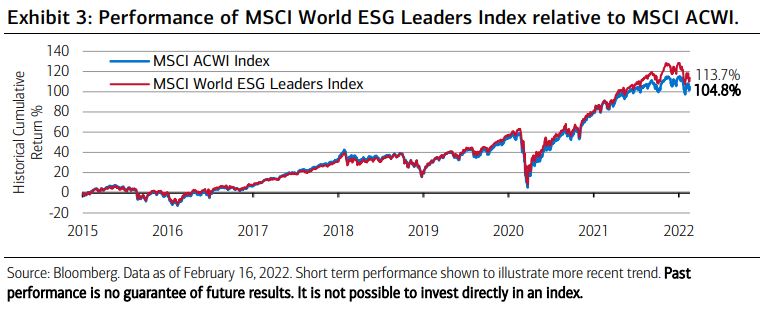

Der er megen diskussion og uenighed om ESG-investeringer, men tallene taler deres eget sprog. Det globale indeks for ESG-investeringer er i løbet af 2021 kommet over det samlede globale indeks (MSCI), og i flere år har de to indeks fulgt hinanden. Derfor er ESG-investeringer og Sustainable Investments kommet for at blive, skriver Merrill, der mener, at begrebet Stakeholder Capitalism nu kan defineres som Shareholder Capitalism. Der er sket så megen forbedring i håndteringen af SI- og ESG-investeringer – og i vurderingen af deres data – at virksomhederne nu bør betragte Stakeholder-interesserne som økonomisk forsvarlige, mener Merrill. I USA blev tilstrømningen af investeringer til SI på 69,2 milliarder dollar og nåede et rekordbeløb på 357 milliarder dollar.

Sustainable Investing & Environmental, Social & Governance (ESG):

It’s here for the long haul

Sustainable Investments – SI―a strategy which seeks to consider both financial return and social/environmental―has been grabbing headlines.

As U.S. sustainable fund net flows accelerated to a record $69.2 billion in 2021,1 assets under management in sustainable investments surpassed record highs ($357 billion as of end of 2021), and investor interest increases, confusion abounds around SI and ESG―group of standards used by socially conscious investors to screen investments―factors—yet these debates are not new.

It’s an alphabet soup out there: The language can be confusing, but the industry is

continuing to make meaningful strides toward standardization. And it’s really important to

understand the role that ESG metrics and ESG data play in this. ESG ratings (aggregations of

data points created by different firms using proprietary methodologies) were—and are—

attempting to capture the financially relevant risks and opportunities for companies.

With over

90% of the total asset value of the S&P 500 now derived from intangible assets3 and the

potential for significant climate-related regulation on the horizon, investors are increasingly

shifting to the insights that more granular ESG data can provide. While there are valid concerns

in the industry about greenwashing, focusing on high-quality ESG metrics (carbon emissions,

health & safety, diversity & inclusion) can help identify companies that both manage their ESG

risks and have the potential to have a positive impact on the world.

Embrace the genius of the “and:” The hyperbole that societal impact has to come from

either SI or government policy misses the mark, in our opinion. Just as we do not recommend

viewing ESG data to be used in isolation but rather alongside traditional financial fundamentals,

we believe that corporations can make meaningful strides in tandem with, and serve as

accelerants of, changes in public policy.

Good companies can also be good stocks: We unequivocally believe you don’t have to

necessarily give up returns to invest with a sustainable lens—indeed, full-year 2021 returns for

the MSCI World ESG Leaders Index gained 25.3%, while the MSCI All Country World Index

(ACWI) returned 19%.2

Stakeholder Capitalism is the new Shareholder Capitalism: There is vast room for

improvement and enhancements in the SI and ESG space; notably as it pertains to better

disclosure and classifications, and a shift to include outcome-related metrics and better

accountability for engagement. We believe that a company’s orientation to serve the interests

of all stakeholders is essential to the long-term success of any business—and in turn, SI will be

here for the long haul, in our view.