Uddrag fra Goldman Sachs, Zerohedge:

As GS trader Mike Washignton writes in the daily market wrap note (available to pro subs), Regional Banks (ZION, WAL) and JEF were under pressure on credit provisioning weakness: it was the 2nd worst day for the group since the SIVB implosion in March 2023.

So going back to the prevailing confusion, Washington writes that the number of clients calling the desk and just asking ‘WHAT IS GOING ON’ in financials is HIGH. And until answers come in, we are on Regional Banks ‘NDFI credit’ watch (loans to non-depository financial institutions) after ZION booked a $50 million NCO from 2 credits. Court filings indicate it’s related to two investment funds fully unrelated to First Brands and Tricolor, vindicating those who – like us and Jamie Dimon – said there is “more than one cockroach.”

Separately. WAL also plunged as it appears they have a separate lawsuit going on against the borrowers in question, seeking to recover $100mn. Lot more inbounds on NDFI loan exposure now, and Goldman senses that some of the “private credit anxiety” is shifting towards regionals.

ZION released a Form-8k Disclosing a $50mn loss ($60mn provision to impact bottom line), which is quite sizable: as Goldman Nash/GIR notes this is ~7bps of CET1 or ~5% of consensus ’25 earnings.. Quoting the 8’k below so you all can read it yourself.

Zions Bancorporation, N.A. (the “Bank”), recently became aware of legal actions initiated by several banks and other lenders against parties that appeared to be affiliated with two borrowers (the “Borrowers”) under two related commercial and industrial loans extended by the Bank’s California Bank & Trust division (the “Loans”). The Bank’s Loans are guaranteed by several individuals (the “Obligors”).

Upon discovery of this information, the Bank commenced an internal review of the Borrowers, the Obligors, the Loans, and the supporting collateral. During this review, the Bank identified what it believes to be apparent misrepresentations and contractual defaults by the Borrowers and Obligors and other irregularities with respect to the Loans and collateral. The Bank’s subsequent demands and notices of default and acceleration to the Borrowers and Obligors have gone unanswered.

Based on currently available information, on October 15, 2025, the Bank determined to take a provision for the full approximately $60 million outstanding under the Loans and charge off $50 million of said amount. The provision and charge-off will be reflected in the Bank’s earnings and financial statements for the third quarter of 2025. The Bank intends to pursue its legal remedies and has commenced a lawsuit in California against the Obligors for full recovery. Although the Bank believes this is an isolated situation, it plans to engage counsel to coordinate an independent review.

Shortly after, clients presumably did a bunch of digging in court filings, and feedback quickly noted there’s potentially other smid/regional banks named/exposed to the same borrower in question.

JEF had its investor day today – and per feedback, some investors didn’t feel comfortable with how risk to First Brands / Point Bonita was handled. Alone, this normally would be modest underperformance for a few idiosyncratic banks and we’d move on; however the timing is poor, and it’s causing sentiment to spiral out of control and leak into the broader market.

Why?

Recall heading into earnings, the market got itself nervous on both consumer CREDIT and private CREDIT. This (in our view) was mostly noise, but the client worry was real, and just the other day Jamie Dimon warned of more “cockroaches”

So following Tricolor/First Brands (two other credits where banks had alleged potential fraud), as well as general anxiety on consumer credit (wrote about what was going on here at the time), the question isn’t ‘is this specific credit a contagion risk’ (though we have gotten some of these questions from generalists) it’s been mostly

- ‘how is this getting through underwriting’ (lots of questions on this re JEF too, not just regional/commercial banks)

- why have three unrelated potential frauds been discovered in the past month and a half (this is a VERY important question. It smells like something is OFF to people), and

- ‘are underwriting standards at smaller banks getting loosened to juice loan growth’

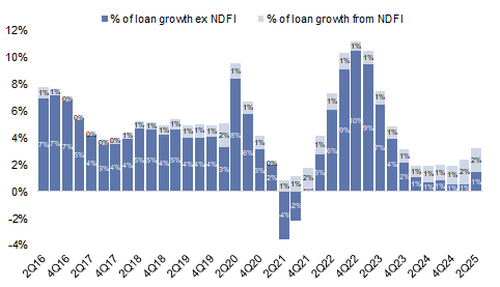

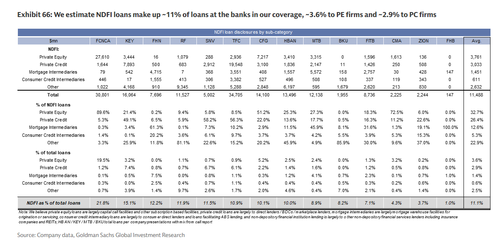

That last part is also unsettling to people as it fits their broader narrative. These loans are mostly coming from “NDFI” loans (which are loans to non-depository financial institutions and include a lot of different things .. this morning’s note had USB’s slide that showed the types of stuff that are in it), These loans have increasingly become a source of loan growth for regional banks (attached a chart from Ryan Nash’s 2Q25 handbook below), and generally are ~15% of loans (with variation) but clients are also emphasizing that not all NDFI loans are the same – additionally, not all NDFI underwriters are the same (You see this given great variation in bank performance today.. larger banks are outperforming smid/regional banks by ~300bps, in some cases up to +1000bps)

Within NDFI, Most of the focus incremental in conversations is on the ‘private credit’ and to a lesser degree ‘consumer credit intermediaries’.

With that said, it seems like we are in ‘discovery phase’ as no one seems to know what’s going on. These moves in Financials are LARGE: ZION’s loss it disclosed was ~5% of its earnings and the stock is down 13% as of send a couple of minutes before close. Regionals overall are down 7%, Moneycenters down 3.9%, JEF -10.6%, anything tied to credit both across Consumer (COF -6%) and the Alts (-5%) is trading heavy, Conventional defensives like the card networks are down -2-3% and even the exchanges can’t catch a bid (defensives CME CBOE -2%).

Additionally, pricing-related pressure in insurance is also not helping Financials investors, and the #1 perceived ‘takeout’ regional bank dropped -9.4% yesterday as it messaged to the market it was interesting in buying. You can see the pain – and you can almost hear the sound of money leaving Financials.

Overall, this seems a bit crazy after net incremental disclosure around one borrower (though clients are saying ‘now it’s three’) but at the end of the day, there’s been a NOTABLE shift in tone of our conversations where the prevailing view now is ‘seems like something is going on.’

We still have a LOT of regional banks to go through earnings, and expect this to remain a huge focus in calls & disclosure.

Refreshing some charts from Nash’s handbook again on NDFI loans in regionals.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her