Uddrag fra Bloomberg macro strategist,

The Federal Reserve may be forced to cut interest rates ahead of its next scheduled meeting in September to prevent a recession-inducing feedback loop forming between markets and the real economy.

For now, it’s all about markets. An interest-rate rise from the BOJ, followed by weaker-than expected economic data, has sparked the unwind of huge global imbalances that have been building to extreme levels, with another big slide in Asian equities and a rally in the yen overnight.

In such periods, the near-impossible can become the plausible lightning-fast. There has been no sudden pick-up in the pace of deterioration in the economy — last week’s jobs data was not a cast-iron portent of a recession, with the health of the labor market likely in between positively-biased payrolls and the negatively-biased household survey, while the triggering of the Sahm Rule is a red herring.

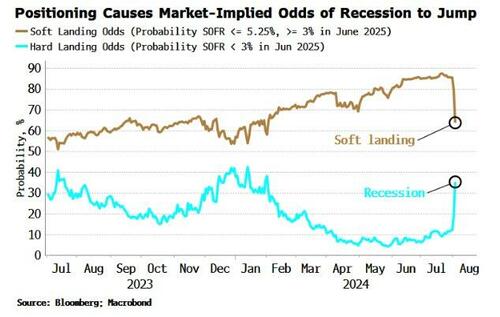

But when reflexivity rears its head, positioning creates its own reality. Even more so when geopolitical tensions are heightened. The economy today may look little different to how it did last week, but the market’s shift to pricing a recessionary outlook is precisely what makes it more likely to happen. The Fed might now be forced to cut rates as soon as this month to prevent falling asset prices feeding into the real economy and triggering such a downturn.

In such a fluid environment, outcomes matter less than distributions for investors. The spread of potential forward outcomes is changing rapidly and that opens up pitfalls as well as opportunities. August Fed Fund futures look cheap given the evolving distribution, the contract until Friday only pricing in an approximately 5% chance of a 25 basis-points cut this month, that rising to an about 20% chance this morning — although in such an environment, even larger reductions become more likely.

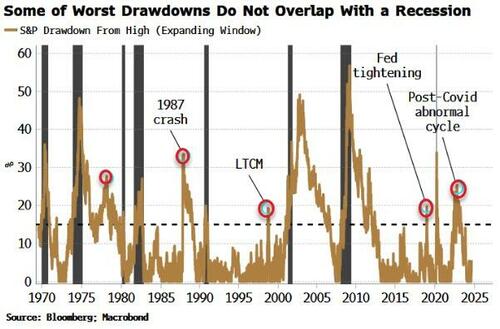

We need to invert the problem to understand why. Typically, too much time is spent on recessions and not what really matters for investors: avoiding the biggest stock-market drawdowns.

The two often overlap, but not always. The worst equity-market drawdowns have coincided with NBER recessions, but there are periods where there was a steep drawdown in stocks without a recession.

This gets to the heart of the problem. Recessions are regime shifts.

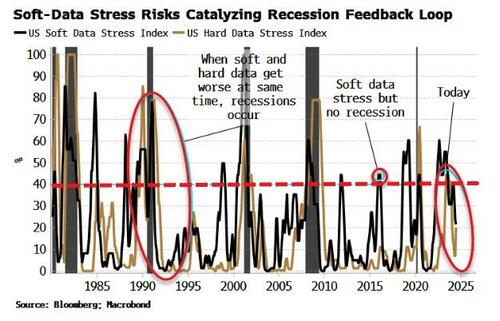

They are caused by feedback loops germinating between the real economy (hard data) and the market (soft data). When hard data starts to become excessively stressed, it feeds negatively into market prices and into other soft data such as ISM and PMI surveys.

This stressed soft data can then start to negatively impact the hard data. Falling stock prices and wider credit spreads hit the wealth effect, and dent investment through constrained capital markets and bruised confidence. Wider credit spreads stress the balance sheets of corporations. If this doom loop continues unchecked, we soon get the regime shift of a recession.

As the chart below shows, when hard and soft data become stressed at the same time, we get recessions. Note also that there are times when soft data gets stressed but the hard data does not, and thus there is no recession.

