Den offentlige amerikanske gæld er steget ekstremt gennem de seneste ti år, ikke mindst under pandemien, og det giver mange investorer sved på panden. I de seneste 20 år er gælden blevet tredoblet på grund af terrorkrigene, finanskrisen i 2008-09 og senest pandemien! Den er nu på 100 pct. af bruttonationalproduktet. Men på grund af den lave rente i mange år er gælden til at servicere. Sidste år var rentebetalingen på 1,6 pct. af BNP. Og så skal man ikke glemme Uncle Sams råstyrke, skriver Merrill, med verdens mest dynamiske erhvervsliv og en enorm tilstrømning af udenlandsk kapital. Selv om renten nu stiger, vil dette og gældsbyrden ikke udgøre en fare for aktiemarkederne, hverken nu eller fremover, vurderer Merrill.

Memo to Investors: Don’t Sweat America’s Public Sector Debt

Taking on debt is nothing new in Washington but the gusher in federal spending and attendant rise in public sector debt since the pandemic has been nothing short of extraordinary.

Some key numbers to consider: federal debt held by the public was equal to 99.7% of GDP in fiscal year 2021, down slightly from 100.3% the year before. Roughly a decade ago (2010), the comparable figure was 60.8%; in 2000, the percentage was just

33.7%.

Since the start of this century, then, America’s gross public sector debt as a percentage of GDP has tripled—a rise associated with excess federal spending due to multiple wars in the post 9/11 world; soaring entitlement liabilities as the U.S. population

ages; the carnage of the Great Financial Crisis; and the economic and financial havoc wreaked by the pandemic.

All of the above has generated a tsunami of red ink and raised concerns among investors over the sustainability of U.S. finances. That said, while mindful of America’s public sector debt, we don’t believe current debt levels are a risk to the capital markets for a number of reasons.

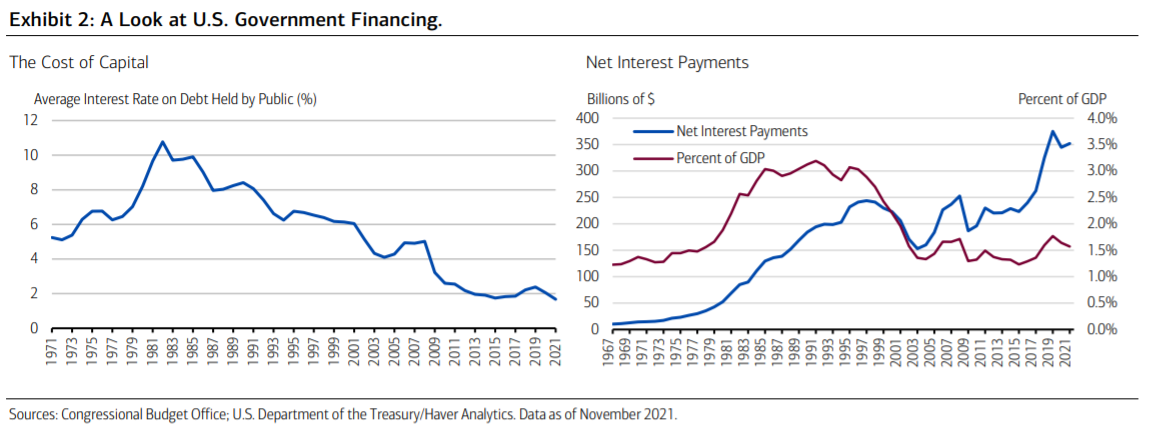

One, America’s debt is being financed at very low interest rates, as depicted in Exhibit 2.

Two, while net interest payments rose moderately in FY 2021 (to $352 billion from $344.7 billion the year before), interest payments were actually 9.1% below the peak of 2019 ($375.2 billion). Why the decline: think maturing debt being rolled over at ultralow interest rates over the balance of last year.

Three, net interest payments as a percent of GDP declined in full year 2021, to a very doable 1.6% of total output.

Finally, never forget that Uncle Sam’s finances are backstopped by the world’s reserve currency (the U.S. dollar) and underpinned by the most dynamic and resilient private sector in the world. The latter has been key in expanding the U.S. economic pie and attracting foreign capital flows, making U.S. debt and servicing levels quite manageable.

Looking forward, we are very mindful of the fact that as interest rates rise this year, interest costs will eventually rise as well. And past isn’t prologue—more structurally embedded inflation expectations could structurally shift upwards the future cost of capital.

But that said, we are not anticipating a significant spike in interest costs near-term, and continue to believe that America’s debt levels are non-threatening to current and future prices of U.S. securities.