Merrill har registreret en bemærkelsesværdig udvikling i det amerikanske erhvervsliv. Selv om der er sket en kraftig stigning i virksomhedslukninger som følge af pandemien, så er der sket en endnu større stigning i etablering af nye, små virksomheder – startups. De er steget med hele 50 pct. i forhold til gennemsnittet for de seneste ti år. Det er afgørende, da virksomheder med under 500 ansatte har halvdelen af alle beskæftigede i USA. Det negative i den overraskende udvikling er, at der ikke bliver ansat så mange mennesker som forventet.

The Pandemic Startup Surge

A recent Fed survey suggests that the pandemic resulted in the permanent closure of

200,000 excess businesses compared to recent years (on average 600,000 establishments

permanently close annually, at an 8.5% closure rate). This means, more “closed” signs

were hung on storefronts during the first year of the coronavirus outbreak, for obvious

reasons.

At the same time, a less expected dynamic developed—and that’s the spike in

applications to start new businesses.

Applications for employer identification numbers that entrepreneurs need in order to start

a business numbered 4.3 million during 2020, an excess of 845,000 business formations

compared to the prior year and 50% higher than an average spanning 2010-2019. What’s

more, over the first quarter of this year, applications jumped by 62% from a year ago.

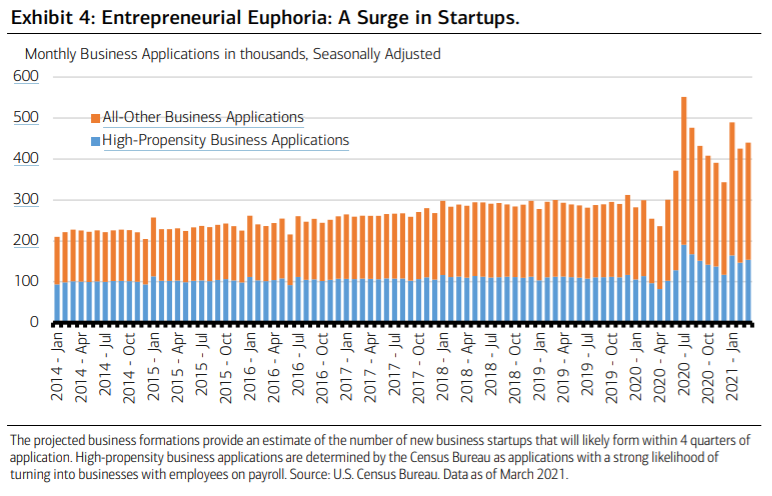

Exhibit 4 shows how in July of last year, business applications spiked, reaching a monthly

high of 551,000, only to spike again in January of this year, remaining at an elevated rate

of 400,000-plus. The 440,000 applications filed in March were up 47% from February

2020, the last month before the pandemic. All of the above reflects American ingenuity

during its darkest hour.

The key takeaway: A critical engine of job creation is small businesses with fewer than

500 employees, accounting for nearly half of private-sector employment, according to the

Census Bureau. The good news is that the onslaught of business formations is promising

for future employment growth.

The not-so-good news: As reported in the National Federation of Independent Business survey of small businesses, 42% of owners reported “job openings that could not be filled,” a record-high reading.

Hence, while the reflation trade is on, and the recovery is gaining momentum broadly with both the U.S. economy and corporate earnings cycle turning up, a key potential inhibitor to our market outlook is the labor market.

An unexpectedly soft April jobs report and a revised down March report

suggests slowing momentum in the labor market. Rising concerns around wage

pressures/inflation and labor supply could become more prominent and prevalent in the

months ahead and therefore demand the close attention of investors.