Merrill analyserer de seneste årtiers investeringsstrategi, der er karakteriseret ved 60/40, dvs. 60 pct. aktier og 40 pct. obligationer. Det er en strategi, der bør modificeres under de herskende og forventede vilkår, men dog ikke skrottes, skriver Merrill. Banken finder det nødvendigt for investorerne at bruge obligationer som sikkerhed over for et volatilt aktiemarked. Men investorerne bør investere mere i f.eks. ejendomme og råvarer, og de bør være mere langsigtede for at komme ud over udsvingene på markedet. De skal altså anlægge en mere robust strategi, men stadig i grove træk inden for 60/40 strategien.

Enhancing the Traditional Investment Strategy

Much has changed for markets in 2022 relative to the last two years. The strong rally in Equities since the depths of the pandemic has been met with an about-face. The sharp selloff in the broader equity market has pushed the S&P 500 Index near bear market territory, or a drawdown of 20% from its January all-time high. Inflation has posted multidecade highs forcing the Fed to turn hawkish.

Investors have long relied on a traditional portfolio construct, illustrated and often referred to in the financial press as a 60/40 portfolio, a mix comprising a 60% allocation to Equities and a 40% allocation to Fixed Income. Its exposure to stocks provides potential opportunities to gain

from capital appreciation and act as a hedge against inflation, while the exposure to bonds provides opportunities to capture income and to help mitigate risk during economic downturns.

Looking back at its long term historical performance since 1926, the strategy has worked well, averaging 8.9% in annual total returns.2 It only saw negative 12-month returns 19% of the time with an average negative return of -8.5%, while positive annual returns occurred 81% of the

time averaging 13.8%.

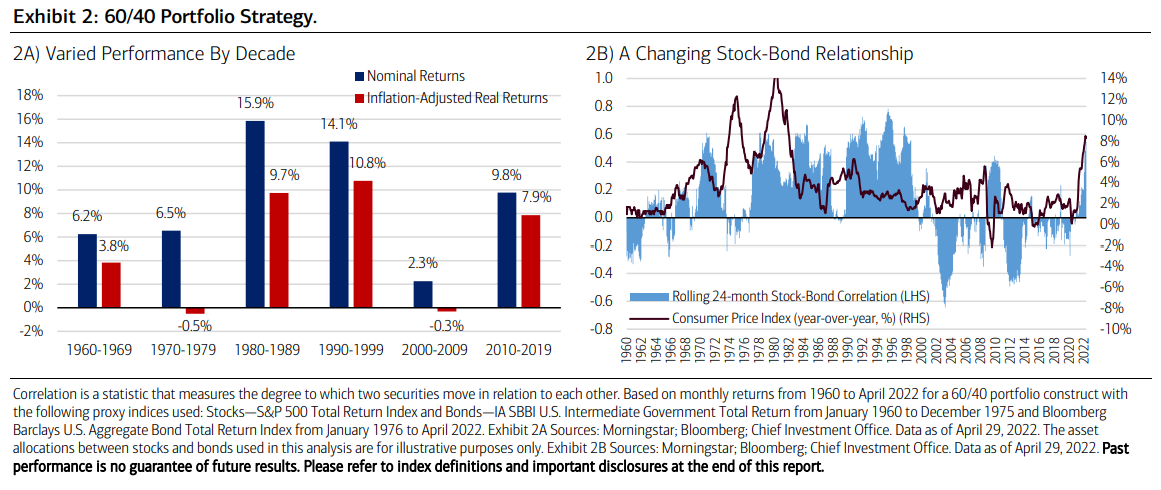

Performance outcomes for the strategy tends to depend on the investment environment of the era as well as the relationship between stocks and bonds. Strong annualized total returns on both a nominal and inflation-adjusted basis during the 2010s, 1990s and 1980s came in stark contrast to the weaker nominal and negative real returns seen during the 2000s and 1970s (Exhibit 2A).

For context, during the 2010s, strong Equity returns amid historically low interest rates and a low inflationary environment following the Great Financial Crisis yielded impressive annualized total returns of 9.8%, and generated real returns of 7.9% when adjusted for inflation. A negatively correlated relationship between stocks and bonds, or strong independence in the movement between these two asset classes, helped underpin its positive performance and mitigate risk during market volatility.

The breakdown in this relationship during the 1970s, on the other hand, meant weaker diversification benefits as the asset classes performed more similarly which ultimately led to lower returns, with an annualized total return of 6.5% for the decade, and less protection against surging inflation, leading to negative real returns of -0.5% on an annualized basis.

More recently, the 60/40 construct has come under greater scrutiny as the correlation between stocks and bonds flipped positive (Exhibit 2B). In the last few months, elevated inflation has contributed to a selloff in stocks, with investor’s fearing that tightening monetary conditions will

weaken growth, at the same time as a steep rise in bond yields has led to a sea of red across Fixed Income sectors year-to-date. As a result, with bonds not acting as a hedge for Equities during this inflationary shock, the 60/40 construct has posted a sharp pullback in returns.

In the medium term, several shifting elements of the investment environment could lead to further sustained weakness in both stock and bond markets and pressure the traditional portfolio strategy. For one, the period before the pandemic and immediately following it, which was characterized by low inflation, is long gone, and the gusher of money supply growth that drove markets higher in recent years is quickly fading into the rearview.

The new macroeconomic backdrop will likely be characterized by more moderate levels of nominal economic expansion and tighter financial conditions. Central banks will likely continue to raise interest rates and shrink their balance sheets in an effort to combat inflation that could

remain stubbornly elevated for the foreseeable future.

Slower growth, tighter profit margins and Fed tightening will weigh on Equity valuations, while bond yields remain biased higher as inflation stays above trend. In our view, volatility will remain in a higher range and investment returns for traditional assets will be more muted as compared to the stellar returns seen in recent years. 60/40 portfolios have typically seen weaker performance amid similar macroeconomic backdrops, suffering three straight years of negative total returns during the slow-growth/high-inflation era of the late 1970s.

But even considering these headwinds, we don’t believe that the traditional asset allocation mix should be abandoned entirely. Rather, investors should be dynamic in their investment approach and consider building upon traditional portfolios to better align with the new

environment.

Appropriate allocations to Equities and Fixed Income may be complimented by exposure to non-traditional investments like Alternative Investments for qualified investors including Real Assets comprising of Commodities and Real Estate exposure. These asset classes could help mitigate risk and enhance returns in a high-inflation, elevated uncertainity, volatile and slow-growth regime.

From a portfolio positioning perspective, we continue to emphasize diversification across and within asset classes as an evergreen principle of long-term investing. America’s market-based economy with all the benefits it has accrued to long-term investors in the financial markets will inevitably have reset periods when recessions happen.

During these times, easier monetary policy and weakening inflation should support bond prices, which should again act as a ballast against Equity volatility. On the flip side, when expansions take hold, the dynamism of the corporate sector’s profit engines should drive new highs in

Equity markets. Given the above established portfolio utilities for these traditional asset classes, investors should stick to their long term financial plans using them within their core strategy while including non-traditional investments for further diversification benefits, inflation protection and enhanced returns purposes.