Merrill erkender, at det er blevet dyrt at investere på de finansielle markeder. Alt er blevet dyrt. Price-earnings er kommet op på 21 mod det historiske niveau på 16. Renterne er historisk lave. I USA er de på 1,45 pct. mod en inflation på 5 pct. Det er forståeligt, at investorerne finder ubehag ved at gå ind på markedet, skriver Merrill. Men Merrill har en række argumenter for, hvorfor det kan betale sig: Investorer bør i højere grad bruge indeks, da indeks rummer forholdsvis mange vækstvirksomheder. Innovationen er steget i erhvervslivet. Store selskaber vurderes til at have en større værdi for aktionærerne. Trods stigende renter vil aktierne stadig være mere attraktive. Merrill anbefaler, at aktionærerne forbliver på markedet, men at de også skal tænke ud af boksen, f.eks. kan ejendomsmarkedet bliver et forholdsvist stærkt alternativ til aktier, inflationen og renterne stiger.

Investing in an “Everything Expensive” Market

A conundrum facing investors today is that asset prices have done exceedingly well since

the pandemic-driven bottom last year and valuations are seemingly stretched, while

investable cash on the sidelines has remained elevated. Additionally, for long-term asset

allocators, higher valuations statistically present the challenge of lower prospective

returns.

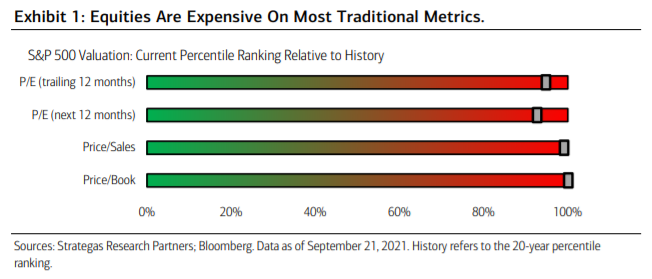

It’s hard to argue that Equities and bonds aren’t expensive today versus their own history

on almost all traditional valuation metrics (Exhibit 1). The S&P 500 is trading at a price-to

earnings ratio (PE) of 21x, on a 12-month forward earnings per share (EPS) basis, versus

its historical average of 16x. Within equities, the dominating Technology sector is trading

at a PE of 27x versus its historical average of 19x. Bond yields remain near historical lows,

with the 10-year Treasury yielding 1.45%, much lower than current inflation levels of

around 5%.

Corporate bonds, meanwhile, are offering only moderate additional yield over

Treasurys—Investment-grade spreads at 0.84% and high-yield bonds spreads at 2.75%,

both near historical lows. No wonder investors with cash get that uncomfortable feeling

when going into the markets.

Multiples May Stay Higher For Longer

Valuation multiples have historically been mean reverting, which is why many investors

may be skeptical given today’s seemingly lofty PE ratios. However, on a forward-looking

basis, it’s worth considering that even though multiples could compress some, they may

structurally remain in a higher range compared to their own history. There are several

reasons this could be true for the S&P 500 Index:

First, the index has more exposure to companies and industries that can be considered to

be of secular growth nature. Take the Technology and Communication Services sectors,

for example, which are at the forefront of the digital revolution. Today, their combined

weight in the index is 39%, compared to only 18% in 2005, according to Bloomberg.

Better long-term growth prospects should attract more investors seeking long-term

returns to U.S. equities. European markets don’t have as much exposure to secular growth

industries (Technology is only 9% of the Euro STOXX 600 Index versus 28% of the S&P

500) and Chinese technology companies are under intense regulatory scrutiny from their

government, causing investors to question their long-term holdings in the space.

Second, in the last decade or so, the level and pace of innovation has accelerated, which

has helped keep profit margins elevated. This often comes at the expense of labor, as

evidenced by the slower-than-anticipated growth in wages in recent cycles. A more

profitable index of companies should typically attract higher valuation multiples.

Third, Large-cap Equities are considered a higher-quality asset class. The return on equity

(ROE) of the S&P 500 index is roughly 18% today (and looks to be heading higher) versus

a range of 12% to 15% before the pandemic. The S&P 500 index stands out amidst a

global scarcity of assets, providing a combination of growth, quality and yield

characteristics—one of the reasons why the U.S. Equity markets have dramatically

outperformed other regions in the last 10 years.

Finally, interest rates are likely to rise but remain near historically low levels, and, thus,

from a relative valuation standpoint, Equities continue to look favorable compared to Fixed

Income, its primary competing asset class for investor dollars. The earnings yield (E/P,

using next year’s EPS estimate of $220) of the S&P 500 is roughly around 5%, much

higher than bond yields. For comparison, the earnings yield of the index was lower than

bond yields in early 2000, when the dotcom era came to a crashing end amid a major

stock market valuation overshoot.