Merrill drager en optimistisk lære – i 10 punkter – af 2020 trods coronakrisen og den økonomiske nedtur. Kriser skaber altid en ny dynamik, som også aflæses i aktiemarkederne. Nogle af konsekvenserne af krisen er, at regeringer har fået en stærkere rolle, at globaliseringen ikke er død, og at der kommer en hårdere konkurrence mellem USA og Kina – og at sundhed i mennesker som i samfund har betydning for, hvordan vi kommer gennem kriser.

What We Learned in 2020

With this being the last Capital Market Outlook publication of 2020, we thought it would

be a good time to look back on the key lessons of an extraordinary year. 2020 is replete

with teachable moments, and in that spirit, here are our top 10 lessons of 2020.

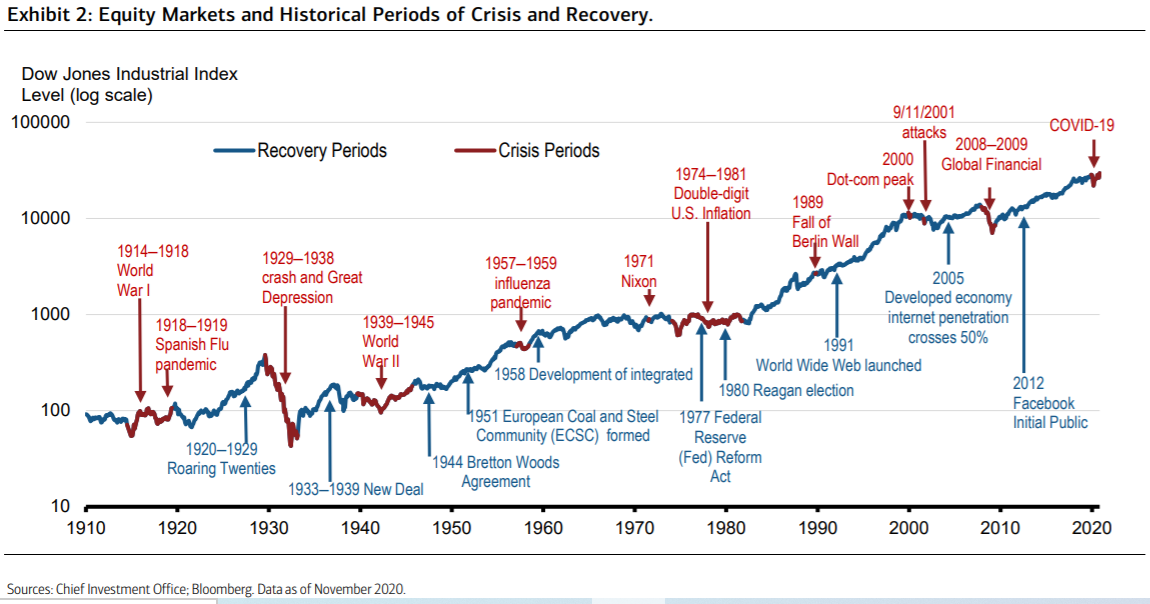

Lesson 1: All Crises Are Accelerants—And Coronavirus Is No Different.

Past crises or shocks often pull forward the future and give way to rejuvenated periods of

growth, innovation and development (Exhibit 2). As we wrote earlier this year, “the early

20th century included a world war and a global flu pandemic. The 1930s saw an economic

depression and military conflict on an even larger scale. The 1970s was a period of

economic stagnation and high inflation. And the first decade of the new millennium

brought the collapse of a stock market bubble, the rise of global terrorism and a financial

crash.

Crucially, each of these historical crisis periods was ultimately succeeded by an

economic revival, a more favorable investment environment and sustained price gains for

equity markets.” The pandemic of 2020 will be no different.

Lesson 2: Policy Makers Learned And Applied The Lessons Of History

Fortunately, policy makers took to heart one of the key lessons of the Great Financial

Crisis: Go big and go fast when it comes to the policy response amid collapsing economic

growth and cratering confidence in the capital markets. The pandemic’s unprecedented

shock to the global economy was matched by unprecedented policy responses from

around the world. Think “double-barreled bazookas”—with policy makers (fiscal) and

central banks (monetary) flooding the capital markets with trillions of dollars of liquidity as

the coronavirus jumped borders.

Lesson 3: Health = Wealth

If we have learned anything from this pandemic, it’s that health is a fundamental

determinant to economic growth. The healthier the population, the stronger, more

dynamic and competitive the economy. Sick nations, in contrast, are handicapped in terms

of production, consumption and aggregate growth.

