Merrill har en interessant analyse af det igangværende opsving, som skyldes de enorme hjælpepakker samt den ekstremt høje ekstra opsparing, der har fundet sted under coronakrisen. Der er en lang række faktorer, der understøtter opsvinget, og det fylder det meste af Merrills lange analyse. Men Merrill siger nøgternt, at investorerne skal nyde fremgangen og det opsving i forbruget, vi vil se i år og næste år, for forbruget vil aftage næste år og få afdæmpende betydning til virksomhedernes investeringer og overskud. På længere sigt – i løbet af næste år eller senere – forsvinder opsvinget og alle stimulanserne, og det gælder især, hvis centralbankerne skrider ind mod en højere inflation. Da bliver der barskere tider for investorerne, som derfor skal skal forberede sig på mere normale forhold som midt i en cyklus.

Uddrag fra Merrill:

Keep on Keeping On Until Pent-up Demand Is Gone

Coincident and leading indicators of U.S. business investment spending remain positive heading into the back half of the year, but pent-up demand will quickly evaporate at this pace of growth. For now, this backdrop is supportive of the overall business cycle and cyclical asset classes. The outlook is more ambiguous a year or more out.

The pandemic-induced capital expenditures (CAPEX) decline was shallower than most

expected, and the recovery has been quicker and stronger as firms rush to meet the

demands of the future economy. Business confidence is soaring on higher profits, and

financing conditions are accommodative. This is a supportive backdrop for cyclical assets like

industrial capital goods stocks and business-related technology equipment, but historically, a

faster expansion can mean a shorter expansion when it comes to the highly cyclical

investment sectors of the economy. In other words, investors will likely need to consider

shifting gears when pent-up demand vanishes from the housing and business investment

sectors. For now, though, a positive near-term outlook reinforces our cyclical asset allocation

positioning.

Overall, core CAPEX spending in the U.S., as measured by shipments of nondefense capital

goods excluding aircraft, has had a “check mark” shaped recovery. Shipments were back to

pre-coronavirus levels by July 2020 and continue to march higher. From the April 2020

trough, core shipments of capital goods registered the fastest year-over-year gain on record,

up 22%, and the level now far exceeds pre-coronavirus forecasts. Similarly, orders for core

capital goods, a leading indicator, are running at an annual rate of more than 15% over the

last three and six months, suggesting the CAPEX surge isn’t done yet.

The stronger global backdrop is a key contributor to the CAPEX outlook and is reflected in

corporate confidence and business survey data both here and abroad. The Organisation for

Economic Co-operation and Development (OECD) projects that real global growth will be

5.8% in 2021, the fastest pace since 1973, setting up the accelerator effect whereby

stronger growth and corporate profits feed business investment with a lag. Partially as a

result, the May Conference Board’s measure of CEO confidence is at a record high, with data

since 1976. The National Federation of Independent Business’s (NFIB’s) survey data also

show small businesses are increasingly confident. In the April survey, a net 27% of firms

reported planning capital expenditures in the next three to six months, up from 20% the

month before.

Alongside faster global growth, profits growth is boosting CAPEX potential, and nonfinancial

firms have ample dry powder. According to flow-of-funds data from the Bureau of Economic

Analysis, nonfinancial corporate balance sheets are increasingly liquid. The ratio of liquid

assets to short-term liabilities, for example, is at a record high, with data since 1945. Profit

growth is up, and balance sheets are improving in the rest of the world as well. The ZEW

Financial Market survey in Germany shows profit expectations in the machinery space are

the highest since 2007.

Domestic credit conditions are also supportive and tend to lead the CAPEX cycle. At a high

level, monetary policy is providing support through a number of channels. Directly, firms are

seeing low borrowing costs, while commercial banks that were tightening standards for

commercial and industrial (C&I) loans have shifted into easing mode. The Federal Reserve’s

(Fed’s) Senior Loan Officer Survey shows a growing net percentage of firms are easing

standards for C&I loans. In previous CAPEX upturns, including 2018, these credit survey data

were leading indicators, another piece of data suggesting the current acceleration in CAPEX

growth has legs through year-end.

