Merrill har lavet en meget grundig analyse af de kinesiske indgreb den seneste tid mod en række high-tech og forbrugervirksomheder. Det har ført til voldsomme kursfald, mens andre sektorer af både high tech og forbrugervirksomheder klarer sig godt, og der er generelt en betydelig forskel på markedsværdierne i kinesiske og udenlandske indeks, hvor kinesiske selskaber spiller en stor rolle, især Nasdaq-indekset Golden Dragon. Merrill gennemgår en række sektorer og udpeger de sektorer, som ifølge Merrill stadig er relevante for udenlandske investorer. De knytter sig alle til de områder, som den kinesiske regering lægger vægt på som en slags vindersektorer i Kinas strategiske satsning på udviklingen hen mod 2025. Der er et stort langsigtet potentiale i disse sektorer. Der nok sket store kursfald, op til 48 pct., men det kinesiske investormarked er ikke dømt ude.

China’s Regulatory Challenges: Down but not Out

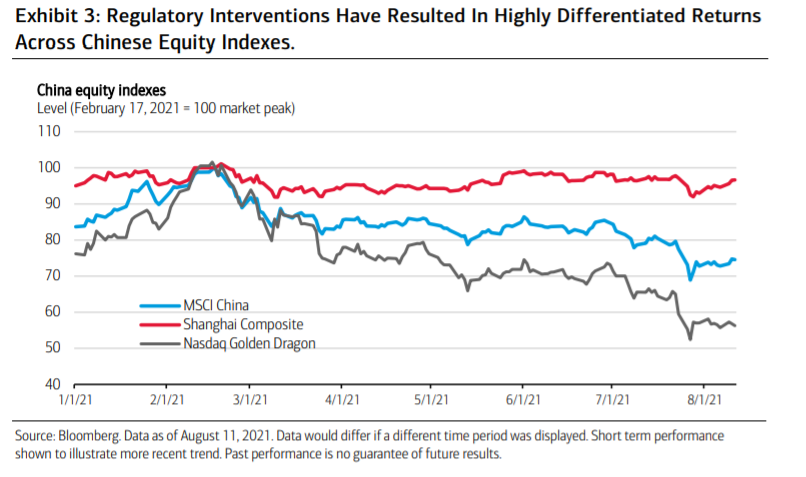

After weeks of volatility for the Chinese equity market, a degree of calm returned in the

first half of August. The MSCI China Index fell by 19% during the month of July, capping a

31% peak-to-trough decline from its February peak as local regulators tightened controls

on a number of individual technology companies.

The new measures were aimed primarily at consumer internet firms, particularly those listed on U.S. exchanges. And though these moves largely came as a continuation of what has been an existing trend, the wide range of firms targeted in this most recent episode demonstrates that regulatory risks are here to stay and could potentially broaden. This in turn leaves us more cautious on selected

areas within the Chinese market.

The net result of these policy moves has been a significant de-rating of the Chinese

market over the past six months. But the selloff has not been uniform, either by sector or

by exchange. The most digitally oriented sectors of Information Technology, Consumer

Discretionary and Communication Services have led the downdraft, and shares listed

outside mainland exchanges have also been the hardest hit.

China-listed shares, by contrast, have performed much better across the broad market, reflecting the relative strengths of the underlying economy (including its high absolute growth rate, high

vaccination uptake, current account surplus, contained inflation and recent monetary

support), particularly compared to many lower-income countries within the emerging

world.

The onshore Shanghai Composite Index, which is also the most diversified by

sector, has registered the smallest peak-to-trough decline this year so far from February’s

highs (9%). The Nasdaq Golden Dragon China Index, which includes only U.S.-listed

companies and has 85% of its market capitalization in Technology, Consumer

Discretionary and Communication Services, has seen the largest drop (48%). And the MSCI

China Index, which still has a relatively high 60% concentration in the three most techdriven sectors but is also the most diversified across U.S., Hong Kong and mainland China

exchanges, has fallen in between the two (31%) (Exhibit 3).

This latest series of regulatory interventions has therefore resulted in highly differentiated

drawdowns across different Chinese indexes. But this does not represent a new risk for

investors in the Chinese market, and similar episodes occurred during the last cycle. In

2016, for example, new rules were imposed on digital advertisers in the wake of a

marketing scandal involving counterfeit online medications.

Two years later, new restrictions were introduced for online gaming licenses, which dealt a severe blow to the large digital media firms and precipitated a near-30% drop for the MSCI China Index in the second half of 2018—a decline comparable to that of the past six months. Investors in the

Chinese market have therefore had similar experiences in past years.

