Merrill er en smule i syv sind, når banken vurderer den kommende tid på aktiemarkederne. Aktiekursstigningerne er vitterligt ekstreme og usædvanlige, og de offentlige stimulanser er det ligeledes. Det kan indebærer risici og i hvert fald mere volatilitet. Men Merrill tror fortsat på aktier – i forhold til obligationer – og tror, der er grundlag for en moderat udvikling, fordi virksomhederne trods alt har en god indtjening.

Equities up 90%. Now What?

Since the market bottom, the S&P 500 has gained 90% on a total return basis, reaching new

all-time highs, propelled by accommodative monetary policy, giant fiscal stimulus and

prospects for economic reopenings.

Concerns, however, over the next leg for equity markets have become more acute, with investors asking how much more upside could possibly exist from here given the threat of rising yields, inflation, the potential for higher taxes and the next major decision to likely come from the Fed: the timeline for tapering of asset purchases.

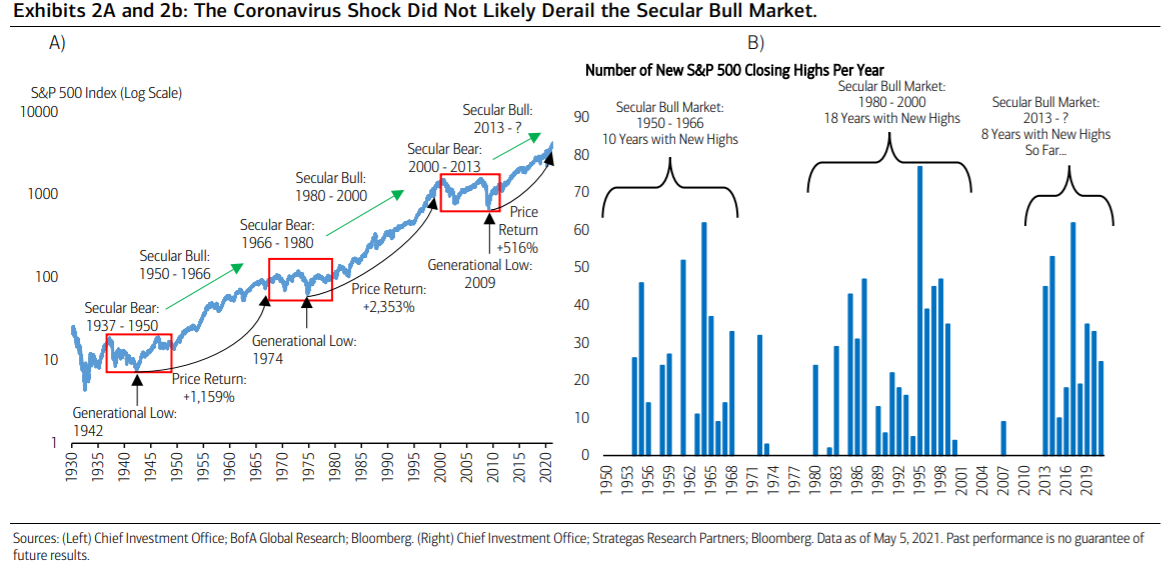

As we highlight here, history would dictate some consolidation in the near term, higher volatility and moderating returns, adding to the growth of the secular bull market.

Our preference for Equities over Fixed Income is rooted in our view of rapidly rising

corporate earnings, interest rates drifting higher and attractive relative valuation. The equity

risk premium (ERP), expressed as the difference between the earnings yield of the S&P 500

and the 10-year Treasury yield, at 3.1% and in the 57th percentile, shows that stocks remain

more attractively valued to bonds.

Rising earnings should be a major support for the ERP, especially as earnings revision ratios continue to turn higher. While not our base case, another rapid and sharp move higher in interest rates would be a headwind.

Still, this cycle, for many reasons, can be characterized as “unusual,” and thus any historical

precedence could potentially turn out to be less of a guide. For one thing, the exogenous

shock derived from a pandemic led to a widespread global economic shutdown that canceled

mobility, and in-person consumption and resulted in widespread unemployment for workers,

especially for employees who could not easily shift their work to a remote environment.

Equally historical has been the experimental giant fiscal and monetary support. For now,

despite the unusual circumstances, there is plenty of fuel left to push the economy forward

from the lagging effects of stimulus to healthier household balance sheets relative to

previous recessions and signs of material progress on the health front. All of these together

should support equity markets, which is likely to consolidate its gains in the near term while

building the foundation for the continuation of the secular bull, as earnings catch up and

sentiment moderates.