Lesson 4: The “Commanding Heights” Now Belong To The Government

Ronald Reagan once said, “Government is not the solution to our problem. Government is

the problem.” Not anymore. Times have changed. Along with the rise of China, the

unprecedented global healthcare crisis has swung the pendulum of control of the

“Commanding Heights”—or the most important elements of the economy—back to the

state, away from the markets. This seismic shift was underway before the crisis but has

gained more momentum. There is rising bipartisan support for a U.S. industrial policy in

such key sectors as aerospace, electronics, rare earth minerals, telecom, agriculture and

other sectors deemed vital to national security.

Lesson 5: It’s Too Soon To Write Off Globalization

Populism, protectionism and the pandemic are headwinds to a more integrated global

economy and have sparked a debate about the risks of de-globalization. We are more

sanguine. A more multilaterally minded President-elect Biden administration; “sticky”

global supply chains; the stronger-than-expected rebound in global trade; and greater

crossborder service activities as the world goes digital—all are signs that augur for

greater globalization, not less. As we recently noted, there is no better example of

globalization being alive and well than the Pfizer/BioNTech vaccine—the world’s first

coronavirus vaccine approved for mass use. As the Financial Times recently noted: “the

vaccine was developed in Germany by the children of Turkish immigrants; tested in

Germany, the U.S., Turkey, South Africa, Brazil and Argentina; manufactured in Belgium and

first approved in the U.K.”

Lesson 6: U.S.-China Relations: Is This Time Different

There were glimmers of hope that U.S.-Sino relations would improve this year, buttressed

by the signing of the Phase One trade deal in January 2020. The pandemic, however, only

served to amplify the differences between the two nations in trade, technology, foreign

investment and a host of geopolitical hot spots (Hong Kong, the South China Sea, etc.). We

learned this year that it’s different this time in our view—that the U.S. and China have

entered an era of great power competition that will likely play out over the next few years,

if not decades.

Lesson 7: Europe—More United Than Divided

When the pandemic struck early this year, Europe did what it does best: It dithered and

became more divided in fashioning a policy response. Border restrictions among member

states were erected in a confusing and uncoordinated way, growth declined, nationalism

soared, and the risks of Europe collapsing skyrocketed. Thereafter, however, Europe’s

principal institutions—the European Commission, the European Council and the European

Central Bank (ECB)—swung into action and crafted a number of pro-growth policies that

stunned investors and even the most diehard Euroskeptics.

Lesson 8: Some Cuts Are Deeper Than Others

Early in the pandemic, and with the coronavirus mutating all over the world, coronavirus

was described as the “great equalizer”—i.e., that everyone was at risk from the disease. In

practical terms, that’s true. In reality, it’s not even close. The pandemic has taught that

we’re not created equal—some cuts are deeper than others.

In a nutshell, the pandemic has exacerbated and exposed numerous inequalities, a lesson

investors and policy makers ignored at their own peril.

Lesson 9: Climate Change Can Be Slowed

Something untoward happened when the world went into shutdown earlier this year: The

skies in Delhi, one of the most polluted cities in the world, cleared, while in other parts of

India, the majestic Himalayas became visible for the first time in decades. In China,

another major global polluter, emissions dropped by roughly 25% at peak shutdown over

March. In some of the largest cities in the world, like Delhi, Sao Paulo and New York, levels

of fine particulate matter known as PM2.5 fell dramatically, by 25% to 60% in many cases.

Heeding this lesson, mitigating climate risks remains a key objective of governments and corporations around the world, creating investment opportunities across a spectrum of industries—solar, wind, electrical vehicles, water, waste management, storage and distribution, and related activities.

Lesson 10: Never Bet Against America

The final lesson of 2020 is never bet against the dynamic, resilient U.S. economy—warts

and all. Yes, the war against coronavirus has yet to be won—we are not out of the woods

yet. In addition, the nation confronts a number of structural issues heading into 2021. But

think how far we have come since the dark days of March and April, when the markets and

economy were in a “free fall”. As we close out the year, the S&P and other major indexes

are hovering at all-time highs—a turn unimaginable back in the dark days of spring. The

pandemic is a lesson on how adaptable the country is to extraordinary change—or to a

once-in-a-century shock.

We end were we began: The key lesson/takeaway of Exhibit 2 is that history is always

replete with crises and challenges, but these event risks are also opportunities for

investors who can see the forest before the trees. History shows that markets and the

economy tend to bend but not break. That’s another way of saying stay long U.S. equities.