But looking forward, we would expect to see some persistent effects from these most

recent events. The risk and reality of regulatory intervention is likely to reduce both the

willingness and ability of U.S. investors to move into selected Chinese companies.

Restrictions on funding and operational activity by the Chinese agencies will clearly play a

role. And U.S. regulators are also likely to demand more disclosures from prospective

listings given the heightened uncertainty over potential actions by the Chinese authorities.

This should not, however, come as a major impediment to future price appreciation for

Chinese equities. Large pools of domestic savings and investment capital remain available

within China and Hong Kong, and offshore yuan and Hong Kong dollar-denominated

holdings dominate the MSCI China Index with an 80%-plus market capitalization

weighting.

The underlying growth rate across technology-related segments should also

remain strong, particularly given the need for more investment in digital infrastructure and

online services post-coronavirus. Consumer internet firms have come under the most

regulatory scrutiny, but the Chinese authorities should nonetheless remain keen to avoid

undermining the role that its technology companies play in domestic innovation and

domestic employment. This role will only increase in importance over the coming years

given the growing strategic competition with the U.S. and the structural slowdown in

growth driven by productivity and demographics.

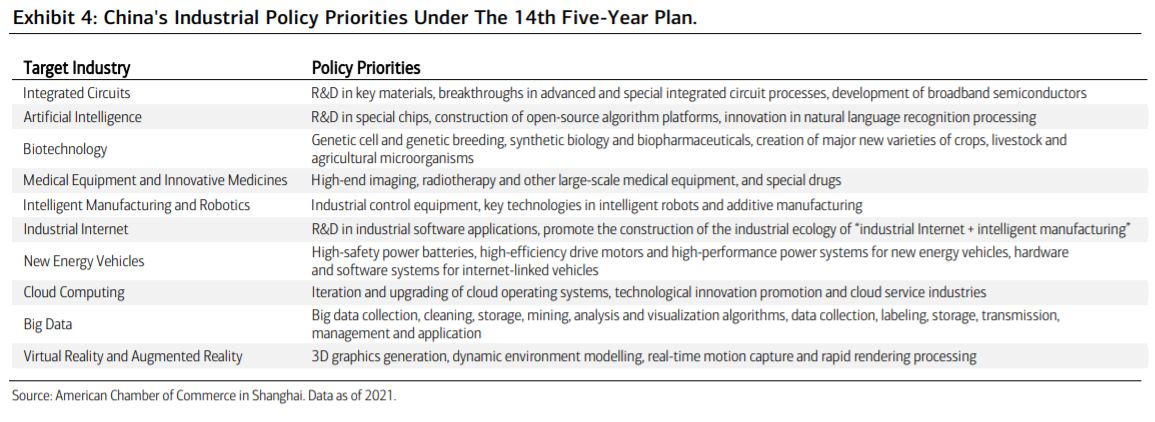

China’s technological capacity will therefore remain critical to its aim of becoming a high income economy by 2025 and delivering on national priorities of indigenous innovation,

inclusive growth, economic self-sufficiency and emissions reduction as outlined last

October in the 14th Five-Year Plan. And this helps to explain why explicit projections for

economic growth have been abandoned in exchange for a narrower focus on more specific

2025 targets such as increasing the value-added share of GDP in digital industries from

8% to 10%, maintaining annual growth in research and development (R&D) spending at

over 7%, doubling the number of high-value patents per 10,000 people from six to 12, and

decreasing carbon intensity by 18%.

Rather than avoiding China as an investment destination altogether, this in our view

emphasizes the need for investors to remain focused on market segments that are aligned

with China’s longer-term strategic goals. And this spans a broad range of industries

including semiconductors, cloud computing, robotics, artificial intelligence, cybersecurity,

advanced manufacturing, biotechnology and clean energy—groups that are less likely to

be subject to regulatory restrictions and should receive more official support over the

years ahead as target areas for future growth (Exhibit 4).

As we have seen over recent weeks, the risk of periodic market interventions by the

Chinese authorities should persist as regulators enforce rules designed to preserve social

stability. And these are likely to be periods of increased uncertainty. But we nonetheless

still see an underlying trend of continuing expansion in technology-oriented markets,

particularly in segments tied to strategic aims of the Chinese leadership. This underscores

the potential for longer-term gains in China’s growth sectors, as well as for shorter-term

return enhancement from active management within China allocations.