Merrill advarer om, at den kommende økonomiske ekspansion efter coronakrisen ikke bliver så langvarig som efter finanskrisen. Investorerne skal gøre sig klart, at der kan komme mange tømmermænd efter krisen og politiske beslutninger. Risikoen skyldes, at gældstrykket var højt før coronakrisen, men det afhjælpes dog af, at renten er blevet ekstrem lav. Derfor bør investorer lægge mærke til gældsstiftelsen i selskaberne, ligesom de bør lægge vægt på cash-flow.

Nonfinancial Leverage

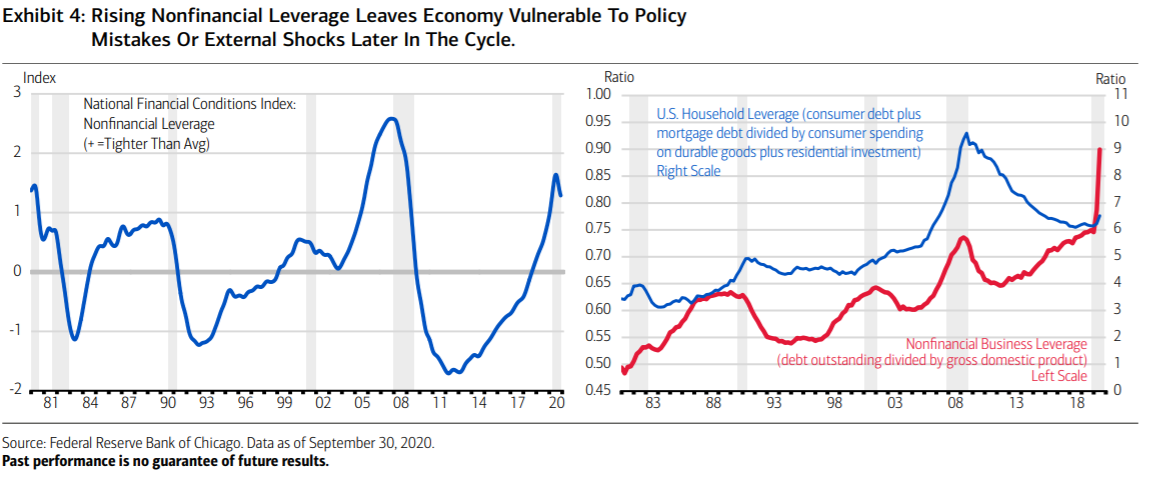

The Chicago Federal Reserve (Fed) National Financial Conditions Index (NFCI)

Nonfinancial Leverage Subindex was designed to be an early warning system for financial stress.

As the data show, there tends to be a buildup in nonfinancial leverage

(household and nonfinancial businesses) in advance of recessions. This is not a coincidence, as the presence of excesses in the investment sectors of the economy like housing, consumer durable goods or business investment make these cyclical sectors vulnerable to external shocks or tighter monetary policy that have the potential to induce deleveraging.

For investors, it is worth noting that this U.S. expansion is starting with a higher level of nonfinancial leverage than past expansions (Exhibit 4), with nonfinancial corporate business leverage particularly frothy.

Given the non-traditional nature of the coronavirusinduced recession, the debt deleveraging that often occurs during recessions did not take shape. In fact, the virus sparked a boom in housing, which is financed mostly through debt/credit, while Fed’s interest rate cuts and the temporary nature of the

recession also encouraged businesses to take advantage of low rates, leading to a surge in corporate debt issuance relative to GDP.

Similarly, households are also taking advantage of low rates, but household leverage is far from extended and has room to run. As the Exhibit 4 shows, households were in the very early innings of a releveraging cycle when coronavirus hit, and balance sheets are historically strong.

It’s never too early to start watching for excesses and imbalances, though.

Importantly, low interest rates are making servicing the debt much easier for both households and businesses, and the Fed is on hold for the foreseeable future.

If the Fed succeeds in running inflation above 2%, nominal growth and associated cash flows will likely benefit, making it easier to service that low-interest debt.

Nonfinancial corporate profit margins are also supportive of debt service on the corporate side. Interestingly, the overall Chicago Fed NFCI of which the leverage index is a subcomponent, suggests financial conditions are easy.

Lower rates are offsetting higher leverage to balance the

headline index.

Still, long-term investors should consider what the higher starting point for nonfinancial leverage might mean for the duration of this cycle and the relative performance of risk assets.

While elevated nonfinancial leverage does not necessarily mean a double-dip is in the cards, in our view, it could mean that the expansion may not last over a decade like the last expansion.

As the economic expansion stretches out over the next few years, businesses, consumers, investors and policymakers should be cognizant of the

potential for a shock or policy mistake to induce a hangover.

Higher leverage means a deleveraging cycle would be that much more painful. In the near term, investors should favor cash flow generation and be aware of leverage ratios for sectors, industries and companies in both fixed income and equities.

Given the positive cyclical dynamics in the U.S., including a strong consumer, a V-shaped rebound in business investment spending, a domestic housing boom, and very accommodative fiscal and monetary policy, we think growth is set to remain above trend in 2021.

This provides some cushion for debt service, but investors should also be on top of medium-term risks and the potential for a more severe deleveraging cycle the next time around.