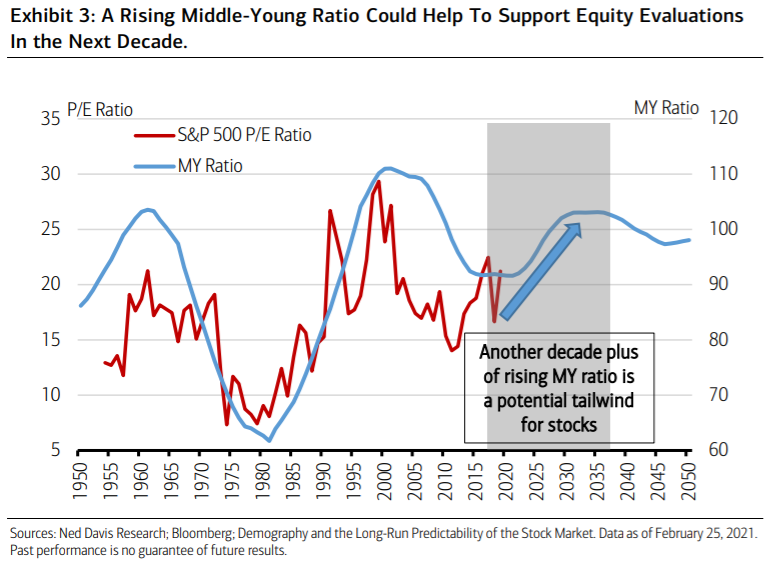

Merrill tager de lange briller på for at vurdere effekten af den unge generation, the millennials, der vil præge aktiemarkedet de næste 10-15 år. Den ældre generation i USA vil overføre mellem 30.000 og 68.000 milliarder dollar til den unge generation, der vil investere mere miljøvenligt og ansvarligt end den ældre generation, og de vil investere mere i internet-vækstaktier, mener Merrill. Det kan holde aktiemarkedet oppe de næste 10-15 år. Men derefter vil den voksende ældrebyrde og et lavere fødselstal sætte spørgsmålstegn ved udviklingen.

The Great Wealth Transfer should drive certain themes

The positive effect of millennials on the stock markets over the next 10 to 15 years could

be further amplified by their expected participation in the impending Great Wealth

Transfer. BofA Global Research found that the silent generation and the baby boomers

held $78 trillion, or 80% of all household wealth, as of Q2 2020.

Estimates vary significantly with regards to how much wealth will be transferred to younger generations over the coming decades, but it could range anywhere from $30 trillion to $68 trillion.

As millennials become more affluent, the effect of their consumption and investing

preferences will likely become more pronounced. This generation emphasizes their values

when investing and tends to support businesses, brands and products that contribute to

societal well-being—85% of millennials will seek out environmentally and socially

responsible products whenever possible.

Given their relative comfort level with technology, the younger generation is also attracted to new-economy digital-based companies that tend to be more growth oriented. And as they enter their mid-30s, they are more inclined to be less interested in renting and more to transitioning to

homeownership and suburban living, fueling the current V-shaped housing recovery that

started to materialize last year. We expect these trends to continue to build steam in the

decade ahead.

In the long run, despite the potential for millennials to provide an economic boost in the

coming decade, demographic challenges remain as reported in the Capital Market Outlook

“Measuring Coronavirus Influence on Demographics”, February 1, 2021. The global

population continues to age, and the graying of baby boomers as they enter retirement

could potentially cause a drag.

The bearish demographic narrative is further amplified by the pandemic induced “baby bust,” which estimates 300,000 to 500,000 fewer births in the aftermath of the coronavirus.5 These dynamics will likely have economic consequence in the long run.