Trods de voldsomme kursstigninger i high-tech sektoren mener Merrill, at den digitale revolution stadig er den store drivkraft for investorerne. High-tech er den eneste store erhvervssektor, der vokser i markedskapitalisering i S&P 500-indekset. Merrill har udpeget fire store vækstsegmenter: Internet of Things (IoT), big data, kunstig intelligens og cloud computing. Det er på de områder, at der vil ske massive investeringer med stor indtjening for de mest kvalitative virksomheder. Alene de produkter, der er i forbindelse med omverdenen via internettet (fra maskiner til pc’er og smartphones) bliver på 30 milliarder styks om to år. Det giver investeringsmuligheder, ligesom pandemien har vist vækst i nye digtale services, og cloud gør data-bearbejdning meget billigere. Det bliver inden for de mest avancerede digitale virksomheder, at gevinsterne ligger.

The Four Horsemen of the Digital Revolution

Waves of technological change have defined certain time periods—like the introduction of mainframe computers in the 1950s, to the spread of PCs in the 1980s, to the dawn of the World Wide Web in the 1990s and the proliferation of mobile devices in more pockets

through the 2000s.

The next wave of the digital revolution will help to provide a significant shift up in real GDP and productivity growth as a larger share of the economy is driven by technology. Our “Four Horsemen of the Digital Revolution” described below are the Internet of Things, big data, artificial intelligence and cloud computing—all symbiotic technologies in nature.

For the Internet of Things (IoT), the pandemic served as a major accelerant to the rise of digitalization and the number of “things” having network connectivity, both sending and receiving data. Devices and connections are growing fastest at a 10% compound annual growth rate (CAGR) compared to the general population (1% CAGR) or internet user growth (6% CAGR).

By 2023, Cisco estimates there will be 29.3 billion devices on the internet, including 7 billion smartphones, a billion wearable devices and nearly 15 billion machine-to-machine (M2M) connections including domestic appliances such as thermostats, cameras and garages, all animating smart homes.

Big data, the second horsemen, or the raw input collected and catalogued about and around the world, has enabled the datasphere (the amount of digital data generated) to grow to zettabyte1 level. With more pervasive and faster networks and advanced semiconductor technologies, the amount of data usage has approximately doubled since 2015 and is forecasted to rise another 400% by 2025.

This future growth is driven broadly across industries, with annual growth rates in data usage of certain sectors such as 36% in healthcare, 30% in manufacturing and 26% in financial services.

With an avalanche of collected data, the evolution of artificial intelligence (AI)-based algorithms such as machine learning and deep learning are the computer science capable of learning and deriving insight.

When applied to the IoT, an AI-enabled IoT will be key to the productivity enhancements for businesses. An example of AI improving both the practice and science of healthcare is the finding in one study that AI programs trained to read pathology images can now diagnose certain kinds of lung cancer with 97% accuracy.”

The cloud computing shift, or transition from on-premises data management and localized servers to cloud services, will enable the dramatic growth in data usage. “[If] the web is hyperlinked documents; the cloud is hyperlinked data.” What’s more, cloud computing offers 31% lower operational costs than comparable on-premises infrastructure and even greater savings when people and downtime costs are included.

Estimates suggest that by 2025, 50% of data could be stored in the cloud, and, although growing, there is significant runway for more assets to transition to the cloud. Already, major airlines have committed to migrating a majority of their information technology

infrastructure to a cloud infrastructure over the next decade.

Investment Considerations for the Four Horsemen of the Digital Revolution

A number of megatrends have created tailwinds for tech-enabled sectors over the long term—cloud computing, AI, IoT, big data and many more. Digital economies are not only an increasing share (currently around 10% of GDP) for the economy but for earnings as

well.

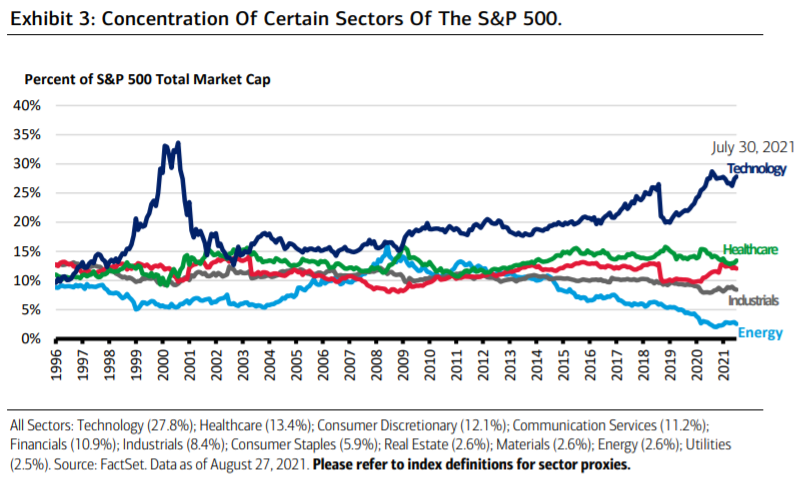

The market capitalization of the S&P 500 Information Technology sector is 27% of the broader market’s total (Exhibit 3), and its earnings share is 22.4%. (Note: The concentration of the tech sector in the S&P 500 is not as high as levels seen August

2000, which was around 34%).

Investment across the digital infrastructure value chain continues to rise at a 15.5% compound annual rate, reaching $6.8 trillion in 2023.

In addition, elevated corporate bank balances led to a technology-led capital expenditure (CapEx) recovery, with tech CapEx now about a third of total CapEx, totaling around $960 billion by Q2 of this year.

There are various ways investors should consider allocating toward sectors that stand to benefit from future cyclical and secular dynamics. We maintain our positive long-term outlook on high-quality growth stocks due to a secular rise in spending on innovation and competitiveness, and the continued digitalization of the economy.

Pandemic-driven shifts across cloud storage could boost demand for its related cybersecurity investments.

More opportunity given remote work, online banking and generally more tethered points of entry offer hackers’ opportunities to find a way into the network, making cybersecurity a top priority for retail and enterprise users.

The potential infrastructure plan seeks $100 billion in revitalizing digital infrastructure, resulting in spending tailwinds in industries across next-generation technology such as broadband internet service and advanced semiconductors.

With policy and investment serving as tailwinds, long-term growth opportunities from increased demand for processing power exist within technology such as software and services, chipmakers, semiconductor capital equipment, and hardware applications such as networking equipment and cloud servers.

As AI adoption increases, developers of computer vision, speech recognition and AI-digital assistants should benefit as more products and services leverage these capabilities.

Bottom line, and with our “Four Horsemen of the Digital Revolution” top of mind, consider maintaining positions in high-quality secular growth leaders in these areas.