Investeringerne vil kun stige moderat, men med en klar undtagelse, skriver Merrill: Der er fortsat stærk fremgang i den avancerede del af high-tech, herunder i den digitale sektor, udtrykt ved informationsbearbejdning og intellektuel ejendomsret, IPP. Det er dér, investeringsmulighederne ligger.

Uddrag fra Merrill:

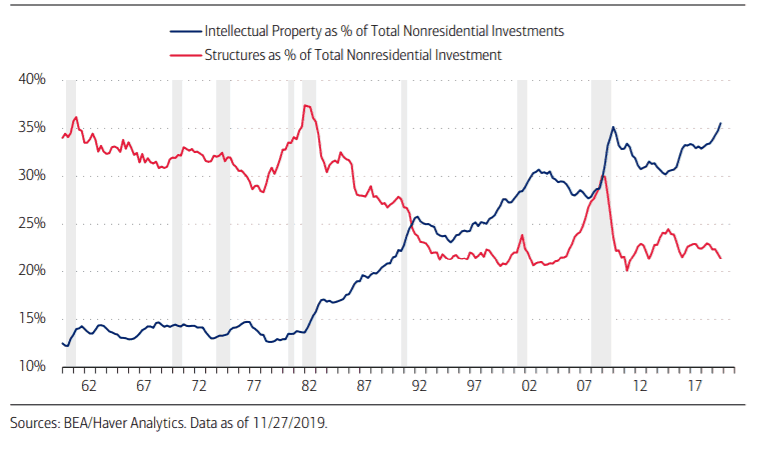

Painting calendar year 2019 broadly as a year with weak capital expenditures (CAPEX) is

misleading. Similarly, the blanket statement that U.S. CAPEX is likely to be weak in 2020

because of issues in the energy, retail and air transportation sectors, for example, ignores

a major structural shift in U.S. business spending dynamics. More than half of business

investment spending now comes from technology spending, including both information

processing equipment and intellectual property products (IPP). The latter (IPP) has been

consistently growing at a high-single-digit pace and makes up more than a third of

total business spending (Exhibit 1). This has been at the expense of more traditional

areas of CAPEX like retail and energy structures. For example, fixed investment in

multimerchandise shopping is about one-quarter of what it was before the financial

crisis. Nominal tech investment at around $1.5 trillion dollars is well over twice the size

of structures investment in nominal terms. Shopping malls are out. The cloud is in.

A key reason for maintaining our mildly positive outlook for CAPEX in the U.S. is the Federal Reserve’s (Fed’s) pivot to lower-for-longer interest rates. The interest rate effect should

work through a number of channels. Directly, firms are already seeing lower borrowing

rates as policy rates have moved lower and spreads have narrowed. This was timely as

nonfinancial corporate balance sheets look “late cycle” in terms of leverage ratios. From a

corporate margin perspective, lower interest rates help to offset the pressure on margins

from a tight labor market and moderate wage growth. More indirectly, lower rates have

had a positive impact on housing and other interest rate sensitive sectors that should

ultimately lead to higher levels of business spending via the “accelerator effect.”