USA er blevet den store magnet for udenlandsk kapital, fordi investorerne søger efter nye investeringsmuligheder i et rædselsfuldt år, skriver Merrill. S&P 500-indekset er i år faldet med 18 pct., Nasdaq med hele 27 pct. 2021 blev et come-back år for udenlandske investorer, men mens europæiske investorer de seneste år har stået for ca. halvdelen af kapitalstrømmen til USA, så faldt Europas andel betydeligt sidste år til omkring 20 pct. De europæiske investeringer er steget kraftigt i år, og det skyldes i høj grad, at Europa har holdt massivt igen på deres investeringer i Kina på grund af covid-lockdowns. Merrill foretrækker nu amerikanske aktier fremfor internationale. Kapitalstrømmen fra udlandet understreger denne udvikling, skriver Merrill.

Pulling the Rip Cord: the U.S. as the Target Zone for Flows

Lauren J. Sanfilippo, Director and Senior Investment Strategy Analyst Considering the collective maelstrom of Russia’s invasion of Ukraine, a “store-of-value”-no-more cryptocurrency crash, damage from the coronavirus shutdowns bringing the second largest economy to a mere halt or indexes in most corners of the world in free fall, investors are waiting for parachute release to cushion this drop.

It’s been a terrible start to the year for the S&P 500 Index, now down 18%, as the NASDAQ has corrected 27%, and the Dow Jones Industrial Average, on an eight-week losing streak, has retraced 13% since the beginning of the year. Paltry performance abroad is nothing to brag about: Most European indexes as measured by EURO STOXX 50, Germany’s DAX Index or France’s CAC Index are all down at least 17%. Asian indexes are barely faring better, with the Korean KOSPI (-17%), China’s Shanghai Composite (-18%) or Japan’s Nikkei Index (-16%) well into double-digit declines.1

Enough hesitancy and risk-off sentiment has grown toward risk assets that the preference for fund managers has been to hoard cash. Cash balances among fund managers surged to a 20-year high of 6.1% of assets in May, as surveyed by BofA Global Research. Meanwhile, cash can’t always be king, at least not in an 8.3% inflation-eroding environment.

Despite U.S.-based concerns about elevated (albeit deflating) Equity valuations, U.S. dollar strength, or the Fed’s aggressive monetary policy shift, by way of the TINA (there is no alternative) principle or relative attractiveness, the U.S. has been the target zone for inflows as measured by foreigner flows into U.S. securities and FDI. The U.S. Treasury Department’s

recent data shows the U.S.’s allure has barely dimmed and, by most measures, has brightened post-crisis.

2021 was a comeback year for foreigners buying into U.S. securities of all types: Treasury bonds, government agency bonds, or corporate bonds and stocks alike. The largest inflows YTD have been into the widest safety net of them all: U.S. Treasury

bonds and notes. Given the perception as a “safe-haven asset” for investors, foreign inflows of U.S. Treasury notes and bonds for Q1 of 2022 exceeded all quarters back to 2010. Post-the initial coronavirus shock in March 2020, net foreign purchases were elevated over the second half of 2020, when foreigners piled $678 billion into U.S. securities, turning flows positive for the year. An almost tripling of flows rushed into U.S. securities over 2021.

