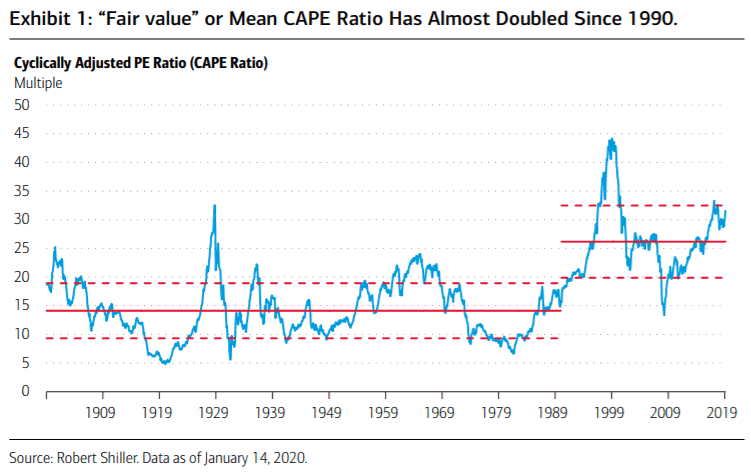

Merrill fastslår i en analyse, at aktiernes “fair værdier” er kommet op på et permanent højere niveau siden 90’erne. Det bryder med mønstret fra hele forrige århundrede. Recessioner og en høj inflation er blevet langt mindre udpræget end tidligere.

Uddrag fra Merrill:

Macro Strategy—A confluence of structural changes in the U.S. economy over the

past 70 years has dramatically reduced the incidence of recessions and raised the

value of each dollar of corporate earnings. This helps explain why traditional valuation

metrics have trended higher in the recent decades, confounding those looking at old

guideposts for clues about equity returns.

Basically, the traditional valuation metrics, like the dividend yield-Treasury yield

relationship, the ratio of market capitalization to GDP, and the Shiller CAPE ratio show

that based on previous valuation “rules of thumb,” the stock market has been and

continues to be persistently overvalued. However, as noted, there are strong reasons for

these valuation metrics to have shifted given the confluence of structural changes in the

economy since World War II. As a result, the old “fair value” is not the new “fair value.” A

dollar of earnings power today gets a higher valuation than it did in grandpa’s economy.

In addition, the conduct of monetary policy has gone through several phases since World

War II as central banks learned how to best control fiat money not backed by gold or

any tangible asset. By 1990, the Federal Reserve (Fed) and other major central banks

were well under way to taming inflation around the 2% target. Since then, inflation has

been extremely stable around that target. In fact, according to Leuthold Research, “Since

the late 1990’s, the trailing 15-year volatility of inflation has hovered near 1%, lower than

any other time since at least 1900. Inflation has not only been low, it has been predictably

low.” In short, the reduced economic volatility of recent decades makes both inflation

and growth much more predictable and stable than during the previous historical record,

which is still the basis for many existing valuation “rules of thumb.” This increased

stability warrants higher valuations, and that’s what we observed across most valuation

metrics over the past 30 years as this more predictable economic structure filters into

asset values.