Merrill skriver, at value-aktier vil få mere glæde af en højere inflation end vækstaktier, at sektorer som finans, byggeri og energi vil få mere glæde af en stigende inflation end andre sektorer, og at små og mellemstore virksomheder vil klare sig bedre under en stigende inflation end de store selskaber.

Arming Portfolios for the Inflation Rotation

Equities

Equities that offer cash flows over shorter time horizons may also get a tailwind from

higher inflation.

While Growth stocks are often characterized by future earnings growth and little to no income, Value stocks offer limited future earnings growth and more nearterm cash flows in the form of dividends.

Value has recently started to outperform as the reflation trade has gained steam, and the Russell 1000 Value Index outpaced the Russell 1000 Growth Index by nearly 13% year-to-date.

Given the inherent characteristics of each style, inflationary signals would indicate that the rotation from Growth to Value could continue to gain momentum.

Value also has more exposure to cyclical sectors that are more likely to outperform as

inflation rises, with the two biggest beneficiaries being Energy and Financials, according to

BofA Global Research.

These areas of the market have also started to reap the benefits of higher inflation expectations, with Financials leading relative outperformance against the S&P ex-Financials Index by 19% year-to-date. Conversely, defensive sectors like Consumer Staples and Utilities are more likely to underperform as inflation climbs higher.

Small-caps and mid-caps may also have an advantage, as they tend to be more cyclically

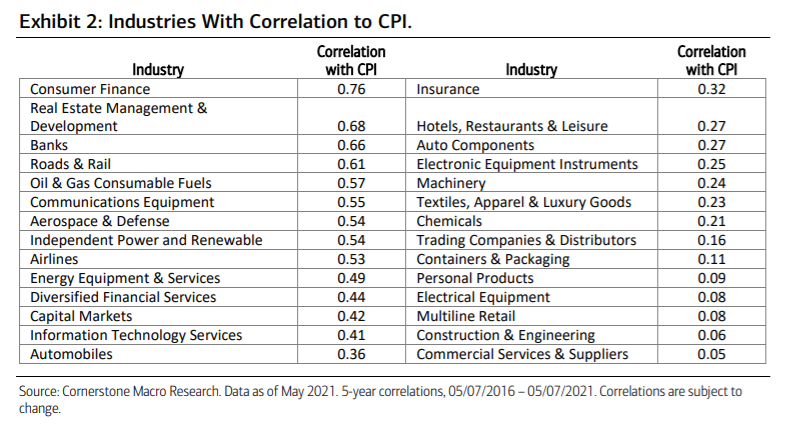

oriented than their Large-cap counterparts. Drilling down even further, Equities with

exposure to certain industries may get a boost, as some are more highly correlated with

CPI than others (Ex 2).