En analyse fra Commerzbank konkluderer, at en lav oliepris på 30 dollar vil styrke vækstraten – i Tyskland med 0,9 pct. og i eurozonen med 0,6 pct. Det vil presse inflationen i bund. Men Commerzbank venter alligevel, at ECB vil lempe renten.

Uddrag fra Commerzbank:

The consequences of the oil price collapse

After Russia canceled its cooperation with OPEC on Friday, Saudi Arabia went on a confrontational course and massively lowered the price of its crude oil. As a result, the price of a barrel of Brent oil fell from $50 on Friday morning to $33 this morning. On a daily basis, this is sharpest drop in oil prices in percentage terms since the Gulf War in 1991.

What does this mean for the economy?

The collapse in oil prices is an indicator of the massive increase in economic risks. On the other hand, it represents a welcome cost relief for the many oil-importing countries. For example, German oil imports accounted for 2.9% of GDP in 2019, compared with 2.1% in the euro zone. The recent oil price collapse thus lowers the German oil bill by an amount equivalent to 0.9% of GDP (euro zone: 0.6%). However, this should not prevent GDP in Germany and the euro zone from shrinking in both the first and second quarter.

Euro inflation could fall to 0% in May

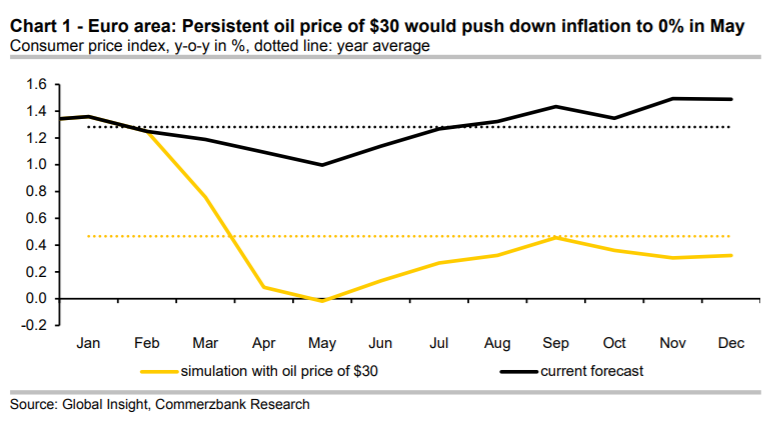

The fall in oil prices will not only affect the economy but also inflation. If the oil price remains at around $30 , inflation in the euro zone could fall to the psychologically important 0% mark in May (Chart 1). On the other hand, declining oil prices will have only a slow impact on core inflation (inflation excluding energy, food, alcohol, tobacco).

According to ECB calculations, a 10% drop in oil prices reduces core inflation by a total of 0.2 percentage points within three years. Because the oil price has fallen much more sharply this time, it should reduce core inflation by 0.2 percentage points in

2020 as a whole. In February, core inflation stood at 1.2%.

ECB: More than ever a significant easing of monetary policy

Central banks should look through a temporary slump in oil prices, as it does little to alter the

long-term inflation outlook. But the ECB de facto already announced a week ago that it would

respond to the risks posed by the coronavirus. After the collapse of oil prices, we expect more

than ever that the ECB will significantly ease its monetary policy at its meeting on Thursday. It

is likely to increase the volume of its bond purchases from €20 to €40 bn for a limited period of

six months. We also expect the deposit rate to fall by 10 basis points to -0.6%.