Coronakrisen viser, at der er et kæmpestort potential for investorer i sundhedssektoren, især i Asien, hvor udgifterne til sundhed er langt mindre end i Vesten. På globalt plan er sundhedsudgifterne stagneret.

Uddrag fra Merrill:

The Other Side: Buying Opportunities in the Post-COVID-19 World

Every crisis leaves its mark, and the global COVID-19 pandemic will be no different. More spending on global healthcare; new automation-led supply chain configurations, notably among big pharmaceutical firms; and the acceleration of digital retail—these are some of the key dynamics that investors can expect on the other side of the crisis.

In a nutshell: the duration of the virus-induced bear market remains anyone’s guess, although for long-term investors rebalancing portfolios, think large cap leaders in healthcare, automation and robotics, and e-commerce.

In brief, we outline each trend below. The boost to global healthcare spending. The COVID-19 has not only pushed healthcare to the top of the agenda of every government in the world. It’s also brutally exposed cracks in the healthcare systems of rich and poor nations alike, portending more

global spending on healthcare in the decade ahead.

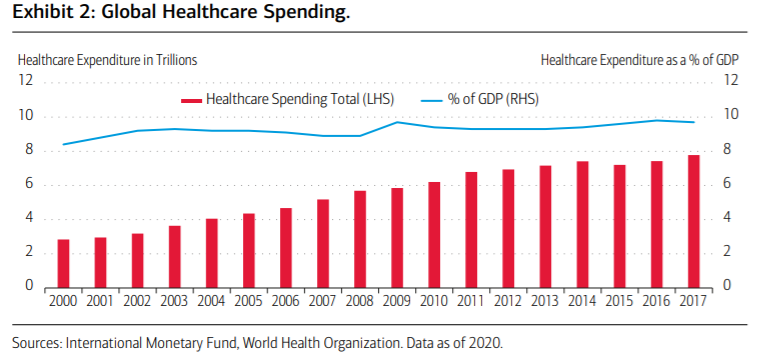

Per the numbers, global healthcare expenditures have climbed steadily over the past two decades, reaching nearly $8 trillion in 2017. However, spending on global healthcare as a percentage of world GDP has barely budged, flat-lining at around 9% over the past two decades (Exhibit 2). This, at a time when the world is rapidly aging (putting even more stress on healthcare systems); when non-communicable diseases are exploding around

the world; and when global obesity levels are at all-time highs. So even before this virus hit, the world’s healthcare infrastructure was straining at the seams, notably in Asia.