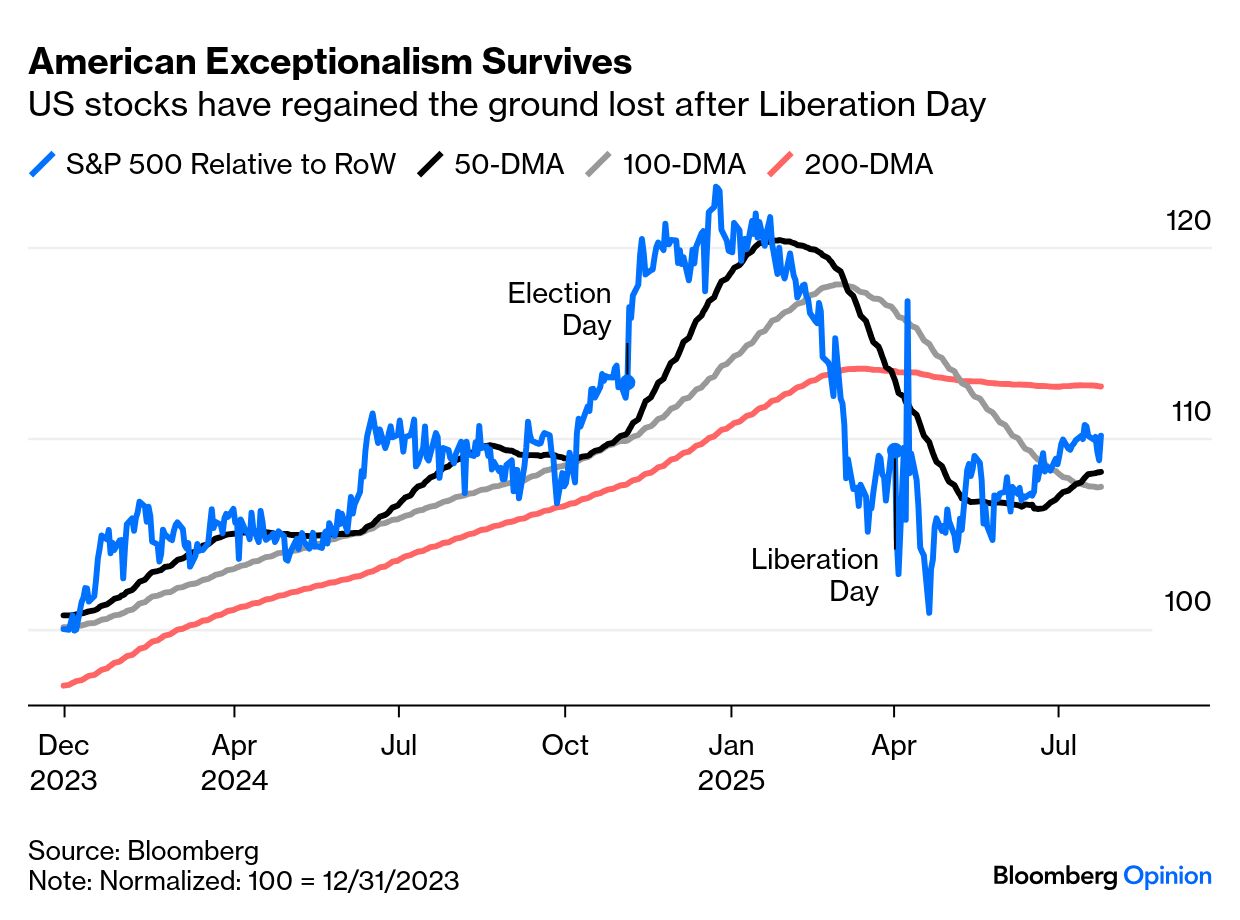

But US stocks have their mojo back. Their steep underperformance as tariffs took shape is over, and they’ve regained what they ceded to the rest of the world since Liberation Day on April 2. The US is now back above shorter-term moving averages:

How can this be, after the all-out choke that followed the announcement of tariffs on Liberation Day? Despite appearances, investors haven’t changed their mind on tariffs. The old saw that markets hate nothing more than uncertainty also comes into play. Eric Robertsen of Standard Chartered said:

Increasingly, equity and bond markets are sending the message that the resolution of tariff uncertainty might matter more than the actual level of tariffs. For now, the risk seems to be that markets are under-positioned for a sustained rally in risky assets.

These are not detailed and carefully negotiated treaties, and may not survive for long. But some clarity on what the tariffs will be for at least a few months, and the knowledge that countries are chickening out of a damaging fight with the bully, are good for now and allow a focus on positive things like artificial intelligence.

Whether this is a secular bull market will depend on how the economy and markets digest the mixture of fiscal juice, much higher tariffs and mostly lower interest rates that they have been prescribed. Trump has won his bout via two submissions. It will be months before we know whether the economy delivers a fall or a knockout.