Siden marts er kronen blevet styrket over for euroen. Det skyldes en lav likviditet. Hvis ikke likviditeten stiger, kan Nationalbanken begynde at intervenere, mener Nordea. Kronen var i marts knap 7,475 over for euroen, men den er steget til 7,445.

Low excess liquidity paves the way for a stronger Danish krone

Since mid-March the Danish krone has been strengthening markedly against the euro. Despite this, the Danish central bank has not yet intervened. However, unless excess liquidity starts to pick up, the bank could start to sell DKK soon.

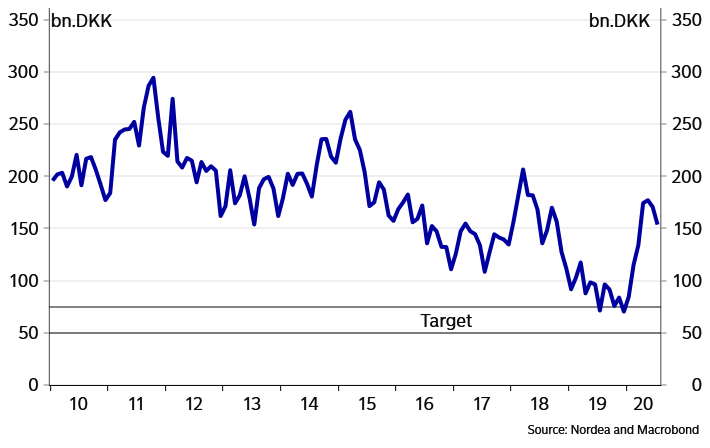

Large prefunding has absorbed liquidity

At end-July the government’s account at the central bank stood at DKK 153.8bn. This is much higher compared to what was expected at the start of the month in the central bank’s daily breakdown of government payments. According to our estimates and adjusted for issuance and buybacks in DKK during the month, the government account was expected to be at around DKK 120bn

Chart 1. Government’s deposit at central bank stays elevated

This was the fourth consecutive month with a markedly lower drain on the government’s deposit than expected. The main reason is most likely that the demand for disbursement of subsidies has been much lower than expected as the Danish economy in general has performed better during the crisis than anticipated just a few months ago.

This holds especially for the compensation of fixed costs for companies. According to the Danish Ministry of Finance, the expected use of this facility would reach a total of DKK 65bn. However, up until now only DKK 3.2bn has been disbursed.

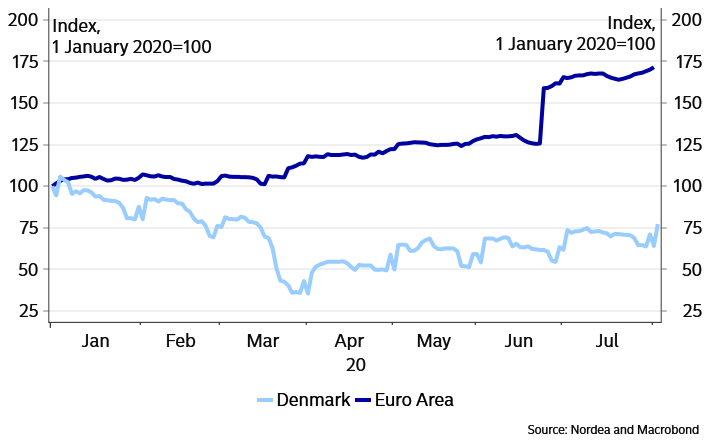

Low excess liquidity pushes DKK stronger

As a direct consequence of the lower-than-expected financing requirements, excess liquidity in the Danish money market has been much lower than anticipated by the central bank. In sharp contrast, excess liquidity in the Euro area has increased markedly since late March due to the expansion of the QE programme and the large uptake in TLROs.

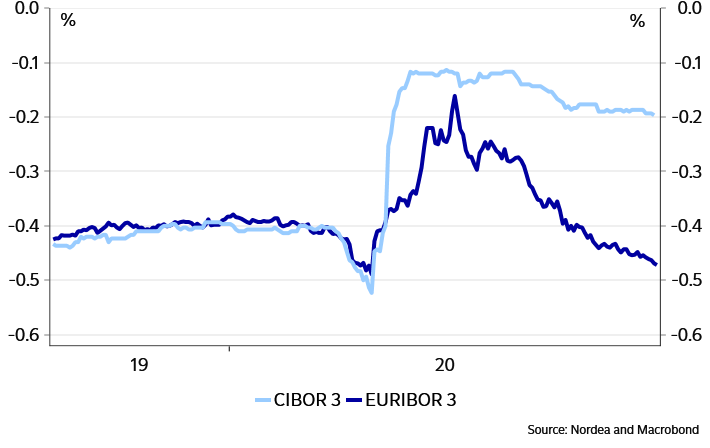

This opposite move in excess liquidity has triggered a large increase in spreads between short-term money market rates in the Euro area and Denmark which again has triggered a strengthening of the Danish krone against the euro.

Chart 2. Large discrepancy in excess liquidity trend …

Chart 3. … has triggered much higher money market rates in Denmark compared to Euro area …

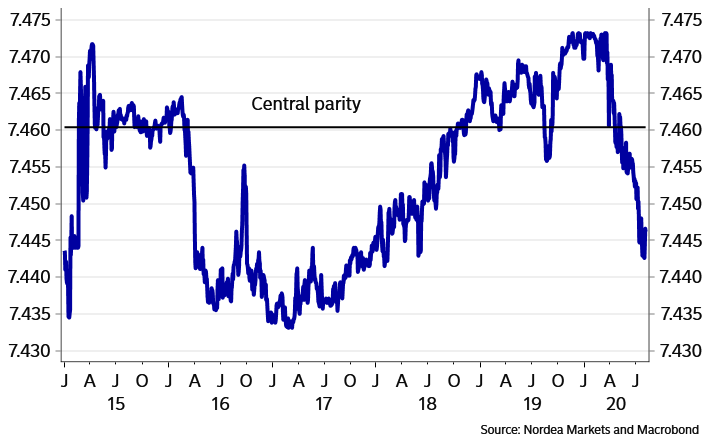

Chart 4. …and caused DKK to appreciate against EUR

The Danish central bank could start selling DKK soon

Currently, EUR/DKK is trading around 7.445. Given the large interest rate spread we find it likely that the Danish krone will continue to appreciate, thereby increasing the likelihood of the Danish central bank starting to sell DKK. We expect this to happen if EUR/DKK goes below 7.440.

If the bank starts to intervene in the FX market, this would bring some much-needed liquidity to the Danish money market. However, as the ECB will most likely continue to increase excess liquidity in the Euro area, this intervention from the Danish central bank will not necessarily be enough to reverse the current downward pressure on EUR/DKK.