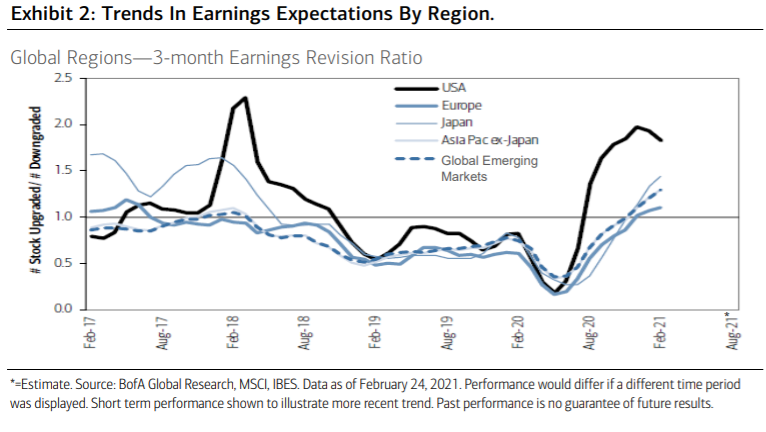

Merrill har analyseret amerikanske virksomheders indtjening og markedets forventninger til indtjeningen og mener, at markedet har undervurderet virksomhedernes indtjening. Forventningen til de amerikanske virksomheders indtjening i år er langt højere end for europæiske og asiatiske virksomheder. Indtjeningen i USA ligger stadig over forventningerne, og det indikerer højere kurser i løbet af 2021.

Sell the News: Fourth-Quarter Earnings Review

As the current earnings season winds down, the majority of S&P 500 companies reported

better-than-expected fourth-quarter earnings results compared to consensus expectations,

with 78% of companies beating expectations.

Fourth-quarter 2020 earnings also turned positive, growing +5% for companies that reported Q4 results so far, compared to consensus estimates prior to earnings season of -9% earnings growth.

However, the initial reaction for many stocks was to “sell the news” of improved earnings results, even for the companies that beat on both sales and earnings. Investors may ask why stocks

underperformed after reporting better-than-expected earnings. It is important to

remember the equity market is considered forward looking and discounts future earnings

and cash flows ahead of actual results.

The equity market as measured by the S&P 500 index discounted the improving economic and earnings environment with gains of over 20% and 11%, respectively, for the second half and fourth quarter of 2020. Arguably, the earnings improvements for Q4 were already discounted or baked into stock prices prior to this earnings season, and the market is currently consolidating the strong rally from last spring, in our opinion.

The muted reaction to Q4 earnings is not a signal that the earnings recovery is over. To

the contrary, a new profit cycle recently started and can continue over the course of 2021,

in our view. The Street may still be underestimating the tailwinds from the record

stimulus, improving coronavirus vaccination numbers, rebound in economic data, and

recovering sentiment from both consumers and corporations on the gradual reopening of

the economy. Surprising many market participants, the S&P 500 experienced sequential

earnings growth in Q4 for the first time since Q4 2019.

In the coming quarters, earnings expectations and YoY comparisons could provide an attractive setup for additional positive earnings revisions and for earnings to potentially beat expectations given that earnings estimates were cut too drastically last year.

Furthermore, initial S&P 500 consensus earnings estimates were not only negative for

Q4, but also below the weak and negative Q3’20 results. This was too bearish, and

consensus earnings estimates were revised higher over the course of the fourth quarter

and into 2021 as the Street and analysts realized estimates and expectations were too

low (Exhibit 2). Despite earnings revision ratios (ERR) moving higher over the course of Q4,

earnings are still coming in above expectations, with 79% of companies reporting upside

surprises to earnings compared to a five-year average of 74% above expectations.

We could see earnings revisions moderate in the short term with some market consolidation

and as analysts finish updating estimates as earnings season ends. We would not view this

as negative, as earnings estimates catch up to the rally in stock prices last year.