De amerikanske virksomheders forventninger til indtjeningen har været faldende, og de faldt også i oktober. Forventninger til indtjeningen per aktier er mindre nu end for et halvt år siden, men Merrill ser dog tegn på lys for enden af tunnelen. Virksomhederne begynder at opjustere deres indtjeningsforventninger.

The Light At The End Of The Tunnel For Earnings And Valuations?

The trough in corporate earnings growth may be behind us, and certain valuation

multiples appear primed to compress a bit as third-quarter (Q3) profits pick up and

future expectations gather steam.

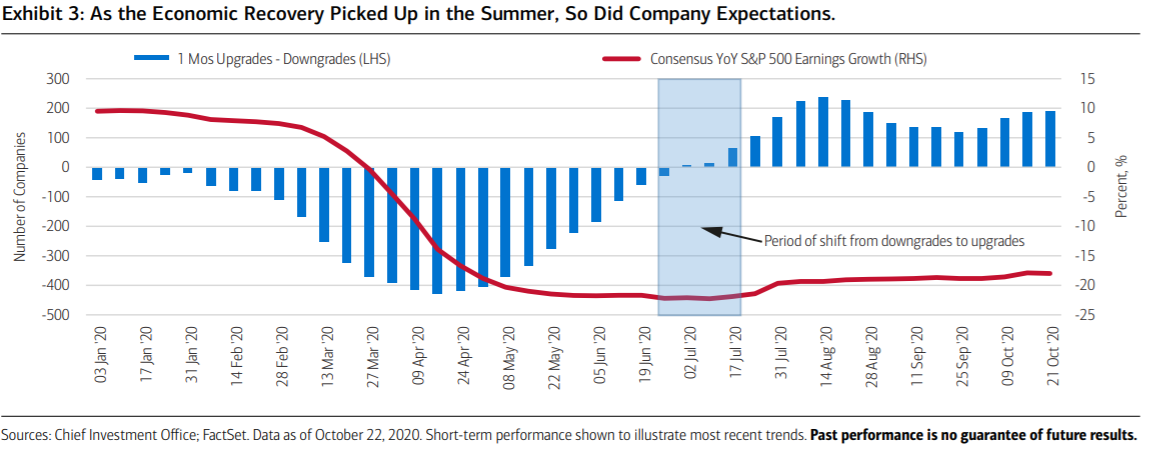

The pace of economic recovery in the U.S. has helped corporate sales and profitability to a level unexpected by many, and as management guidance turns increasingly positive toward the future so too have analyst projections.

On June 26, the consensus earnings per share (EPS) estimate for the S&P 500 this year had dropped to $127, representing a 22.2% year-over-year (YoY) decline, according to FactSet.

This contrasts with consensus expectations of $178 at the beginning of the year. Having endured the historic economic fallout from the pandemic, yearly profits

are still expected to contract; however, the pace has declined, with current estimates

tallying $134 EPS.

Q3 is anticipated to be a pivot quarter, in which the pace of profit

deterioration would decline, and, thus far, this has proven accurate. Of the 121 companies to have reported, YoY profit growth reported is -14.3% as opposed to -31.6% in Q2.

The lagging sectors remain Consumer Discretionary, Industrials and Energy, while Technology, Staples and Healthcare are actually expected to post positive full-year earnings growth.

Importantly, future expectations are also improving, with 295 companies having positive one-month upward revision momentum as opposed to just 104 downward revisions.

We continue to believe that relative valuation measures, such as the Equity Risk Premium, remain more relevant given the historically low rate environment.

However, earningsbased valuation measures are also becoming more attractive as current and expected profits increase.

Since August 28, the S&P 500 multiple on expected 2020 earnings has decreased by 1x. The process of earnings growing into multiples has started, and this

should ultimately create a stronger foundation for the equity markets in 2021 and beyond as the economic normalizes post the arrival of a vaccine.