At the company level, the backlog of orders underpins the need to invest, as evident most

recently in the semiconductor space. Supplier delivery times in the headline Institute for

Supply Management (ISM) manufacturing survey have increased to a multidecade high at the

same time the labor market is tightening. The survey data reflect the fact that production is

not keeping up with new orders and that inventories are lean, a function of both supply and

demand factors. Capacity utilization metrics are rising. Existing supply chain bottlenecks

delay the production and shipment of capital goods but do not take away the orders, and

firms will need to speed up production by investing in labor and capital to meet current

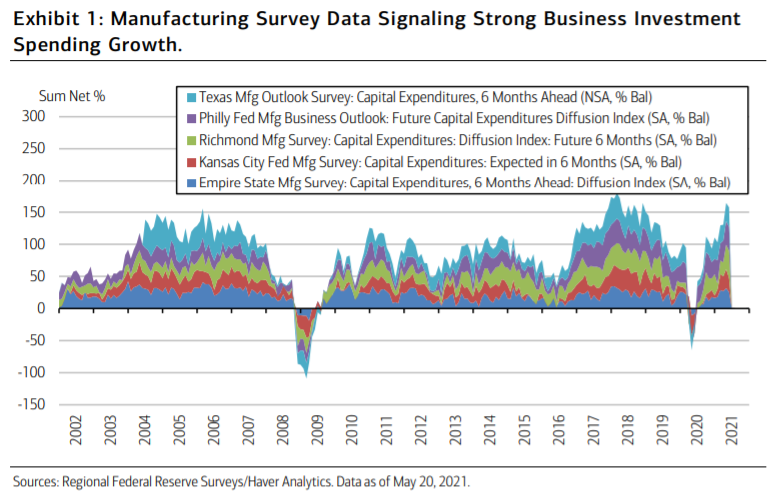

demand and rebuild inventories. Regional Fed manufacturing survey data reflect the need to

alleviate the backlog through CAPEX. The aggregate survey data of CAPEX expectations are

at the highest level since February 2018 (Exhibit 1). That year, real equipment spending grew

a strong 8%, and intellectual property investment grew 7.8%.

U.S. consumer spending on goods will continue to play an important role in the speed of

the CAPEX expansion both here and abroad. The strength in the Auto, Manufacturing

(including Technology) and Housing sectors is likely to continue as U.S. consumer

fundamentals remain strong, even if consumers switch their focus to services spending.

Capital equipment-related stocks already buoyed by the private sector could receive an

additional boost from a federal infrastructure package that targets traditional

infrastructure as well as electrification and clean energy. Policy could also indirectly

support near-term CAPEX if firms pull forward investment decisions in anticipation of less

business-friendly policies (including higher taxes) in the years ahead.

Technology continues to be the workhorse that drives the trend, and the pandemic

reinforced the dominant role technology spending plays in the overall U.S. CAPEX cycle.

Tech spending has historically played an important role in part because so much of it is

mission-critical maintenance spending. The existing trends in cybersecurity, cloud

computing, digitization and artificial intelligence are reinforcing the role that technology

spending on software and research and development play in overall CAPEX trends. In

addition to the pandemic fueling demand for work from home technology and virtual

education solutions, recent cyberattacks on critical infrastructure in the U.S. highlight the

vulnerability of private firms and the government and the need for large dollar flows (both

private and government) to play cyberdefense. Lastly, the need for semiconductor firms to

boost production globally is an additional near-term positive.

While the CAPEX expansion appears well entrenched for now, we are less optimistic on its

longevity. For one, monetary policy could be less accommodative next year if inflation

surprises to the upside. CAPEX could help alleviate that risk if it ends up boosting

productivity. Second, the strength of the ongoing CAPEX expansion means pent-up

demand could be largely exhausted in a number of sectors by next year. The most recent

capital stock data show the age of capital equipment was falling leading into the

pandemic and likely also dropped in 2020 and the first half of this year.1 The economy’s

investment sectors like Housing and CAPEX tend to swing between periods of

overinvestment and underinvestment, driving the business cycle and the under- or

outperformance of cyclical stocks. Third, policy risk is elevated. A corporate tax hike would

have a negative effect on after-tax earnings and margins. All in all, given the strength of

the recoveries in both housing and CAPEX, a more “neutral” cyclical state is likely sooner

rather than later.

For investors the key message is to enjoy the cyclical upswing in CAPEX and the overall

cycle while it lasts, but be cognizant of the state of the cycle (over-or-underinvestment).

The pace of growth means pent-up demand will melt away, and cyclical assets will have to

price a more mid-cycle outlook for the investment sectors of the economy within the next

few years.