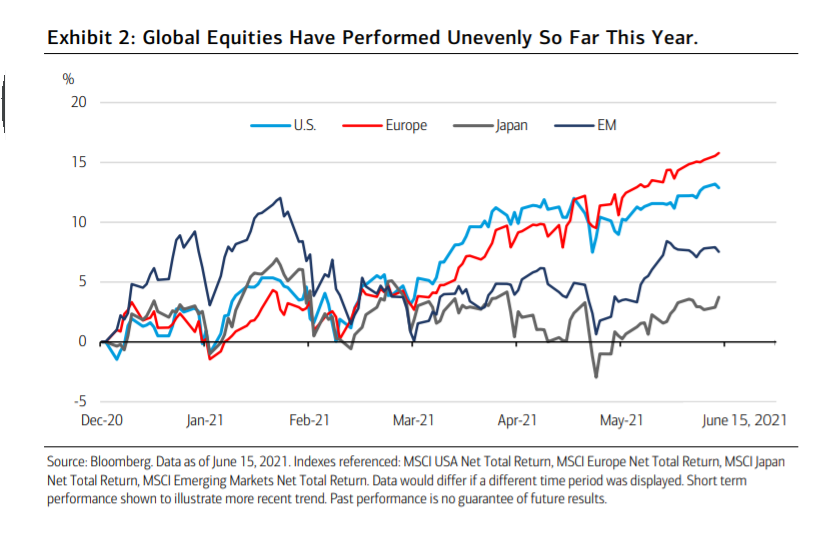

Merrill har analyseret aktiemarkedernes udvikling i år og konstaterer, at de europæiske aktier har klaret sig bedre end alle andre i de seneste måneder, også de amerikanske. Value har klaret sig bedre end vækstaktier. Virksomhedernes indtjeningsvækst har været forrygende i år, men den ventes at falde markant næste år. Der har generelt været meget store udsving i dette halvår på aktiemarkederne i Japan og Emerging Markets.

A Mid-year Glimpse at Global Equities

Heading into mid-year, global equity performance has proven somewhat uneven with the

U.S. and Europe surging ahead while Japan and the EM lag behind (Exhibit 2). Here we

recount what we have seen so far and what investors should consider into the second half

of the year as potential drivers for further performance differentials shape out.

U.S.

The U.S. currently continues to be a leader in the global recovery on the back of strong

economic data, an improving coronavirus situation and a stimulative policy mix. Several

factors suggest that further upside for growth and corporate profits lie ahead, with a

pickup in spending, an expected increase in labor market engagement as coronavirus risks

subside and as elevated corporate cash levels drive a new capital expenditures (capex)

cycle, building out a positive backdrop for U.S. equity performance. So far, U.S. equities

have done well under these conditions, with the S&P 500 up 13.8% on total return basis

year-to-date (YTD).

Strong earnings have helped to solidify investor confidence in the economic recovery. The

first quarter saw S&P 500 earnings beat consensus estimates by a record 21%.1 Given

that we still remain at the early stages of the consumer pent-up demand cycle,

expectations for revenues should continue to move higher. BofA Global Research expects

earnings growth of 29.4% for 2021 and 10.8% for 2022, although potential tax hikes

remain a primary downside risk. The strengthening earnings recovery has been a major

driver of the recent rally, which is typical in the second year of a recovery. Whereas

multiple expansion fueled much of the equity returns last year, valuations have

compressed with the forward price-to-earnings (P/E) multiple down 6% since the start of

the year, moving from 22.6x to 21.3x.

Participation remains broad, with roughly 92% of companies in the S&P 500 trading above

their 200-day moving average. As vaccination progress boosts broader reopening

prospects and profit momentum accelerates across the board, the rotation toward more

economically-sensitive areas of the market should continue, in our opinion. So far, Value

has trounced Growth, with the Russell 1000 Value up 18.2% while the growth index

lagged, now up only 8.9%. Value outperformance is closely tied to the economic cycle

given its higher exposure to cyclical sectors like Energy and Financials, both sector leaders

so far this year. These areas of the market have seen higher earnings revisions relative to

more secular growth sectors, and should continue to benefit from a rising inflation and

interest rate environment. From a valuation perspective, improving earnings have

supported more attractive valuations for Value, with the Value forward P/E at 17.7x

compared to 28.4x for growth. Small-caps have similarly outperformed large-caps, on the

back of an improving economic outlook and stronger earnings recovery, with the next 12

month’s earnings estimates for the Russell 2000 above the highs from 2018.

Recently, U.S. equities have traded in a narrower range as investors try to digest

implications of rising inflation on monetary policy after the U.S. CPI for May reported a 5%

YoY increase, the first report of its kind since 2008. Fed officials continue to present any

near term inflation as “transitory,” essentially affirming the central bank’s accommodative

policy stance. For now, the trajectory for U.S. equities remains positive.

International Developed

Looking beyond the shores of the U.S., international equity performance has been

relatively strong with the MSCI World Ex-U.S. Index up 13.6% YTD. Earnings recovery has

picked up with estimated growth of 41% this year, and valuations remain attractive.3

However, the pace of economic reopening has varied across countries. The U.K, for

instance, continues to struggle with new coronavirus variants and resulting economic

shutdowns, while reopening has gathered momentum more quickly in other areas.

Performance dispersion will likely remain until the health front normalizes, but as

inoculations continue there may be a sustained pickup in growth momentum across

International Developed markets. We are already seeing signs of this in some places, with

certain International Developed markets far outpacing the U.S. this year.

European equities have surged ahead of the U.S. and other global peers in recent months

as an acceleration in vaccinations pushed the region closer toward reopening. The MSCI

Europe Index is now up 16.3% on a total return basis YTD, widening out the performance

differential with the rest of the world. May marked the fourth consecutive month of

positive performance for the region, with the index up 4.7% and June on track for a fifth as

new all-time highs continue to be reached. The region’s more value-dominated stock

market has benefited from the improving economic recovery and rising interest rates, with

Banks up 27% and Energy and Consumer Discretionary up 20.3% each YTD.

Further economic surprises support a strong corporate earnings outlook. Following record Q1

earnings beats, Europe’s earnings revision ratio jumped to 2.20 in May, the highest level

ever. Consensus expectations are calling for earnings to grow 44% for 2021 and 10% for

2022.

European stocks have benefited from the latest advance in the recovery and from strong

inflows, following nine straight weeks of positive fund flows, according to BofA Global

Research, but not all risks have been abated. A combination of coronavirus setbacks, a

slower recovery in consumption, political cycle volatility, and input cost pressures and

supply chain shortages all pose a risk, but for now the European Central Bank remains

committed to its accommodative policy. That said, European equities should continue to

stay afloat given attractive valuations relative to the U.S. with the MSCI Europe forward

P/E at 16.6x, rising bond yields rewarding banks stocks and economic growth momentum

in place.