USA og Kina er i en drabelig geopolitisk kamp, hvor USA forsøger at hindre en kinesisk dominans inden for en række af fremtidens erhverv og teknologier. I dag dominerer Kina f.eks. inden for batterier og sjældne jordarter samt på en række produkter i pharma-industrien. Men også chip-produktionen kommer i centrum. USA foretager en oprustning inden for disse erhverv med enorm statsstøtte, og det kan investorerne få gavn af, hvis de hopper med på bølgen, mener Merrill Lynch, der peger på følgende sektorer, som USA satser voldsomt på: materials, metals and mining, machinery, power generation, software and services, chipmakers, semiconductor, capital equipment, and hardware applications such as networking and cloud servers.

The Flashpoint for U.S. Supply Chains

Trade wars, weather interruptions, and supply/demand imbalances have weighed on supply

chain production of everything from cars and chips to siding and furniture. In this way, the

pandemic disruption to supply chains has served as a flashpoint in evaluating

vulnerabilities and fragilities across a number of industries.

As outlined by a recent White House report reviewing critical segments, more secure and resilient supply chains are essential in insulating the U.S. economy, national security, and future technological

leadership.1 While the implications of the report are mostly industrial and innovation policy

recommendations, from an investment standpoint this policy backdrop is supportive of

CapEx and R&D cycles, which reinforces our view on cyclical assets and longer-term

investments in tech-related industries.

The four industries of focus are: first, semiconductor manufacturing and advanced

packaging; second, large capacity batteries; third, critical minerals and materials; and

fourth, pharmaceuticals and advanced pharmaceutical ingredients.

Semiconductor manufacturing and advanced packaging: Although tiny chips,

semiconductors are essential components enabling technologies across the

telecommunications, industrial and automotive sectors, with Exhibit 2 showing the end

uses of chips. When it comes to production of semiconductors, the U.S.’s share of global

production has dropped to 12% from a 37% share in 1990. Capacity and production of

chips has grown outside of the U.S., particularly in Asia, leading the Semiconductor

Industry Association to forecast that by 2030 the U.S.’s share will fall to 10%, with Asia

responsible for 83% of global production. Highlighting the U.S.’s foreign dependence, the

U.S. relies on sales to China, the largest market for semiconductors, and is heavily

dependent on foreign sourcing for materials like silicon wafers from Japan, South Korea or

Taiwan.

Large Capacity Batteries: High-capacity batteries such as those used in electric vehicles

(EVs) and energy grid storage are critical to our country’s interest in “cleaner” and

“greener” technologies. EV battery demand is projected to grow from approximately 747

gigawatt hours (GWh) in 2020 to 2,492 GWh globally by 2025. China has a commanding

position across the battery value chain, from raw and processed materials to components

and assembly (Exhibit 3). China refines 60% of the world’s lithium and 80% of the world’s

cobalt, two core inputs to high-capacity batteries and key to the future auto industry.

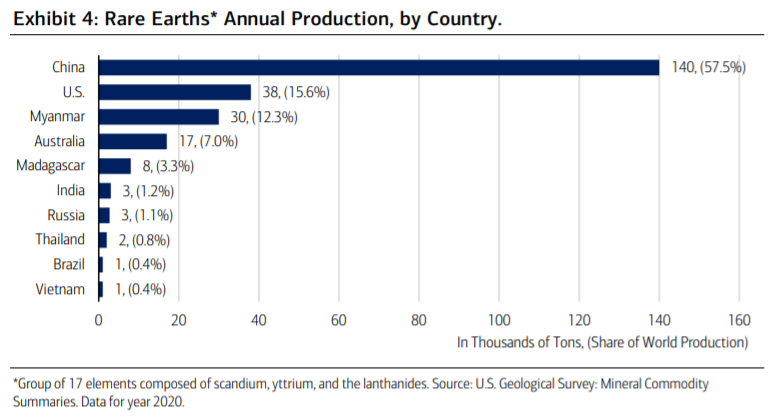

Critical minerals and materials: Related, rare earths elements, critical in manufacturing

most technologies from electronics to fighter jets to weaponry, is controlled by China with

its willingness to mine (57% of global capacity) and refine (85% of global capacity) these

dirty, yet inherently not so rare, elements. The U.S.’s net import reliance has grown

alongside falling production since the Cold War. Exhibit 4 shows the distribution of rare

earth minerals worldwide.

Pharmaceuticals and advanced pharmaceutical ingredients: The pandemic fueled

concerns of “medical protectionism” or hoarding medical supplies for a country’s benefit

by curbing exports. The U.S. is among the largest net importers of medical goods and

equipment—a byproduct of decades of significant cost savings in a “globalizing” world.

China and India became major sources for the active ingredients for drugs beginning in

the 1970s. Exhibit 5 shows China’s control of the U.S.’s drug supply chain. India, which

supplies 40% of generic pharmaceuticals used in the U.S., imports nearly 70% of its active

pharmaceutical ingredients (APIs) from China. Thus, China’s overwhelming control of the

medical supply chain is likely underrepresented in the exhibit.

Source: U.S. Commerce Department. Data as of 2020.

A wide-ranging policy suggestion for the above: Invest in domestic production and

innovation capabilities while diversifying sources of supply and reducing concentrated

geographic risk. The commonality among the four areas is the apparent U.S. and China

linkages, which is why the premium on a CapEx cycle, underway since last year, and R&D

cycle has never been greater. Given the policy intentions of the report, a number of

catalysts underpin these cycles: nations favoring self-sufficiency in the production of

critical goods; the accelerating race for technological leadership in various industries; and

Investment Implications

Investors should consider positioning portfolios toward sectors that stand to benefit from

these cyclical and secular dynamics. With the potential of a federal infrastructure package,

capital equipment and industrial goods-related stocks could profit, including industries

such as materials, metals and mining, machinery, and power generation. We maintain our

positive long-term outlook on Technology due to a secular rise in spending on innovation

and competitiveness and the continued digitalization of the economy. Pandemic-driven

shifts in global supply chains could also boost demand for industrial automation and its

related investments. With policy and public investment serving as tailwinds (Chips for

America Act, which would provide $23 billion to domestic production of semiconductors),

long-term growth opportunities such as software and services, chipmakers, semiconductor

capital equipment, and hardware applications such as networking and cloud servers exist

within Technology.