Sverige klarede sig – økonomisk set – godt gennem første kvartal, hvor væksten faldt meget svagt med 0,3 pct. i forhold til det tidligere kvartal. Der var en stigning i BNP på 0,5 pct. målt på årsbasis.

Uddrag fra Nordea:

Sweden Macro Flash: Q1 GDP not too bad

GDP stood at -0.3% q/q and +0.5% y/y in Q1 according to a fresh flash estimate.

For the first time, Statistics Sweden published a flash on Q1 GDP. As from 2020, Statistics Sweden will present a flash estimate – a “GDP indicator” – for all quarters (previously only for Q2).

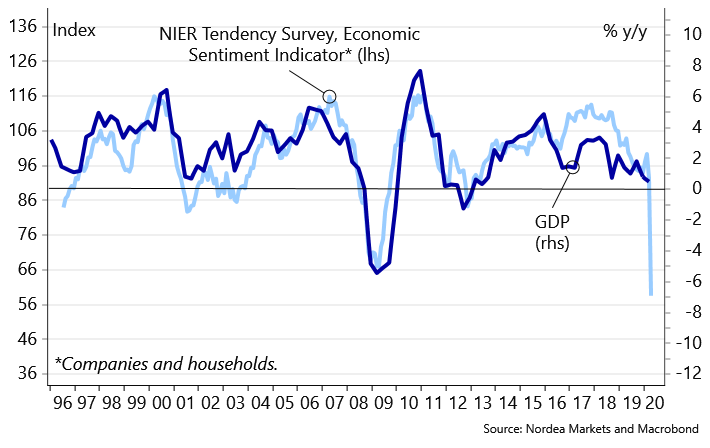

According to the flash, GDP declined by only 0.3% q/q in Q1, which was less than feared. We saw GDP down by 1% q/q. The Riksbank’s two scenarios for Q1 GDP were -1.6% and -1.8% q/q, respectively.

There are few details out. Statistics Sweden says in the press release that exports rose in Q1 while inventories and fixed investment declined and weighed on growth on the quarter.

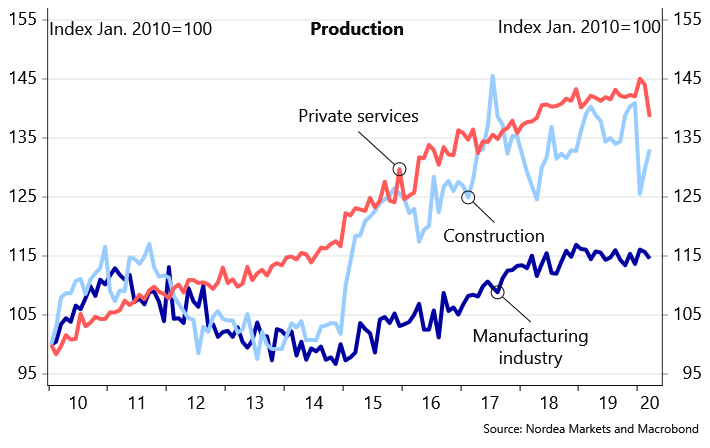

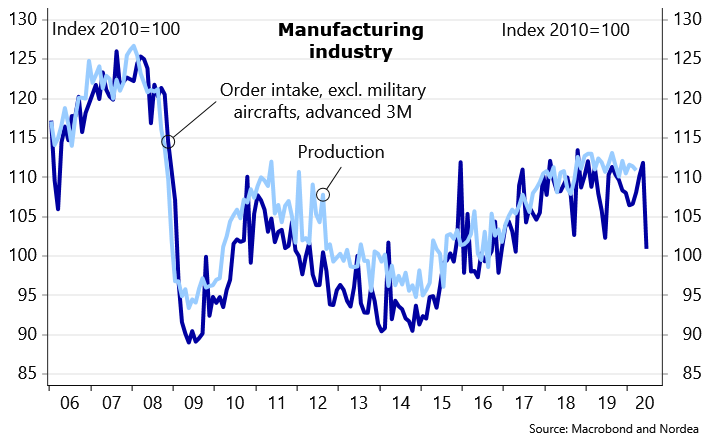

Other data also presented today indicate that it was mainly production in the construction sector that declined in Q1, while the private service sector and manufacturing industry largely moved sideways.

However, production in the service sector dropped markedly in March. Order inflow to the manufacturing industry declined too in March.

All in all, the stronger than expected GDP for Q1 is good news, but is history. The big downturn will come in Q2. The Riksbank and the NIER see Q2 GDP down by around 10% q/q. Even more important is for how long the standstill will last. There are some glimpse of hope, but the uncertainty remains fundamental.

Revised figures and more details for Q1 GDP is due out on 29 May.

Details, Q1:

GDP q/q : -0.3% (Nordea & consensus -1.0%; previous +0.2%)

GDP y/y : +0.5% (Nordea 0%; previous +0.8%)