Merrill mener, at dollaren i dag er fair vurderet, men på sigt kan den komme under pres. Den europæiske, kinesiske og japanske valuta kan få en større rolle globalt, og dollarens rolle som global reservevaluta er blevet svækket. USAs enorme gæld kan også presse dollaren, selv om dens status dog også udtrykker USAs økonomiske og militære styrke.

Uddrag fra Merrill:

Dollar Trends For Investors To Watch

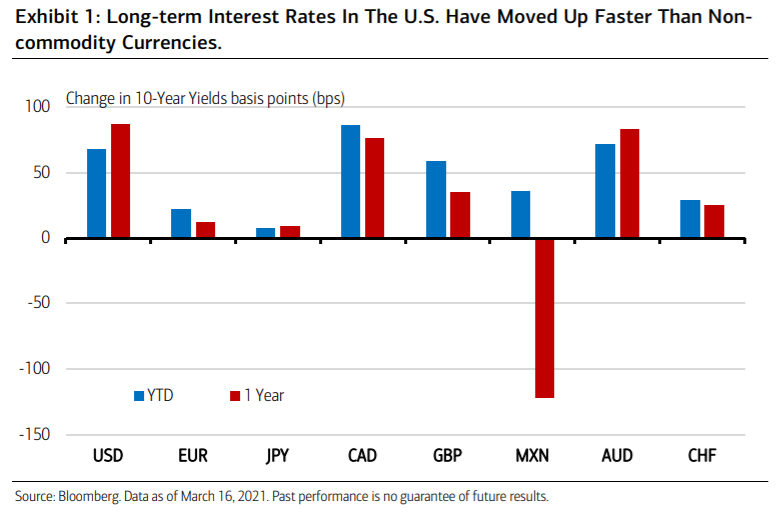

Following the pandemic-induced surge in the U.S. dollar in March of last year, interest rate

differentials that favored the dollar versus its biggest trading partners collapsed as the

Fed immediately drove its policy rate to near-zero and began quantitative easing.

Valuations were an additional headwind for the dollar at the time and the Bloomberg

Dollar Index (BBDXY) ended up finishing 2020 down 6%. Many investors expected that

trend to continue in 2021.

Thus far, the dollar has been resilient, particularly against the euro. While strong global

growth and massive reflationary efforts will likely continue to benefit commodity

currencies like the Australian dollar (AUD), the New Zealand dollar (NZD), and the Canadian

dollar (CAD), the U.S. dollar should hold its own against the euro and Japanese yen as

economic growth differentials and related interest rate differentials are increasingly to its

advantage.

Looking further out, valuations underpin the medium-term outlook, and the dollar is

no longer running against the wind. The balance of data suggests the dollar is near fair

value on a trade-weighted basis.

The euro holds the largest weight in trade indexes and by several valuations metrics, including purchasing power parity (PPP), the euro is close to fair value or perhaps slightly undervalued. Perhaps not coincidentally, the euro is currently trading near its long-term average versus the dollar

while the Bank for International Settlements real effective exchange rate for the euro is

slightly below its long-term average.

Investors should also pay attention to the U.S. dollar reserve currency status, with a

longer time frame. Data from the International Monetary Fund (IMF) for the third quarter

of 2020 showed that U.S. dollar reserves held by central banks or other monetary

authorities as a percent of the global total dropped to 60.4%, the lowest share since the

mid-1990s.

The U.S. dollar’s status as the primary global reserve currency status has been

called an “exorbitant privilege,” as it provides several unique advantages. These benefits

include the ability to finance twin (current and fiscal account) deficits at lower rates, to

use dollar-based sanctions and other financial controls as a tool in the international

relations arena, and to be the global liquidity provider of last resort. More broadly, it makes

it easier for U.S. companies to do business.

In the era of great power competition, the

Chinese renminbi (RMB) gets the most attention as a dollar alternative, despite the fact

that it accounts for just 2% of global reserves. But it is the Japanese yen that has made up

the most ground. Since 2013 the yen’s share has gone from 3.5% to nearly 6%, perhaps

reflecting Japan’s success in threading the needle of security concerns with the benefits of

free trade.

Why should investors care? In addition to the advantages of dollar hegemony that were

already laid out, currency status can be viewed as a proxy for economic power. Currencies

reflect economic health, military might, governance, credibility, transparency and

technology, to name a few factors. In brief, it is a geo-economics beauty contest.

The fiscal-stimulus-driven debt binge across the globe could also lead to a hangover

and add to currency volatility. Currency markets often take on the role of rebalancing the

global economy, and it’s possible that history repeats itself here both tactically and

strategically. Investors will need to raise due diligence standards for currency and debt risk

in an environment of excessive debt. In the current environment this includes emerging

markets where cost of debt exceeds the economic growth rate.