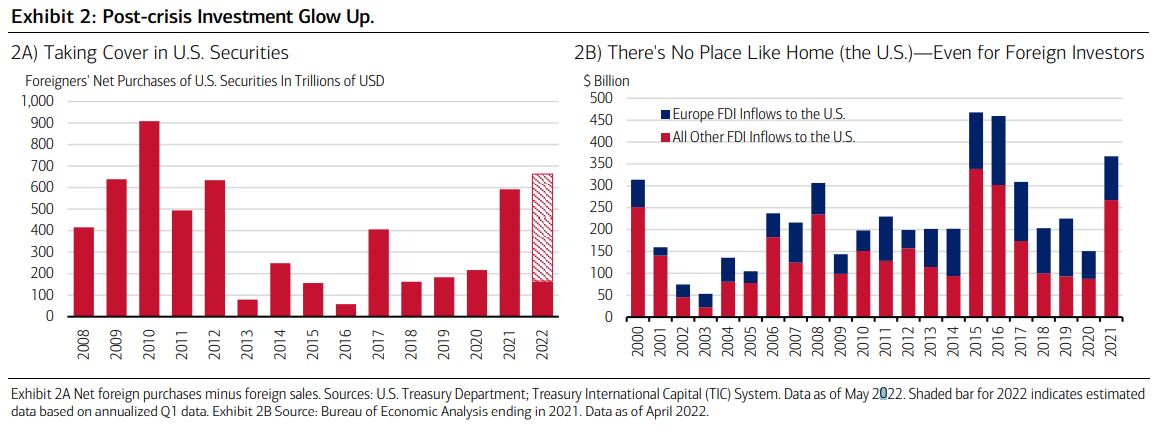

Annualized Q1 flows for U.S. aggregated assets this year are currently on track to top full-year 2021 (Exhibit 2A). Repeat post-crisis periods of elevated foreign investor inflows were seen not long after the Great Financial Crisis, Eurozone Debt Crisis and the Taper Tantrum.2

Call it a post-crisis glow up for U.S. assets, but FDI shows a similar U.S.-preference with foreign investment totaling more than $360 billion in 2021, marking the strongest year since 2016 (Exhibit 2B). Europe, almost a third of the U.S. FDI market, increased their investment by over 200% in 2021 compared to 2020. Based on European company commentary, FDI into the U.S. has been rolling in since year end. Vis-à-vis expansion of manufacturing plants and operations, Europe’s U.S. footprint is growing—as a function of last resort or otherwise, considering “A more expensive, functioning market is better than one that is relatively cheaper but paralyzed” according to the European Union Chamber of Commerce in China.

Its BP’s increased drilling operations in the Permian Basin at the expense of exiting Russia’s market as Airbus expands

aircraft assembly lines at its facility in Alabama, and with ArcelorMittal’s steel manufacturing re-entering U.S. markets after removing its presence, all serving as evidence of the trending preference for American placement.

China’s waning appeal is apparent—with Europe’s exports to China having barely grown the first quarter of this year, while German exports to the U.S. surged almost 20% in the first three months of 2022 compared to the year prior. That’s the equivalent of $36 billion in exports from Europe’s largest economy and evidence of a world increasingly weighing its tripolar (North American, Asian and European) setups.

Our parachute of portfolio preference

General weakness/anemic growth in most other parts of the world boosts the appeal of U.S. markets, never mind other redeeming qualities such as its large and wealthy population, top ranked universities, a transparent rule of law, an ease of doing business that compares favorably to other nations, world-class innovation, a diversified economy across sectors and

industries, a relatively young population, and deep capital markets. Notably, the U.S. dollar’s share of foreign exchange reserves has remained unrelenting around 60% for decades, suggesting no loss of prestige over multiple crises.

Also appealing is the U.S. consumer—a robust market to tap into. Retail sales rose a seasonally adjusted 0.9% last month compared to March, according to the Commerce Department. Despite depressed consumer sentiment levels, persistent signs of consumer fatigue have yet to materialize, although this bears close watching ahead.

While we have lowered our risk budget across most portfolios and asset classes, Equities remain one of the most attractive options for investors on a relative basis, as bond market volatility has increased, and parts of the Treasury and credit curves have flattened. Within Equities, our preference is for U.S. Equities over International, with a recent downgrade of European Equities and International Developed Market Equities indicative of deteriorating fundamentals we see, in addition to declining business and consumer confidence for Europe, the ongoing conflict in Ukraine with little prospects of a cease fire or diplomatic solution, energy dependence on Russian oil and gas, and slowing money supply growth.

Call it a home bias—our portfolio positioning corroborates foreigner’s preference for U.S. assets.