Today, hard-data stress is rising, and soft-data stress will soon follow (the underlying data in the above chart is monthly and smoothed so does not feed through immediately). Whether that becomes a recession or not is down to the Fed.

Its official mandate is inflation and unemployment, but it’s probably not a surprise to most that its unofficial mandate is asset prices, especially the stock market.

Soft data can become stressed far more easily than the tortoise-like real economy. By the time hard data is showing signs of weakness, it’s too late for the Fed to be able to salvage the situation with simple rate and balance-sheet driven monetary policy. That’s the glaring issue with inflation and unemployment as the Fed’s official mandates – they are among the most lagging of economic variables.

The Fed is therefore incentivized to make sure any flare up in soft data is not allowed to persist long enough to catalyze a recession-causing feedback loop. And here, as we have seen countless times, the Fed’s tools do have bite. We can see why — in a financialized economy — it’s really the Fed’s unofficial mandate that gives it a chance of achieving its official ones.

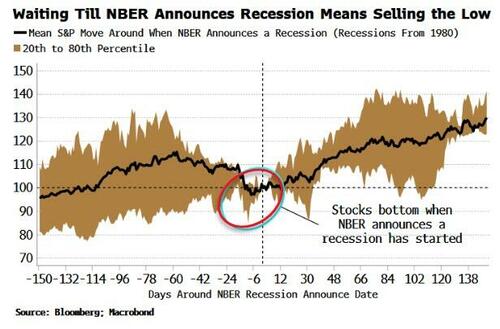

This is where we are today. From a pure economy point of view, it’s unlikely there will be an NBER-recession before the end of the year. It would take a rapid and significant downshift (revised or otherwise) in leading, coincident and lagging data for it to happen.

However, if the market continues to sell off, the chances of a downturn will rise. But as an equity investor, waiting until the NBER declares a downturn to have officially started before selling is a short-cut to ruin — the selloff IS the recession.

The key question now is: will the stock market go from a price maker, forecasting an AI-driven productivity boom just around the corner, to a price taker, accepting the bond market’s view that a recession is becoming more likely?

The coming days will tell, but stocks are already as agitated as they have been for some time. The ingredients are there for an ugly unwind that would make Fed inaction increasingly intolerable.

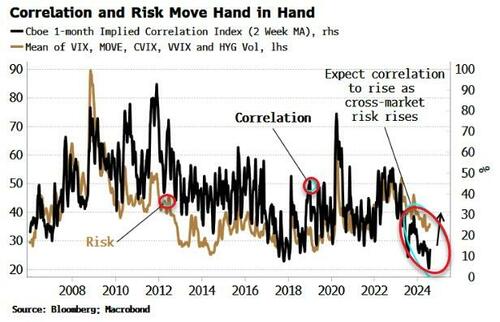

A prime candidate for how this will occur can be seen in index correlation. It recently reached all-time lows and was close to its lowest effective bound. Dispersion selling (where vol on the index is sold versus vol on single stocks) drove much of the move, exacerbated by the fact that only a handful of equities were driving the overall market.

But index correlation has started to rise. It’s what could really cause vol to explode and the market to fall as the volatility of single stocks — which has been high relative to the VIX — transmits with increasing force into the VIX as stocks move more together.

In times of cross-market stress like these, correlations rapidly pick up. Reinforcing the move, there are clear signs of the dispersion trade being exited, most visibly the rapid and abrupt inversion at the front of the VIX curve.

The stock-market perpetual motion machine might be about to shudder to a halt, creating an almighty stir when it does as the huge imbalances built up over the last two years are abruptly unwound. That would make a recession in the next 3-6 months – a low probability event under the old distribution – more likely, despite no material change to the hard data.

Everyone refreshing the Fed website for the emergency rate cut announcement. Just a matter of time now https://t.co/xwIwkd9q5m

— zerohedge (@zerohedge) August 5, 2024

The Fed is in an invidious position, as it will be accused of pandering to the market if it cuts rates ahead of the September meeting. But it will face far more opprobrium if it was seen as failing to prevent a recession. Under this calculus, there is a non-negligible chance it decides to act with alacrity, and much sooner than is expected.