Ifølge Merrill og Brookings er Kina blevet verdens absolut største forbrugermarked, vel at mærke for middelklassen. Middelklassen vil i år have et forbrug på 7300 milliarder dollar mod 4700 milliarder for USA, der i årtier har været verdens førende forbrugermarked. Det kinesiske marked er lige så stort som USAs, Tysklands og Frankrigs tilsammen. Kina er blevet et marked, som multinationale koncerner ganske enkelt ikke kan ignorere. Ser man på det totale forbrugsmarked er USA størst, men markedet for den kinesiske middelklasse vokser markant med 60 millioner om året og omfatter nu 750 millioner. Merrill siger, at udviklingen betyder, at investorer er nødt til at være både på det amerikanske og kinesiske marked.

The Power of the Chinese Consumer

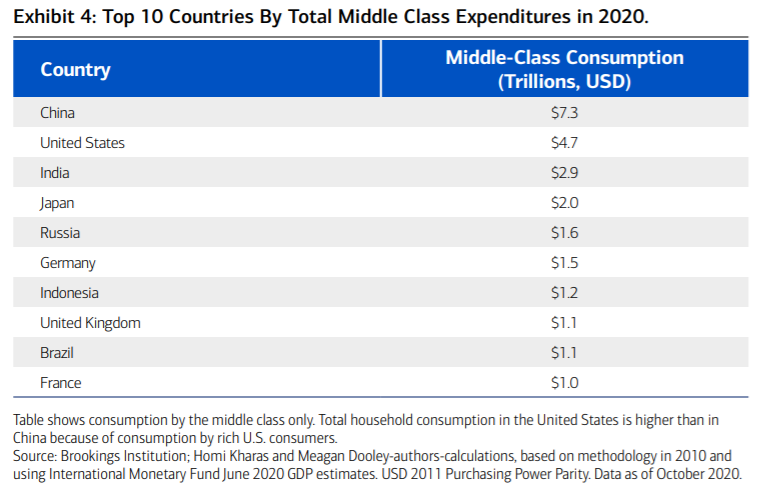

Taking the long view, we believe the future contours of global growth and global earnings are inextricably tied to emerging market consumer demand, notably demand from China. The accompanying exhibit underpins our conviction and is obtained from the Brookings Institution.

Exhibit 4 highlights the attractiveness of the Chinese consumer to leading U.S. multinationals; simply put, when it comes to middle class consumption, there’s China and the rest of the world.

According to Brookings Institution, Chinese middle class consumers are on track to spend $7.3 trillion in 2020, head and shoulders above the U.S. ($4.7 trillion).

Total household spending in the U.S., of course, is higher than in China because U.S. households are richer (higher per capita incomes) although the sheer number of Chinese consumers makes its market size larger—much larger.

To this point, in 2006, China’s middle class was estimated to number 90 million people.

But after adding an average of 60 million people to its middle class every year since then, China’s middle class now numbers roughly 750 million people.

By 2027, according to Brookings, an estimated 1.2 billion Chinese will be considered middle class—a staggering consuming cohort.

Emblematic of this spending power, China now accounts for one-third to one-half of all global car sales and 40% of the global smartphones market.

In 2019, Chinese citizens took a staggering 300 million vacation and business trips, with more than half (116 million) of those trips abroad. Over 90% of Chinese own their own home, with homeownership among Chinese millennials (roughly

70%) much higher than the comparable figure in the U.S. (35%).

Meanwhile, Gen Z accounts for 15% of all household spending in China, compared with 4% in the U.S. China e-commerce accounts for 40% of global e-commerce, while the country remains out front in terms of mobile money—90% of Chinese consumers rely on mobile money as their primary form of payment.

All of the above is neatly summarized in a recent essay from Bridgewater’s Ray Dalio in the entitled, “Don’t be blind to China’s Rise in a Changing World”

and, when it comes to investing in either the U.S. or China, “allocate money to both countries.”

Also consider allocating capital to Western multinationals leveraged to the Chinese consumer, one of the most powerful consuming cohorts in the world.