Fra Rabobank/ Zerohedge:

Summary

- Today, Joe Biden was inaugurated as President of the United States. In his first ten days in office, President Biden is expected to sign a flurry of executive actions aimed at Covid-19, the economy and climatechange.

- The two Democratic victories in the Georgia run-off elections have opened the door to expansive fiscal policy in the next two years. For the near-term, Biden has proposed the American Rescue Plan. For the remainder of his term he is expected to announce a Recovery Plan next month. According to our calculations, Biden’s plans would provide a boost to economic growth, also in the long run.

- However, the question is how much of his plans can be realized, given the minimal Democratic majority in the Senate. It would take only one centrist democratic senator to block a Biden initiative. Consequently, the internal divisions in the Democratic party will come to the forefront in the coming two years. In this sense, Biden’s style may be more reminiscent of that of a prime minister trying to hold together a broad and shaky coalition.

- Under a Biden administration foreign and trade policy will remain focused on meeting the challenge of China as the main rival of the US. However, Biden is likely to return to a multilateral approach.

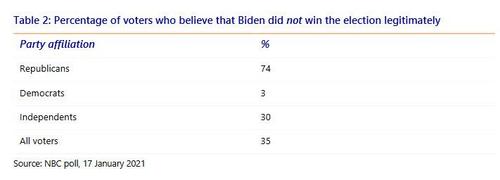

- The contested elections have left the United States with legitimacy issues regarding Biden’s presidency.In fact, a majority of Republican voters does not even believe Biden is the legitimate president of the United States.While we expect Biden’s policies to boost economic growth, we do not expect them to end the vicious cycle of polarization and social unrest that is undermining the country

Today, Joe Biden was inaugurated as President of the United States. In his first ten days in office, President Biden is expected to sign a flurry of executive actions aimed at Covid-19, the economy and climate change.Biden intends to sign orders expanding testing for Covid-19, protecting workers from the pandemic and establishing public health standards.

He also wants to mandate the use of face masks on federal property and for interstate travel on airlines, trains and transit systems.Biden is also expected to keep in place restrictions on evictions and foreclosures and to extend a suspension of interest-free student loan payments.Biden wants to rejoin the Paris Climate Accord and put an end to the Keystone XL pipeline.The reversal of the deregulation of the Trump year swill have an early start.

Biden’s growth impulse

The two Democratic victories in the Senate run-off elections in Georgia on January 5 have opened the door to expansive fiscal policy in the next two years. In the near term, this means a substantial additional Covid relief package. But it also means an expansive fiscal policy in the next two years, aimed at stimulating economic growth. Biden wants to invest more in education, R&D, and infrastructure.

The Democrats want to pay for this partly through higher taxes. The budget deficit is likely to increase further. But our calculations show that Biden’s plans could provide a substantial impulse to economic growth, also in the long run. Biden’s fiscal policy initiatives are split up in a near-term covid relief plan (American Rescue Plan) and a medium-to-long term plan (“Recovery Plan”). He presented the first on January 14 and is expected to release the second in February.

The American Rescue Plan

While it took Congress relatively little time to agree on the well over $2 trillion CARES Act back in March last year, it took until December to come up with a $900 billion follow-up. However, the two Democratic victories in the Senate run-off elections in Georgia on January 5 have opened the door to more covid relief.On January 14, Biden presented his American Rescue Plan, a $1.9 trillion package that includes additional direct payments of $1400 to Americans (in addition to the $600 from the December package), an increase in federal unemployment benefits to $400 (from $300) per week and an extension through September(from March), and increasing the federal minimum wage to $15 per hour(from $7.25 since 2009).

The rescue package can be divided in three large chunks: $1 trillion in direct relief to households, $440 billion for small businesses and communities that were hit particularly hard by the pandemic, and $415 billion for virus response. At present, it is uncertain how much of this plan will be approved by the Senate. For example, there is doubt about the effectiveness of sending people checks without knowing if they really need it. Not only Republicans have their doubts, but also a centrist Democratic senator such as Joe Manchin.

The American Recovery Plan

As for the coming years, Biden is expected to present a Recovery Plan in February. Biden is expected to invest more in education, R&D, and infrastructure. Even if only part of Biden’s plans materialize -the Democratic majority in the Senate is minimal-, we expect a boost to GDP growth in 2021 and beyond.While there may be some common ground between Democrats and Republicans on infrastructure, for a large part they are thinking about different forms of infrastructure. While Republicans may be willing to spend federal money on highways, bridges and airports, Democrats are thinking of green infrastructure facilitating clean energy and electric vehicles.

Although markets are focusing on Biden’s spending spree, we should not forget that tax hikes are also part of his plans. They may not be at the top of his list given the covid crisis, but once the economy regains momentum tax hikes may come back to the surface. Meanwhile, we should not lose sight of the fact that not all businesses and households have suffered due to the covid outbreak. Some have actually done quite well, so they should be able to absorb a higher tax rate.During her Senate confirmation hearings for the position of Treasury Secretary, on January 19, Janet Yellen said that the Biden team does not immediately plan to pursue tax increases, but would consider them as part of a later package that focuses on long-term investments.

