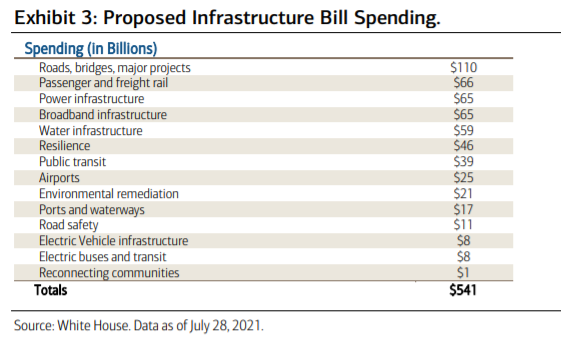

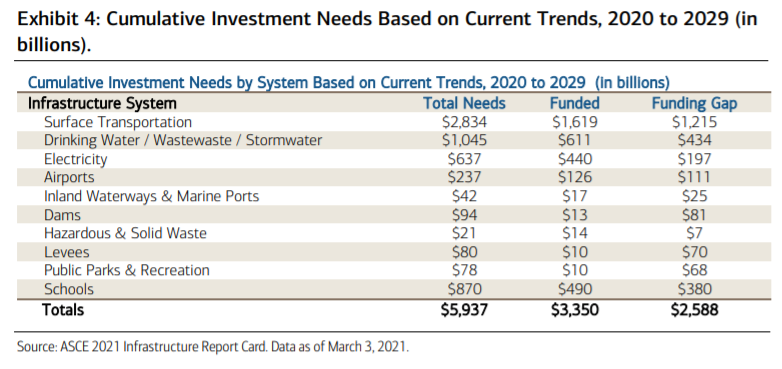

Merrill gennemgår den vedtagne infrastrukturplan i USA og ser på de gigantiske investeringsbehov. Investeringen i infrastrukturen bliver på 541 milliarder dollar, men investeringsbehovet er i virkeligheden 10 gange så stort, nemlig på næsten 6000 milliarder dollar, skriver Merrill, som har lavet en liste over de områder, som investorerne bør se på: solar- og vindenergi, el-biler, el-distribution, opladestationer, batterier og el-oplagring. Relevante råstofområder: Kobber, kobolt, lithium and sjældne jordarter. Bidens plan skal ikke blot styrke den amerikanske økonomi og mindske uligheden. Planen skal også styrke USA over for Kina. Merrill konkluderer, at vi står over for en supercyklus med investeringer, der vil afgøre den geopolitiske kamp mellem USA og Kina.

Uddrag fra Merrill:

The U.S. Infrastructure Bill: Considerations to

Positioning Portfolios

Looking ahead, a supercycle in infrastructure spending could be on the horizon, owing to a

number of factors.

One, the pandemic of 2020 has exposed glaring infrastructure inequalities around internet readiness in the U.S., with inner city and rural areas lagging in terms of internet accessibility and affordability. A consensus is emerging around the idea that upgrading America’s infrastructure is one plank in addressing income and social inequalities in the U.S.

Second, climate change and the movement toward “green”

investing have only gained momentum with the aftershocks of the pandemic and

America’s recommitment to the Paris Climate Accord. Both the public and private sectors

have become stewards of the environment, portending more spending on smart cities,

green grids and increased outlays to de-carbonizing the planet.

Third, and finally, with China now viewed as a strategic competitor, rather than strategic partner, the U.S.-China Cold War pivots around advanced capabilities in 5G, smart grids and a connected/tech-

driven infrastructure. The latter will largely determine who sets the pace in winning the

race for technological supremacy in the 21st century.

Given all of the above, having a modern infrastructure means more than just having more

efficient ports, less congested roads, and secured levees and dams. It’s also about

addressing social inequalities, solving climate change challenges, meeting health care

problems, and positioning via geopolitical considerations. All of these variables, and more,

portend increased infrastructure spending in the U.S. over the next decade. We believe we

could be on the cusp of a supercycle in infrastructure spending.

In terms of asset allocation, this may mean gaining more exposure to infrastructurerelated industrial companies and leaders in renewables (solar, wind, electrical vehicles,

biomass) and the required infrastructure behind each renewable energy source.

Leaders in electricity distribution, charging stations and batteries, as well as in low-carbon hydrogen,

biomethane and advanced biofuels should be included in portfolios.

Ditto for leaders in low-carbon technologies (LED lighting, smart energy meters, and storage) and leaders in transmission technologies like high-voltage direct current (HVDC), which transfers wind

and solar power from where it is created to where it is needed.

Think commodities as well, like copper, cobalt, lithium and rare earth minerals, among others.