Merrill ser positivt på den økonomiske udvikling i USA. Der er et stærk forbrug. Det steg med 11 pct., målt på årsbasis, i andet kvartal. Det ligger over industriens kapacitet og stimulerer dermed til flere investeringer. Bruttonationalproduktet er dermed tilbage på de vækstrater, der har været gældende siden 1985. Derfor er virksomhedernes indtjening også høj. Indtjeningsvæksten kan nærme sig 20 pct. i 2021. Udviklingen har også ført til en bemærkelsesværdig stabilitet i finanssektoren. Endelig hæfter Merrill sig ved, at value-aktier har fået et stærkt løft over hele verden.

Extended Strong Manufacturing Cycle Likely Ahead

The data have continued to confirm our view that the U.S. economy is experiencing

historically strong consumer spending and faster-than-expected inflation. Real consumer

spending increased at an 11% quarter-to-quarter annualized rate for a second consecutive

time between April and June.

Its 70-year high year-over-year growth pace (+16%) has by far exceeded the economy’s production ability, spurring massive inventory destocking, trade deficits, and the fastest seven-month “core” consumer price index (CPI) inflation in 30 years.

After an unprecedented coronavirus-related decline in 2020, U.S. real gross

domestic product (GDP) is now back on its trend since 1985, while real consumer spending

exceeds its long-term trend. As discussed below, there are good reasons to expect it to

remain an engine of robust growth in coming quarters.

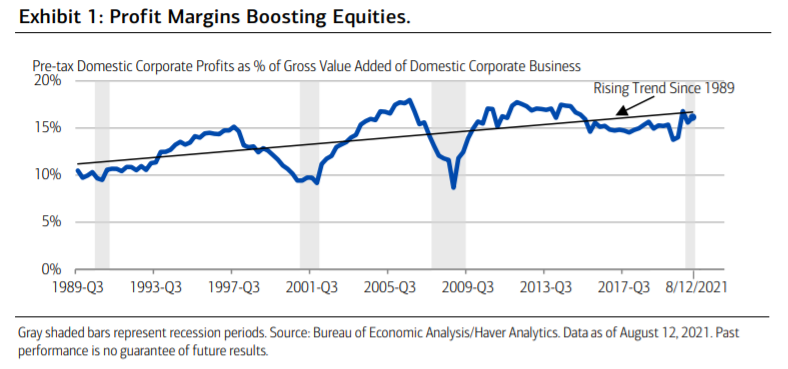

Historically-high nominal GDP growth, strong productivity, and rock-bottom interest rates

have created conditions for booming corporate profits. Pretax GDP-based corporate

profits reached new records in Q1, and Q2 earnings revisions have been overwhelmingly

positive. In our view, this measure of profits is on track to surge about 20% in 2021.

Indeed, with unusually strong demand growth, robust corporate pricing power, and low

interest expense as a share of revenues, profit margins (Exhibit 1) have remained very high

in 2021, consistent with our expectations, and are likely to continue to surprise to the

upside in coming quarters.

First, the Federal Reserve (Fed) has remained on the sidelines even as inflation reached the highest level in decades, rendering policy increasingly stimulative.

Second, we expect productivity growth to continue to fluctuate around a much

higher trend of about 3% compared to less than 1% on average between 2010 and 2018.

Coupled with decades-high revenue growth, this suggests that the outlook for corporate

profitability remains positive.

The firming economic backdrop evident in incoming data and leading indicators helps

explain the impressive stability of financial markets and low levels of financial stress in the

face of an ongoing global pandemic.

Debt refinancings, infusions of equity capital, mergers and acquisitions, and surging earnings have helped boost corporate credit quality, keeping loan charge-off rates and other credit events at bay while spurring record upgrades to company credit ratings. This has narrowed credit spreads and reduced financial-market volatility.

Reflecting normalizing economic conditions, the VIX index has settled mostly below average since early June. Based on historical patterns, a likely yield curve re-steepening will help keep the VIX on a downtrend, and strong growth with high inflation will also keep the reflation trade going.

Indeed, after a corrective period when long-bond yields were falling in June and July, the relative outperformance of cyclical, Value stocks that began last November has resumed all around the world.