Merrill har en meget kritisk analyse af inflationen – forud for disse dages centralbankmøde, kaldet Jackson Hole efter det traditionelle mødested i Teton bjergene. Inflationen er steget langt mere, end centralbanken og de fleste økonomer har forudset – den er nu på over 7 pct. Centralbanken, Fed, har ignoreret det og talt om et midlertidigt fænomen, og den forklaring er økonomerne hoppet med på, skriver Merrill. Efterspørgselen efter arbejdskraft, især kvalificeret arbejdskraft, er overvældende, og det vil presse omkostningerne og inflationen yderligere i vejret. Fed lægger på “de små baby-skridts politik” for at begrænse inflationen, men i lyset af den største finansielle stimulipakke siden Den anden Verdenskrig, er det ikke nok for at dæmpe udviklingen, mener Merrill. Derfor er der ikke udsigt til en lavere inflation, advarer Merrill.

Time to Taper

As noted in our report last week, the July consumer price index (CPI) shows inflation in the U.S. is running at a 7.1% pace year-to-date (YTD), the highest seven-month inflation rate since 1982, and is still accelerating. Indeed, pipeline pressures continue to build for higher future inflation, with the producer price index for final demand accelerating to an 11% pace YTD. Prices of processed goods for intermediate demand accelerated to the highest rate since 1975.

Despite clear signs that inflation continues to gain momentum, consensus economists remain well behind the curve in their inflation outlook. In January, the Blue Chip Economic Indicators consensus outlook for CPI in 2021 was for a 2% rise. Every month since then, that forecast has been adjusted higher, and in August, it reached 4%. Still, despite doubling since the beginning of the year, the 4% consensus CPI forecast for 2021 remains dramatically behind the actual CPI performance to date (+7.1%), with little sign of the sharp deceleration that would bring it down to 4% by year-end. Indeed, as noted above, pipeline pressures and other leading indicators of inflation have pointed to accelerating, not decelerating, inflation ahead.

The Fed has looked the other way, while consensus economists have embraced its “transitory” inflation narrative. The U.S. central bank has deflected attention from the worst inflation in 40 years, focusing instead on its goal of achieving “substantial further progress” in the labor market.

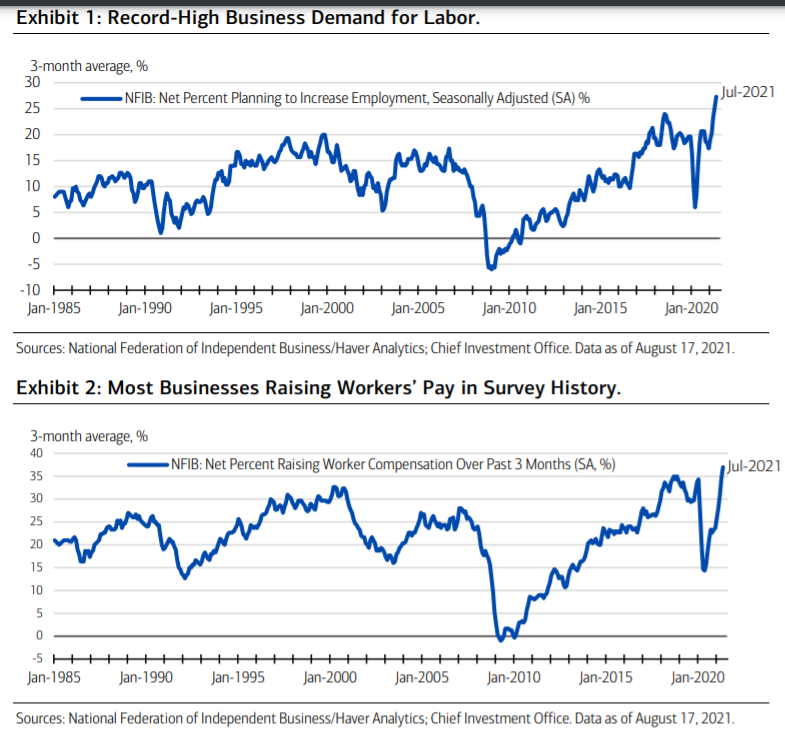

However, the latest NFIB survey of the small and medium-sized businesses that create most of the jobs in the U.S. economy already finds the tightest labor market conditions in the history of its monthly survey, which dates back about 35 years.

First of all, looking at averages of the past three months, the survey finds a record-high percentage of respondents planning to increase employment (Exhibit 1). The fact that the survey shows the strongest labor demand in its history is not surprising, as the JOLTS also finds a record number of unfilled job openings in the economy.

As would be expected given the unprecedented need for more workers, a record percentage of NFIB survey respondents raised worker compensation during the past three months (Exhibit 2).

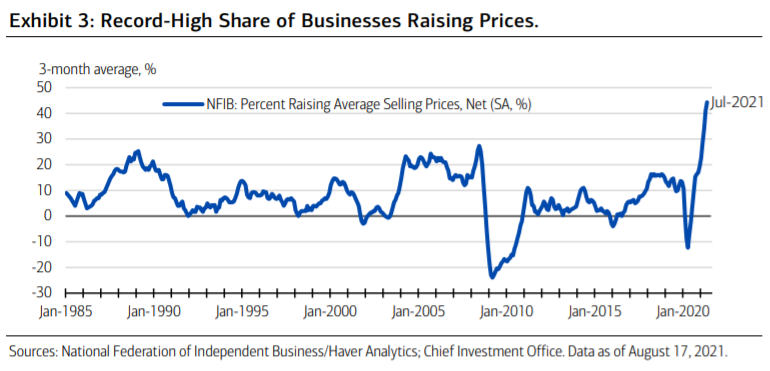

Also not surprisingly, businesses plan to raise their prices to cover rising labor (and other) costs. The percentage of respondents planning to raise selling prices has soared to record highs over the past three months (Exhibit 3), supporting the view that inflation is still headed higher.

All this suggests the Fed will likely be slow to bring inflation under control even if it “baby steps” its way to less accommodation in hopes of achieving the ever-elusive soft landing. In our view, the power of the biggest demand stimulus since World War II remains an order of magnitude greater than the slowing effects of these “baby steps.” As long as demand grows faster than potential gross domestic product (GDP), it will sustain high inflation for the foreseeable future.