Merrill har opdateret sin seneste risiko-analyse over Ukraine-krisen, og nedenstående analyse er fra tirsdag, og den tog dermed ikke højde for Ruslands overraskende og lynhurtige militære angreb på Ukraine. Men analysen er dyster, og det bliver den ikke mindre af efter angrebet. Analysen sammenligner med anneksionen af Krim, og de negative markedsreaktioner varede kun få måneder, og de store indeks i Europa og USA havde stor fremgang et år efter. Men denne gang bliver det helt anderledes og meget mere negativt, vurderer Merrill, fordi konsekvenserne er langt alvorligere. Europa er den region uden for Rusland, som vil mærke konsekvenserne mest, og det skyldes især afhængigheden af energi fra Rusland. Økonomiske sanktioner kan også ramme de vestlige lande hårdt, især Europa. Desuden vil Ruslands stærke relation til Kina betyde, at Vesten ikke har megen handlekraft over for præsident Vladimir Putin, mener Merrill. Det kan få en negativ effekt overalt, men altså mest i Europa. Der bliver mere volatilitet på markederne. Men Merrill tror dog, at på længere sigt bliver markederne mest præget af en eventuel lavere økonomisk vækst og rentestigningerne.

Russia-Ukraine Frictions Escalate

The U.S. and its allies have announced new trade, investment and financial sanctions on Russia following President Vladimir Putin’s order to move troops into two separatist regions of eastern Ukraine and recognize their independence.

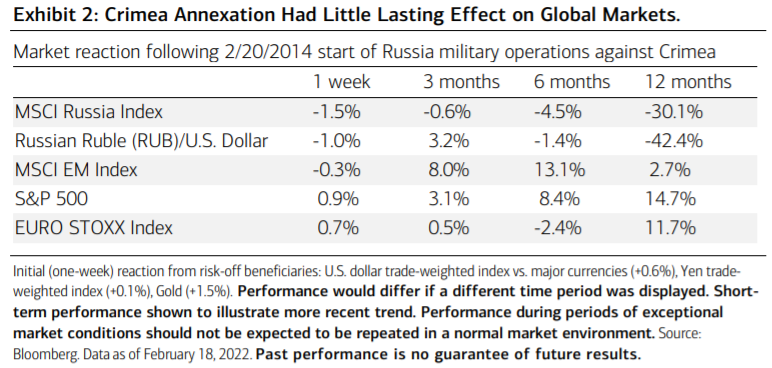

These steps mark a major escalation in the RussiaUkraine tensions that have been brewing over recent weeks and add more uncertainty to an already volatile start to the year for global investors. Past experience from Russia’s 2014 annexation of Crimea suggests that markets closest to the epicenter of the conflict are likely to see the most significant effect from this escalation, with little lasting impact on the rest of the world (Exhibit 2).

Russian Equity and currency markets were the hardest hit eight years ago, but U.S., European and other emerging markets were higher over the 12 months following the start of Russia’s military operations. However, we acknowledge the key differences in the current environment that could potentially broaden the near-term market implications this time around.

High energy prices (particularly in the absence of a supply response from other major global producers) and Russia’s deeper ties with China may act to reduce some of the West’s leverage over President Putin.

And against a backdrop of elevated inflation in the U.S. and Europe, the potential for any disruption to Russian energy supply could add greater uncertainty to the monetary policy outlook in the major developed markets.

Outside Russia itself, European markets are potentially the most vulnerable through their energy exposure, with the European Union depending on Russia for more than one-third of its natural gas consumption.

Any prospective shock to Russian energy supply would only compound the underlying rise in local energy prices, undercutting profitability for the corporate sector and discretionary incomes for households, particularly in major importer markets such as the Baltic states, central and Eastern Europe, Germany and Italy.

U.S. markets should also experience further near-term volatility until the outcome of the current standoff becomes clearer, but in our view should remain more insulated than their European counterparts.

The Defense sector and risk-off beneficiaries such as the U.S. dollar could also see gains in the near-term.

But as we look deeper into the year, we would expect the more fundamental market drivers from inflation and interest

rate expectations, the path of the economic expansion and corporate earnings to be the most important determinants of market direction. Despite the current geopolitical uncertainties, we therefore maintain our tactical overweight in global Equities relative to Fixed Income, with a continuing preference for U.S. over international markets.