Det kan gå op, og det kan gå ned. Så enkelt lyder en 2022-analyse fra Merrill. De, der tror på et bull-marked, er lige så talrige som de, der tror på et bear-marked. Men analysen, der ikke har en konklusion, er dog temmeligt sigende, for Merrill venter på en katalysator, dvs. dét, der kan drive markedet i en positiv eller negativ retning. Inflationen og pandemien samt forsyningsproblemerne kan skabe en negativ udvikling, men omvendt kan en god bekæmpelse af inflationen og de store investeringsprojekter i USA og EU give en positiv stimulans. Merrill tør ikke vurdere, hvad der er mest sandsynligt. På globalt plan kan de kinesiske bestræbelser på at sikre en rimelig god økonomi efter en række problemer få en god afsmittende effekt på verden, med mindre USA vil fortsætte med at begrænse kinesiske virksomheders internationale ekspansion, og med mindre der bliver geopolitiske konflikter omkring Taiwan og Ukraine. Investorerne må med andre ord holde øje med hele verden – med økonomi som politik. Man skal kigge efter katalysatoren!

Taking Stock of Potential 2022 Catalysts

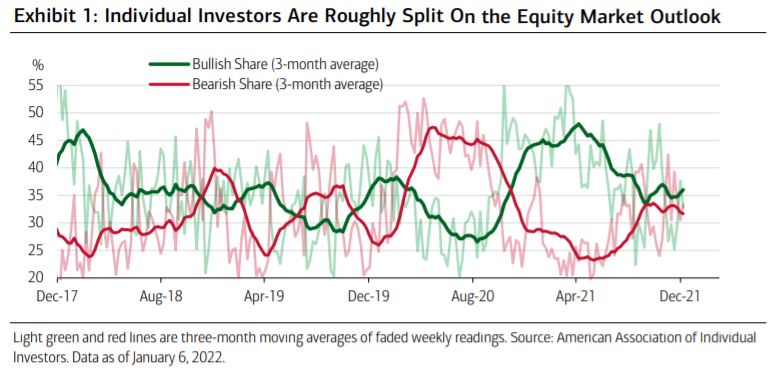

Numerous measures of equity market sentiment suggest a less extreme, more neutral

investor stance. In the U.S., the American Association of Independent Investors reports

greater week-to-week volatility in retail bias, with neither oversized optimism nor

pessimism (Exhibit 1).

The Bull & Bear Indicator also reveals undecidedness by

professional market participants. However, also catalogued, the Global Fund Manager

Survey (FMS) has registered rising portfolio cash levels, recently triggering a contrarian

“buy” signal. This panorama suggests to us an equity market awaiting a catalyst. Helping it

grind out new all-time highs, a “wall of worry” seems ready to be scaled, an evolution

contemplated in our team’s base case for 2022.

Controlled or Disruptive?

Undoubtedly, the evolution of the pandemic will likely continue to be the most important

driver of macroeconomic outcomes. With every subsequent wave of the coronavirus, the

harm to the economy and markets has diminished. Markets seem to be signaling that

Omicron, the latest variant of the pathogen, should not bring a major disruption to global

economic growth, at least over the medium term.

Nevertheless, stricter government measures are clearly possible if more severe strains

emerge or healthcare systems become overwhelmed. We have recently seen several

instances of economic disruption, including a rise in school closures, companies returning

to remote working, and airline flight cancelations due to a large-scale infection of the

workforce.

The uncertainty surrounding the pandemic implies that the risks around our base case will

continue to be large. While the demand side of the economy remains strong, potentially

excluding travel, restaurant dining and other service-oriented areas, the supply side of the

economy may face increasing pressure from a lack of workers, disrupting activity and/or

boosting higher wages, which may exacerbate inflationary pressures.

Managing the Supply Side

An adverse market catalyst may stem from this continued imbalance more decisively

shifting sentiment away from the view that inflation will end up being transitory. This is

still a prevalent judgment among institutional investors, according to the latest FMS. Such

a development may intensify a relatively novel challenge for policymakers. Raising

uncertainty, it may limit the ability of central banks to aid economic growth, or worse, lead

to an unexpected acceleration in the tightening of monetary policy in the U.S. President

Biden’s Build Back Better (BBB) platform may also be undermined by greater political

opposition, particularly as contentious mid-term electoral contests approach.

Still, a more optimistic scenario would see a continued easing of supply-chain bottlenecks,

soothing inflation worries and relieving the global economy and markets over time.

Following pandemic-related restrictions, industrial production in some major Asian

economies has rebounded, while IHS Markit has recently reported that many European

firms had experienced a tentative clearing of congestion. In the U.S., manufacturing-order

backlogs, supplier deliveries and prices paid by firms have signaled cooling pressures since

peaking around mid-2021, according to the ISM. Therapeutic advancements, bolstering

confidence, may buoy the labor force participation rate, raising the supply of labor.

While these events would help raise policymaking flexibility, another positive equity market

catalyst may well be a gradual tightening of monetary policy by the Fed, if investors

perceive it done in response to building economic momentum. An ultimately shallower

path of interest rate hikes would imply a largely sustained simulative policy overall,

fostering an environment of strong nominal economic growth, which would serve as a

backbone for better-than-expected corporate profits.

Cooling inflation expectations may widen the path for a scaled-down version of BBB,

appeasing investors worried about too restrictive fiscal policy over the medium-to-longer

term. Tailored more to address supply-side impediments, a U.S. package would join the

EU’s fiscal recovery fund, termed NextGenerationEU. This initiative, already being infused

into the region’s economy to modernize it, is expected provide a supportive fiscal backdrop

this year, according to the European Fiscal Board.

Global Focus Points

For China, the global spread of a more infectious variant of the coronavirus may raise the

costs of sustaining a zero-coronavirus or elimination strategy, which could stress global

supply chains. Also raising greater economic uncertainty, lacking clarity on a path forward

for the nation’s beleaguered property market may similarly catalyze a renewed swoon for

emerging market assets.

On the other hand, President Xi Jinping is poised to begin an unprecedented third term as

China’s head of state in October. Investors may gauge more cautious management of the

economy approaching this event as an upside catalyst for attractively valued emerging

market assets. Indeed, in last month’s Central Economic Work Conference, Chinese

authorities signaled for “keeping economic development as the central task,” suggesting a

more supportive policy backdrop.

It is this prudence that may underpin continued stability in geopolitical affairs. For the U.S.,

improving its economic relationship with China may help the Biden administration’s fight

against inflation and serve as an upside catalyst for markets. Conversely, rising tensions—

whether related to Taiwan, the South China Sea, and/or long-armed jurisdiction covering

capital and technological regulations—may hamper the longer-term outlook for

commercial interests.

Also for Europe, we believe investors will scrutinize notable electoral contests in France

and Hungary, both set to occur in April. They may also be apprehensive in the case of a

nearer-term military escalation between Ukraine and Russia. The secondary effects of this

crisis could spill over into an already volatile energy market. Finally, the state of ongoing

U.S.-Iran nuclear negotiations is also on our watch list.