Merrill ser tegn på en kraftig fremgang i de amerikanske virksomheders indtjening i det nye år og venter en stigning i earnings per share, EPS, fra 138 dollar til 168 dollar. Når der kommer gang i økonomien, sker der en indtjeningsforskydning fra high-tech og sundheds-selskaber til mere normale selskaber, og forbruget vil stige med 1300 milliarder dollar.

Margins Should Help Earnings Grow into Valuations

Corporate earnings are the ultimate harbinger for equity prices, and profit margins

are key support driving that bottom line.

Historically, U.S. companies have consistently demonstrated the ability to preserve and grow their margins through the business cycle, and particularly out of recessions.

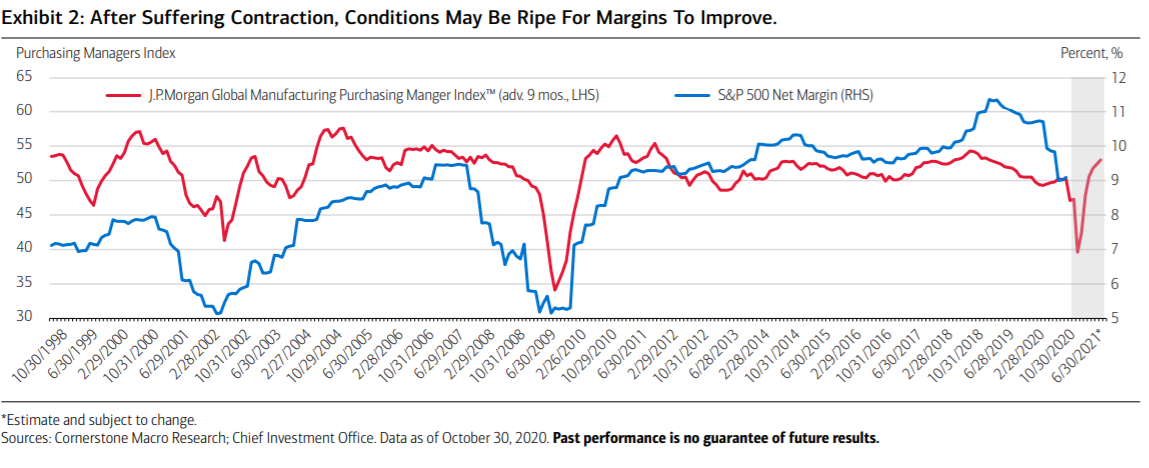

The pandemic-induced downturn dragged down S&P 500 net margins to 9% in the third quarter from 11% at the same point last year, representing the slimmest level since 2010. However, the decline appears to be slowing with green shoots for improvement.

Currently, consensus projects S&P earnings per share (EPS) to rise to $168 in 2021,

from expectations of $138 in 2020, as economic expansion makes forward progress.

We believe there may be upside to these estimations based upon companies being able

to derive better revenues from higher nominal gross domestic product (GDP) growth,

but also lower interest costs and rising productivity.

The makeup of the stock market, which is skewed toward asset-light business models (such as Technology, Healthcare, Communications) also favors higher profitability and margins.

Higher nominal growth potential in 2021

Margins have tended to be cyclical by nature and typically follow the business cycle. As

the economy expands, demand and pricing power pick up, and a shift from consumer’s

saving to spending ultimately drives corporate revenues higher.

Companies that can efficiently manage their costs relative to the increase in sales, namely via operating leverage, can subsequently boost their profit margins to capitalize on the expansion.

According to Cornerstone Macro Research, profit margins for the S&P 500 have

historically tended to follow manufacturing activity, which itself is a leading economic

indicator of the business cycle (Exhibit 2) and has been in expansion since this summer.

As the economic recovery continues and may exceed expectations, the conditions for

higher levels of nominal growth are ripe, especially given the unprecedented backdrop of

synchronized global fiscal and monetary accommodation.

In addition, the U.S. personal savings rate remains elevated after spiking to 33.6% in April as demand cratered, and a normalization back to pre-pandemic levels could represent new consumption of

approximately $1.3 trillion.

Given expectations for higher nominal growth, we would expect margins to follow suit in expansion, which should help equities to “grow into” their valuations.