Merrill ser optimistisk på forbrugssektoren som investeringsmål næste år. Amerikanerne har en dobbelt så høj opsparing som normalt, fordi de ikke har brugt så mange penge på f.eks. service under coronakrisen. Der er 1300 milliarder dollar som ekstra forbrugsreserve. Det kan give et løft til forbrugssektoren, især i serviceindustrien, i det kommende år, vurderer Merrill.

Squirreling Away Savings for Future Spending on Services

Dollars held in savings deposit accounts totaled $11.9 trillion for the week ending November 27

—an amount that suggests many Americans aren’t sitting on a savings cushion, but a couch.

Separate data shows the U.S. savings rate hovering at 14.3%, well above the 20-year average annual rate of 6.6% although down from an all-time high of 33% when stimulus checks hit bank accounts back in April.

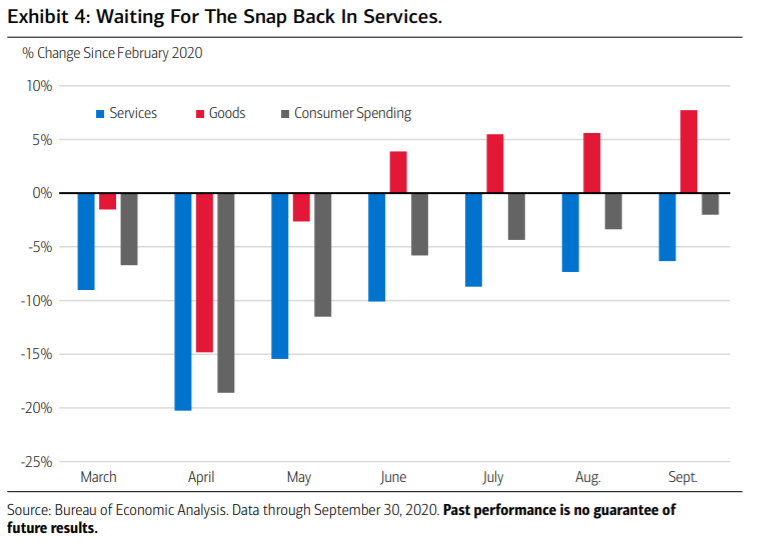

So with household savings as an indicator for future consumer spending, think of the $1.3 trillion in excess savings as cash reserves for rising consumer expenditures into next year, especially in services once this part of the economy is unleashed with continued progress on the health front.

The far larger services sector has borne the brunt of the pandemic, as people avoided spending on

services such as going to a movie theater, traveling or dining out, and instead directed spending

on goods like home furnishings, bikes, or at-home computer equipment.

Indeed, the nature of the pandemic and attendant shutdowns has disproportionately affected services spending.

While the consumer typically drives about two-thirds of the economy, two-thirds of all spending is

specifically on services, making it the biggest component of consumer spending.

Looking forward, we expect recent vaccine developments, the potential passage of

a fiscal stimulus bill, and already strong household balance sheets to spur consumer

spending in the first quarter of ’21 and beyond.

This will underpin a new “Pent-Up Demand Cycle” or the next stage of the workout process focused on service activities.

Think recreational activities, transportation, healthcare and those industries aligned to

travel and entertainment. In the end, we believe the U.S. economic expansion is poised to

broaden out next year, supporting our base case that assumes 3% annualized growth in

the fourth quarter and 4.5% for full year 2021.8