Merrill bruger et indeks over finanschefernes vurderinger af markedsudviklingen og risici. Der er ikke en så entydig tendens som det seneste års tid eller to, men Merrill mener, at når alle forhold tages i betragtning, så peger pilen i en positiv retning for aktier. I den positive retning tæller, at virksomhederne har en god indtjening, og at ny teknologi skaber grundlag for produktivitetsforbedringer. Men geopolitiske spændinger og det høje kursniveau peger også i en afbalanceret retning. Dog kan den høje gæld samt indenrigspolitikken i USA med midtvejsvalget trækker i en negativ retning.

2022 CIO Market Balance Sheet

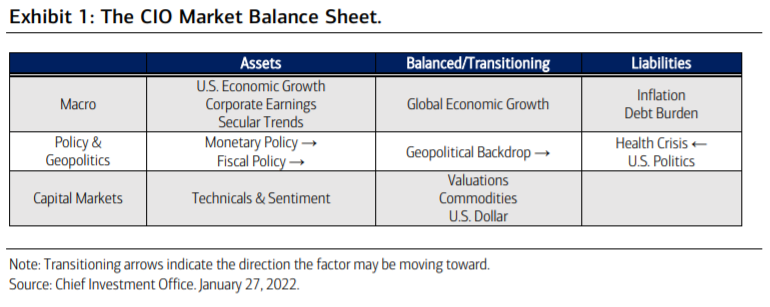

Amid the recent uptick in volatility, we think it’s a good time to revisit the CIO Market

Balance Sheet. Here, we review factors that favor further upside (Assets) versus factors

that call for getting cautious (Liabilities) and then those that are on balance or in

transition (Exhibit 1). Reviewing these factors in aggregate, our balance sheet is still tilting

positive for Equities.

Market Balance Sheet “Assets”

The pace of the expansion should moderate from here, but it’s our view that above-average

nominal GDP growth will remain in place through 2022 as the lagged effect of ultraaccommodative policy continues to filter through the economy. Strong aggregate demand,

normalized consumer spending, increasing capital investment, and improvements on the health

front should help underpin solid growth for the U.S.

In terms of corporate profits, while revenue

growth rates may begin to normalize, still-strong corporate earnings could continue to support the

equity markets. Earnings revisions remain favorable, especially for the U.S., where analyst upgrades

outnumber downgrades by a ratio of 1.13.3 Consensus anticipates earnings per share for the S&P

500 of $224 in 2022,4 representing a 9% year-over-year (YoY) increase, and estimates could move

higher if nominal GDP growth surprises to the upside.

Strong consumer demand should continue

to fuel the profit cycle, with the potential for certain areas of the economy to get a tailwind from

the release of pent-up demand after the latest coronavirus wave subsides.

Monetary policy currently remains supportive, with interest rates pinned near zero and the Federal

Reserve (Fed) announcing a final round of asset purchases at the January Federal Open Market

Committee (FOMC) meeting. Meanwhile, after multiple rounds of stimulus packages, household

net worth totals $145 trillion, and $4.6 trillion5 in cash remains on the sidelines parked in money

market assets. Money supply is up +41% over the past two years and +13% YoY as of December

2021, and money supply growth tends to lead the economy by at least one year. There is still

firepower left over to support the markets in the near term, but financial conditions are expected

to tighten from here. The expectation of the first rate hike to occur in March and a potential

quantitative tightening announcement in June, and there is little likelihood of further stimulus

aimed at the consumer.

While the tailwind currently remains, it’s our view that monetary policy

could soon transition from the Asset side of our market balance sheet to balanced territory.

A variety of technical indicators suggests that the market is nowhere near recessionary levels—

the yield curve has flattened but is far from inversion,7 credit spreads on short-term corporate

credit have not risen relative to the spreads on long-term credit, and the dispersion of returns

across Equity sectors has risen only mildly.

But we’re still seeing an overabundance of concern,

with the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) well above its long-term

average and 47% of investors expressing a bearish sentiment on the stock market for the next

six months.9 In our view, this could be a contrarian signal for strength ahead.

From a longer-term view, secular trends in innovation and technology that were accelerated by

the health crisis should support increased levels of productivity in the post-pandemic world.

Business’s demand for automation continues to increase amid lingering coronavirus concerns

and persistent labor shortages—the technology-led capital expenditures (capex) cycle topped

$975 billion in Q3 2021 according to Bureau of Economic Analysis, and the International Data

Corporation (IDC) estimates digital transformation investment for corporations will reach $6.8

trillion in 2023. We believe the shift toward automation has plenty of runway for future growth

supporting margins and productivity.

Market Balance Sheet “Balanced/Transitioning” Factors

While we believe that the global recovery process should continue in 2022, global economic

growth momentum has deteriorated amid elevated inflation, supply chain issues and a spike in

coronavirus cases. The International Monetary Fund (IMF) expects global growth to moderate to

4.4% in 2022 from 5.9% in 2021. China’s growth outlook has been especially challenged as its

zero-tolerance coronavirus strategy has led to restrictive shutdowns, weighing on consumption.

Economic activity in Europe has also been hampered by the virus, with the services sector a major

drag on the eurozone’s Markit composite Purchasing Managers’ Index for the month, bringing it to

52.4, an 11-month low. Manufacturing activity, however, remained resilient, a sign that supply chain

bottlenecks could be easing and that the toll of this coronavirus wave could be more muted in

Europe. From a geopolitical backdrop, uncertainty over Russia and Ukraine remains high but

tensions on other fronts including trade between the U.S. and China and conflicts in the Middle

East have cooled down for now.

Our outlook on valuations looks more balanced. While the S&P 500 forward price-to-earnings

multiple has fallen in recent weeks, hovering around 20x and nearing the 19x levels from

February 2020, a strong profits backdrop should help offset any major contraction in the

multiple. The S&P 500 operating margin at 15% is still well above where it was in early 2020

at 13%. Other balanced factors include commodities and the U.S. dollar. While rising

commodity prices should boost earnings for producers and Commodity-exposed sectors,

inflationary pressures could start to weigh on the consumer.

Market Balance Sheet “Liabilities”

More persistent inflation continues to add to investor uncertainty. With expectations for

wages and rents to move higher, inflation, despite running at a multi-decade high, could

move up further from here. As a result, episodes of market volatility may be more frequent,

especially once the Fed starts to raise interest rates. Cyclical parts of the equity market as

well as higher-quality companies, including dividend growers and those businesses with

greater pricing power, should benefit in this environment.

But if we see the growth outlook

worsen, perhaps due to negative pandemic-related developments, in conjunction with

persistently high inflation, risks for stagflation would heighten. Still, while we continue to

view the pandemic as a liability within our framework, with high vaccination rates and an

economy better equipped to handle it, the health-related outlook could soon shift to the

balanced or positive side of our Market Balance Sheet.

With midterm elections on the horizon and control over Congress at stake, equity markets

could be choppier. Historically, the mid-term year, or the second year of a four-year

presidential term, tends to be the worst year for the S&P 500, with a correction typically

between April and September or October. But following this pause, Equities typically enter

their most bullish year during the presidential term, beginning right before the November

elections and continuing into the following year.