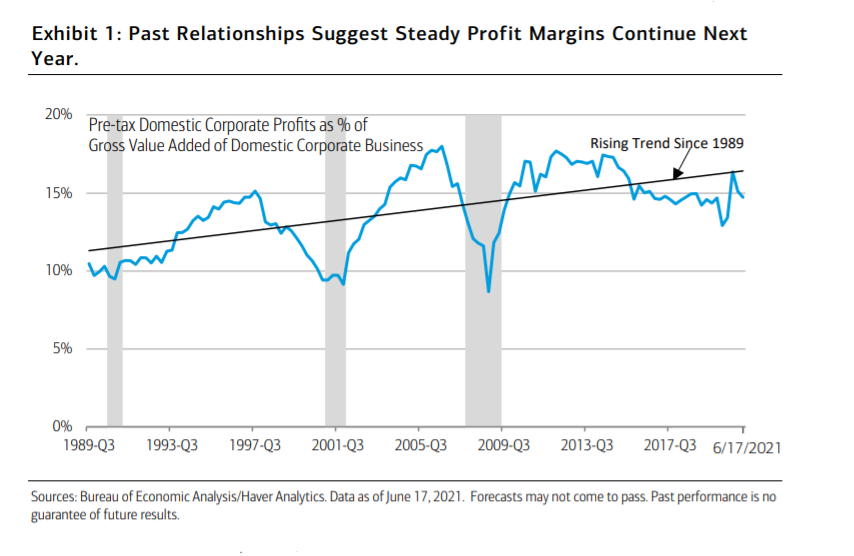

Merrill vurderer effekten af stigende lønomkostninger og højere inflation og renter og konkluderer, at de på kort sigt ikke får den store negative virkning på virksomhedernes indtjenings-margin. Men på længere sigt, bliver marginen mindre end i de seneste mange år. Dog bliver udsvingene i marginen ikke så store som under de tidligere kriser, f.eks. finanskrisen, vurderer Merrill.

Elevated Narrow Range for Margins Likely Through 2022

Accelerating inflation and upside wage pressures have raised concerns about Federal

Reserve (Fed) policy, the economic outlook, and profit margins, causing yields on long-term

Treasury securities to decline and U.S. equity market gains to slow in recent months. The

consumer price index (CPI) has been rising at a 7% to 10% annualized monthly rate since

March and was up 5% year-over-year (YoY) in May, its biggest 12-month increase in 13

years. The producer price index for intermediate goods was up 22% in May, the sharpest

12-month increase since 1975.

In addition, significant supply-chain strains remain widespread, and labor shortages have

become the most pressing problem for most businesses. Indeed, not only did unfilled job

openings reach a 20-year high in April (with particularly big increases in manufacturing,

leisure/hospitality, and transportation/ warehousing), but, according to the latest Bureau of

Labor Statistics’ (BLS) Job Openings and Labor Turnover Survey (JOLTS) report, the quits

rate has spiked to levels far above those seen in the past 20 years.

With the labor force participation rate (LFPR) depressed and quits surging, it’s not surprising

that reports of upside labor-cost pressure have become pervasive. This is reflected in the

BLS employment cost index (ECI), for example, which posted a 3.7% annualized quarterly

gain in the first quarter, the most in 15 years. While this still left the ECI only 2.7% higher on

a YoY basis, labor market conditions suggest an acceleration in labor cost growth to 3% to

4% over the next year and 5% in 2023, in our view, which would be the strongest in 20

years.

Still, because of offsetting long-lagged effects from increasingly negative real interest rates

to date and other factors discussed below, we believe that this wage-growth path and other

input cost inflation are not likely to pose significant risks to domestic profit margins over the

next year and a half. That said, accelerating labor costs are likely to cap margins for the

foreseeable future, and risks to margins are to the downside. Overall, our base-case scenario

indicates that margins are likely to remain in a much narrower, moderate range compared to

past cycles through the end of 2022, increasing less than in previous expansions but only

after also declining much less during the pandemic than in past recessions (Exhibit 1).