Getting plans realized

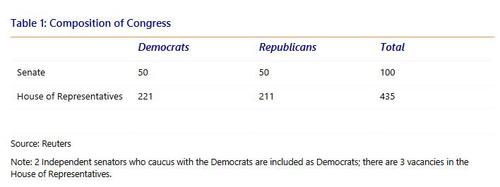

The question is how many of Biden’s plans are going to be realized. After all, the Democratic majority in the Senate is minimal. The Republicans have 50 seats and the Democrats 48. However, independent senators Bernie Sanders and Angus King caucus with the Democrats and the Vice-President is the tie-breaker in case of a 50-50 outcome. This means that Kamala Harris is going to be busy and is likely to spend a lot of time on Capitol Hill. Her main contact may very well be Joe Manchin, who is considered to be the most conservative Democratic senator. He will be able to block the more leftist plans of the Democrats on his own. So we cannot simply assume that Biden can realize all his plans just because the Democrats have majorities in the House of Representatives and the Senate. In the next two years the differences within the Democratic Party will come to the forefront, instead of the differences between the Democratic Party and the Republican Party as in the last four years. How many of Biden’s plans are going to be realized no longer depends on Senate Republicans after the Georgia elections, but on centrist Senate Democrats.In this sense, Biden’s style may be more reminiscent of that of a prime minister trying to hold together a broad and shaky coalition,ranging from centrists to democratic socialists.

Increasing polarization

While Biden’s economic plans are expected to boost the economy, they will probably not reduce the polarization in politics and society. The ever increasing polarization of US politics and society has reached a level that poses a serious threat to the stability of the country. The question is now: is this the culmination of the civil unrest in the United States, or is this just another warning signal that the country is heading toward something worse? If we look at the underlying mechanism of polarization, it appears tobe self-reinforcing. New events or information will be interpreted through two different filters, such as CNN and Fox. What’s more, economic policies aimed at income redistribution will not appease Trump supporters, as we explained in Economy or identity. The Trump vote is not about the economy, it’s about identity. Biden’s plans do not offer a solution to these anxieties. If the US does not find an off-ramp from this route of increasing polarization, we are only going to see a further escalation of civil unrest.

In fact, a majority of Republican voters does not even believe Biden is the legitimate president of the United States.As we argued in Election meltdown, this was going to be the case no matter who would be sworn in. With Trump claiming in advance that the elections were rigged and the Democrats spurring their voters to go to the polls to avoid all kinds of nightmare scenarios, how much trust in the election outcome were voters supposed to have if their side would lose? Meanwhile, foreign adversaries such as the Russians, Chinese and Iranians, are likely to amplify the mutual distrust through cyber warfare. As we concluded in Civil unrest, no matter who would have won the elections, the turbulence in US politics and society is not likely to pass. This was only the beginning.

Return to multilateralism

When it comes to foreign policy, trade policy and international climate policy the Biden administration intends to return to the multilateral approach of the Obama years. Multilateralism does not necessarily mean that the US will go soft on all its rivals and enemies. Rather it means that it will not go at them alone, but instead (re)build coalitions.During his Senate confirmation hearing for the job of Secretary of State, on January 19, Antony Blinken said that he will work to revitalize damaged American diplomacy and build a united front to counter the challenges posed by Russia, China and Iran.However, we should note that America’s leadership of the free world has credibility issues after four years of Trump’s go at it alone approach. What’s more, America’s moral leadership has also lost credibility after the insurrection. In fact, it is already being exploited by America’s adversaries.

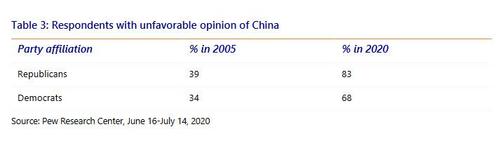

During his Senate confirmation hearing Blinken said that there was no doubt China posed the most significant challenge to the US of any nation, and believed there was a very strong foundation to build a bipartisan policy to stand up to Beijing. While the US is heavily polarized on domestic topics, there is a broad consensus on China. According to the Pew Center, the percentage of survey respondents who say they have an unfavorable opinion of China has risen in the last 15 years from a minority to a majority. And this is true of Democrats and Republicans, even though Republicans always score higher than Democrats on this topic. So there is some common ground abroad for Democrats and Republicans. However, on other issues, such as international climate agreements, Biden – feeling pressure from left wing Democrats – will be at odds with the Republicans.

Conclusion

Biden has an ambitious agenda, but he has only two years with the certainty of a Democratic majority in the Senate. If the Republicans flip just one seat in the November 2022 midterms, it will all be over by January 2023 and the Republican Senate will shoot down most if not all of Biden’s remaining plans. And during these first two years he only has a minimal majority in the Senate, which means that just one centrist Democratic senator can block an initiative. What’s more, the Democratic majority in the House of Representatives has been reduced. Meanwhile, the country is heavily divided and a majority of Republican voters does not even believe Biden is the legitimate president of the United States. Biden’s plans do not address the anxieties that fuel this divide. So while we expect Biden’s policies to boost economic growth, we do not expect them to end the vicious cycle of polarization and social unrest that is undermining the United States