Deutsche Bank går imod en generel opfattelse, at cash forsvinder. Men folk vil stadig have sedler og mønter – i årtier. Derimod vil der ske en dramatisk stigning i digitale betalinger, også med mobile pay. Kontanter er en dinosaur, der ikke udryddet.

Uddrag fra Deutsche Bank:

When people discuss the future of payments they tend to predict the end of cash. Our view is different. Not only do we think cash will be around for a long time, we see the transition to digital payments as having the potential to do no less than rebalance global economic power.

We analyse the unexpected results of our proprietary survey of 3,600 customers across the US, UK, China, Germany, France and Italy and forecast trends in cash, online, mobile, crypto, and blockchain.

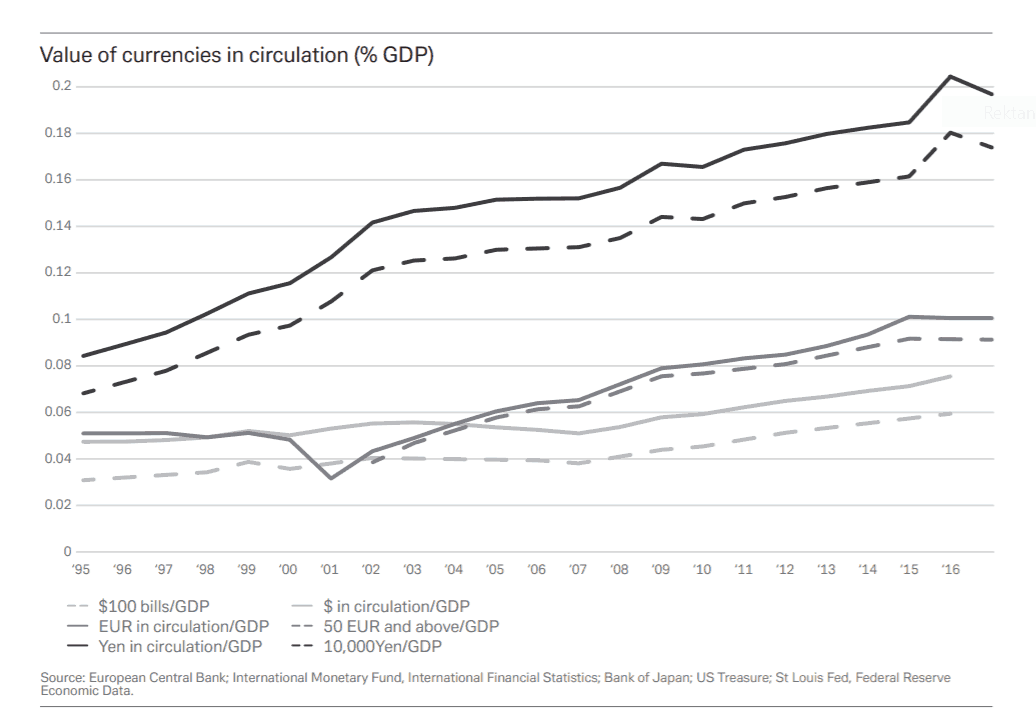

We start by using the lessons of history to predict that cash will be a part of the economy for decades to come. Over centuries, people have developed a deep-rooted trust in paper and coins during uncertain times. Today is no different. For example, the trade war between the US and China has led notable investors to increase their cash holdings. Our survey shows that people also like cash because it allows them to more easily track their spending.

While we believe cash will stay, the coming decade will see digital payments grow at light speed, leading to the extinction of the plastic card. Over the next five years, we expect mobile payments to comprise two-fifths of in-store purchases in the US, quadruple the current level. Similar growth is expected in other developed countries, however, different countries will see different levels of shrinkage in cash and plastic cards. In emerging markets, the effect could arrive even sooner. Many customers in these countries are transitioning directly from cash to mobile payments without ever

owning a plastic card.